Canada's consumer price index (CPI) rose 6.7% (on an annualized basis) in March after rising 5.7% in February, which was also stronger than the forecast growth by 6.1%. Thus, annual inflation in Canada accelerated in March, reaching a new maximum level over the past 30 years. On a monthly basis, CPI rose 1.4%, also the highest since January 1991.

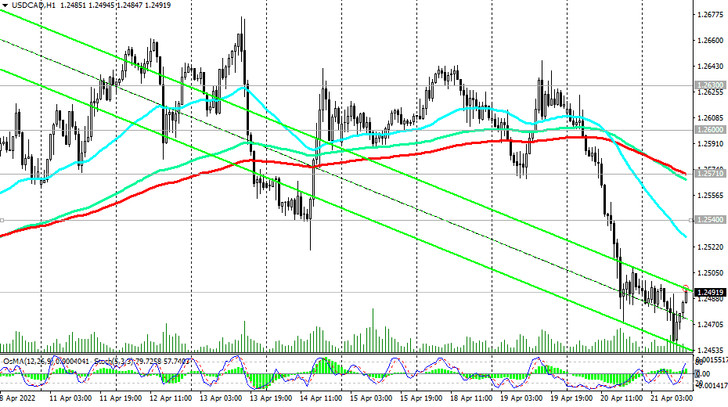

The Canadian dollar strengthened sharply on Wednesday, with USD/CAD touching an intraday low of 1.2472. The decline continued today as USD/CAD dropped to a new 2-week low at 1.2458.

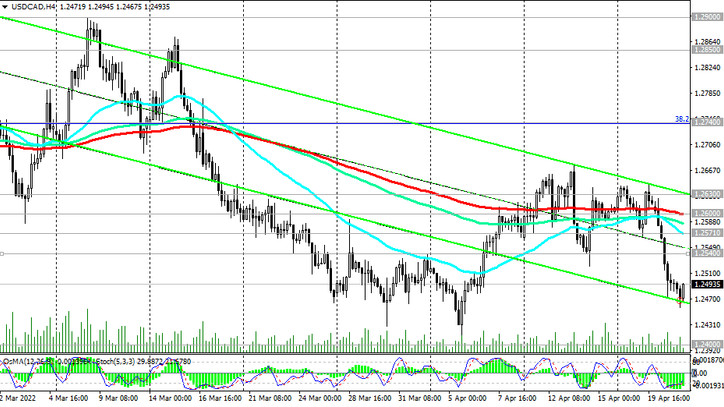

However, we expect USD/CAD to reverse and rise from current levels, although more cautious traders will probably want to wait for a breakdown of the short-term resistance level at 1.2530 (EMA200 on the 15-minute chart).

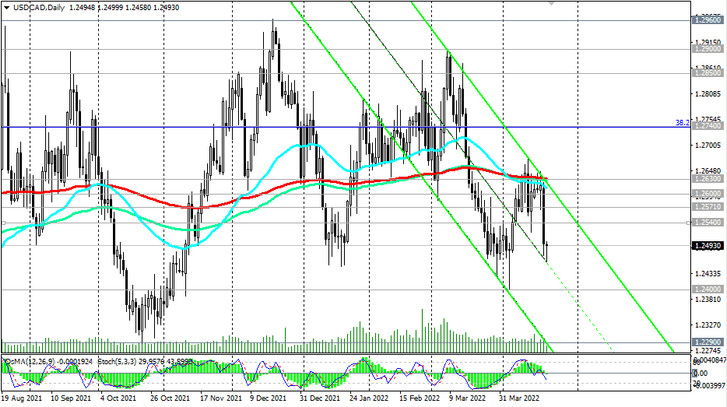

Growth targets: 1.2570 (EMA200 on the 1-hour chart), 1.2600 (EMA200 on the 4-hour chart), 1.2630 (EMA200 on the daily chart). The breakdown of the resistance level 1.2630 may provoke further growth to the resistance levels 1.2850 (EMA200 on the weekly chart), 1.2900, the breakdown of which will once again bring the pair into the zone of a long-term bull market.

In an alternative scenario, the decline will resume after the breakdown of the local minimum of 1.2458 towards the lower border of the downward channel on the weekly chart, passing near the mark of 1.2300.

Support levels: 1.2460, 1.2400, 1.2290, 1.2165, 1.2050

Resistance levels: 1.2530, 1.2570, 1.2600, 1.2630, 1.2675, 1.2700, 1.2740, 1.2800, 1.2850, 1.2900

Trading scenarios

Sell Stop 1.2450. Stop Loss 1.2535. Take-Profit 1.2400, 1.2290, 1.2165, 1.2050

Buy Stop 1.2535. Stop Loss 1.2450. Take-Profit 1.2570, 1.2600, 1.2630, 1.2675, 1.2700, 1.2740, 1.2800, 1.2850, 1.2900