The dollar is strengthening, and the DXY dollar index is rising at the beginning of today's European session. The driver of the current growth in DXY is currently the British pound (its share in DXY is approximately 12%).

This currency has been actively declining since the opening of today's trading day and especially since the beginning of the European trading session after the release of a weaker-than-expected UK retail sales report by the Office for National Statistics in the UK (in March, retail sales fell by 1.4%, while economists expected a fall of 0.2%) and a report by Markit Economics, indicating a fall in the UK composite Purchasing Managers' Index (PMI) in April to a 3-month low of 57.6 from 60.9 in March (the forecast was 58.5). Index values above 50 indicate an increase in activity, however, a relative decrease in the indicator may have a negative impact on the quotes of the national currency.

S&P Global/CIPS also attributed this decline in the UK PMI to "higher prices and rising costs of living". "Covid-19 continues to negatively impact many companies", S&P explained. In addition, the consequences of Brexit and the increase in the delivery time continue to slow down export sales, while the military conflict in Ukraine and the sanctions imposed on the Russian economy negatively affect the UK's foreign trade.

GfK's consumer confidence indicator released yesterday, which fell in April to the lowest level since 2008-2009 -38 (after falling to -31 in March), only complements the current negative picture for the pound.

The possible resignation of Prime Minister Boris Johnson is also added to the above negative factors.

Today, market participants who follow the pound quotes will pay attention to the speech (at 14:30 GMT) of the Governor of the Bank of England, Andrew Bailey. Financial market participants are waiting for clarification of the situation from him regarding the further policy of the country's central bank in the current conditions of a sharp deterioration in the geopolitical situation in Europe and economic indicators in the UK. Probably, Andrew Bailey will also give explanations regarding the decision taken by the Bank of England a month ago to raise the interest rate (the next meeting of the Bank of England is scheduled for May 05) and will touch upon the state and prospects of the British economy after Brexit and the partial lifting of quarantine restrictions due to the coronavirus. If Bailey does not touch on monetary policy issues, then the reaction to his speech will be weak.

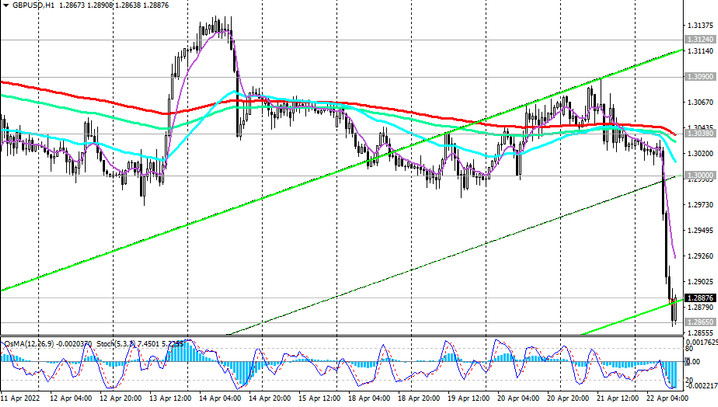

Meanwhile, today the GBP/USD pair has updated the minimum since November 2020, also reaching an intraday low near 1.2865 (we set this target in one of our recent reviews - for 04/12/2022). Below resistance levels 1.3420 (EMA200 on the daily chart), 1.33370 (EMA200 on the weekly chart) GBP/USD is in the bear market zone. The next immediate target in case of further decline is 1.2800, 1.2700, 1.2685.

Support levels: 1.2865, 1.2800, 1.2700, 1.2685, 1.2400, 1.2250, 1.2085, 1.2000

Resistance levels: 1.3000 1.3038 1.3090 1.3124 1.3175 1.3210 1.3297 1.3370 1.3420 1.3580 1.3640 1.3700 1.3745 1.3832 1.30.40

Trading recommendations

Sell Stop 1.2860. Stop Loss 1.2980. Take-Profit 1.2800, 1.2700, 1.2685, 1.2400, 1.2250, 1.2085, 1.2000

Buy Stop 1.2980. Stop Loss 1.2860. Take-Profit 1.3000, 1.3038, 1.3090, 1.3124, 1.3175, 1.3210, 1.3297, 1.3370, 1.3400