So, today after the last meeting of the Bank of Japan, the pair USD/JPY came close to 104.00 for the first time since April 2002. The central bank kept the parameters of the current monetary policy, but said that every working day it will buy government bonds with a yield of 0.25%, so that their yield does not exceed this level.

Thus, despite rising inflation, the Bank of Japan strengthened signals of commitment to a loose monetary policy.

“While central banks in the US and Europe are moving towards tightening monetary policy or raising rates, the Japanese economy is still on track to recover from the impact of the pandemic,” Bank of Japan Governor Haruhiko Kuroda said at a press conference. it is important to support the economic recovery by patiently pursuing an easy monetary policy."

Kuroda reiterated that, in his opinion, the weakness of the currency is positive for the country's economy as a whole. The weakness of the yen increases the competitiveness of Japanese exporters, who pay workers in yen and receive dollars or euros for their goods.

Thus, despite the fact that in less than two months the yen has lost more than 10% of its value, we should expect its further weakening, primarily in relation to the USD.

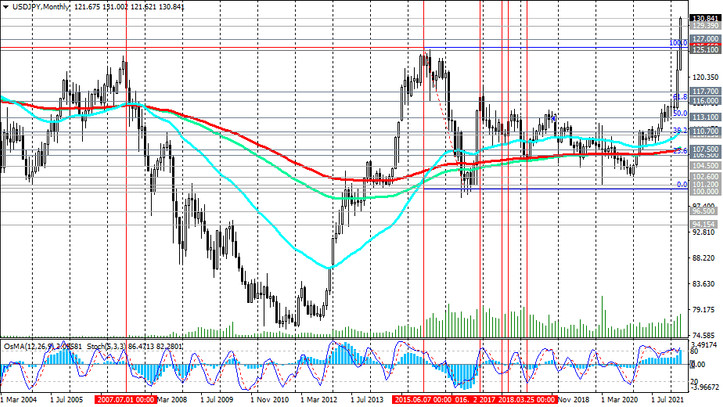

The USD/JPY is currently traded near 130.90, about 400 pips above 127.00, Tuesday's low.

On the weekly and monthly USD/JPY charts, the Stochastic has been in the overbought zone for a long time, not wanting to get out of there, which indicates a strong bullish momentum.

Given the accelerating divergence of the curves reflecting the direction of the monetary policies of the Fed and the Bank of Japan, further growth of USD/JPY should be expected. Note that at the beginning of 2002 the pair was close to 135.00. It is likely that it will become a benchmark and target for the growth of USD/JPY.

The alternative downside scenario should be considered in the current situation only as a short-term correction, which will provide additional buying opportunities.

Support levels: 130.00, 129.39, 127.00, 125.65, 125.10, 121.30, 117.70, 116.00, 113.10, 110.70

Resistance levels: 131.00

Trading scenarios

Buy Stop 131.10. Stop Loss 129.30. Take Profit 132.00, 133.00, 134.00, 135.00

Sell Stop 129.30. Stop Loss 131.10. Take-Profit 129.00, 128.00, 127.00, 126.00, 125.65, 125.10, 123.66, 122.10, 121.30, 117.40, 116.00, 110.70