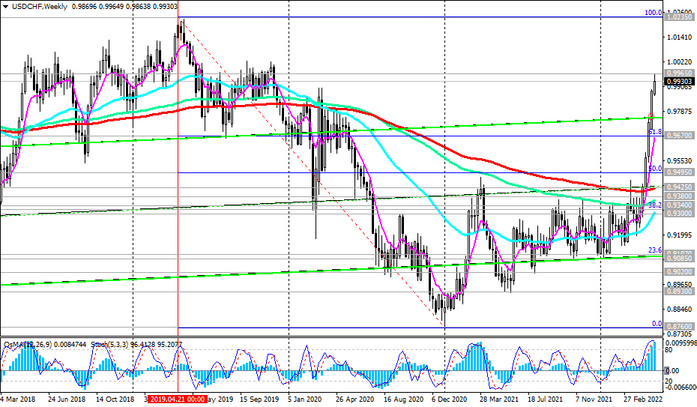

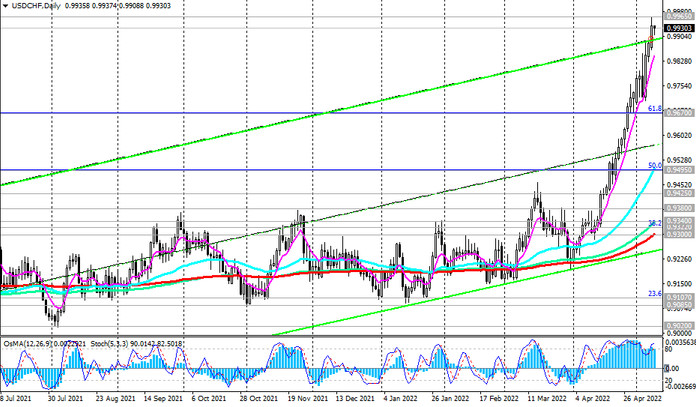

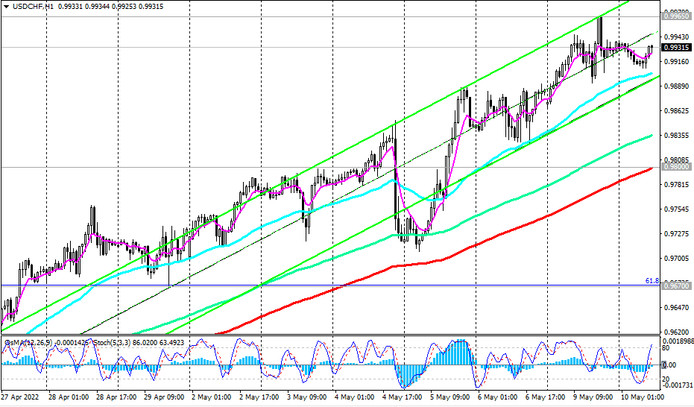

As we noted above, USD/CHF is traded near 0.9940 as of this writing, 25 pips off yesterday's 29-month high of 0.9965. Thru the 0.9965 mark, also an important long-term resistance level in the form of the 144-period moving average on the monthly chart passes.

The pair maintains a strong positive momentum and, accordingly, the potential for further growth. If it takes place, then after the breakdown of the resistance level 0.9965 USD/CHF will head towards the key resistance level 1.0450 (EMA200 on the monthly chart), which separates the long-term bullish trend of the pair from the bearish one. Therefore, its breakdown will finally bring USD/CHF into the zone of a long-term bull market.

In an alternative scenario, there will be a rebound near the resistance level 0.9965 and USD/CHF will fall. However, as we assume, - only within the short-term correction with the target at the short-term support level 0.9800 (ЕМА200 on the 1-hour chart).

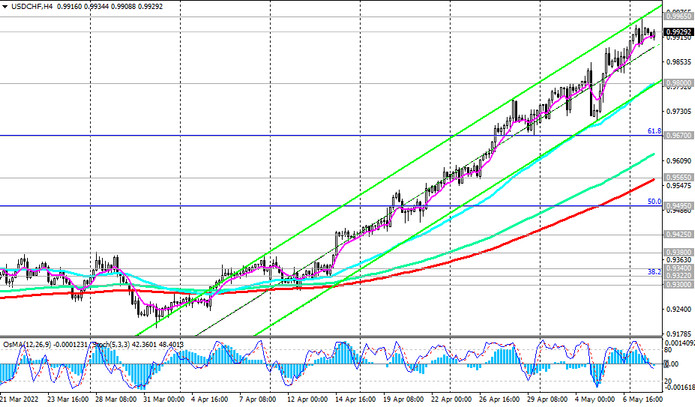

Whether there will be a deeper correction - is unlikely, although, from a technical point of view, it is possible up to the support levels 0.9670 (the Fibonacci level 61.8% of the upward correction to the downward wave that began in April 2019 near 1.0235), 0.9565 (EMA200 at 4-hour chart).

So far, long positions are preferred.

Support levels: 0.9900, 0.9800, 0.9700, 0.9670, 0.9600, 0.9565, 0.9500, 0.9495, 0.9425, 0.9380, 0.9322, 0.9300

Resistance levels: 0.9965, 1.0000, 1.0235, 1.0450

Trading recommendations

Sell Stop 0.9890. Stop Loss 0.9970. Take-Profit 0.9800, 0.9700, 0.9670, 0.9600, 0.9565, 0.9500, 0.9495, 0.9425, 0.9380, 0.9322, 0.9300

Buy Stop 0.9970. Stop Loss 0.9890. Take-Profit 1.0000, 1.0100, 1.0235, 1.0300, 1.0450