As the US Bureau of Economic Analysis reported last Thursday, GDP in the 1st quarter decreased by -1.5% per annum, and not by -1.4%, as previously reported. In the previous 4th quarter, GDP grew by +6.9%, by +2.3% in the 3rd quarter, in the 2nd quarter of GDP - by +6.7%, in the 1st quarter of 2021 by +6.3%. The forecast for the 1st quarter of 2022 assumed GDP growth of +1.1%.

Updated weaker GDP data turned out to be the second negative factor for the dollar (after the release on Wednesday of the Census Bureau's weak report on orders for durable goods). According to this report, the growth in orders for durable goods slowed down in April.

At the same time, inflation in the US remains at its highest levels in the last 40 years. Thus, the consumer price index (CPI) in April rose by +0.3% (+8.3% in annual terms), exceeding the growth forecast by +0.2% and +8.1%, respectively. Although growth was better than expected, it still slowed down from +1.2% and +8.5%, respectively, in March.

The published data, which turned out to be worse than expected, indicate the risks of a slowdown in economic growth in the US, which suggests a negative impact of the Fed's monetary tightening on the economy. Now market participants are beginning to reassess the plans of the Fed and the prospects for its monetary policy.

The week before last (on the radio program Marketplace), Fed Chairman Jerome Powell once again said that if economic indicators are in line with expectations, he considers it appropriate to raise interest rates by 50 basis points at the next two meetings. At the same time, he also said that "if the situation is better than we expect, then we are ready to do less," introducing a kind of intrigue about the Fed's future actions regarding monetary policy.

Yesterday's weakening of the dollar was also reflected in the decline of the DXY dollar index. Today it also continued to decline during the Asian trading session, reaching a local 5-week low of 101.45, which is 361 points lower than the local maximum (since January 2003) of 105.06, reached in the first ten days of May.

The dollar is also losing support from US government bonds, the yield of which continues to decline. Thus, the yield of 10-year US bonds is currently 2.752%, which corresponds to the levels of a month ago.

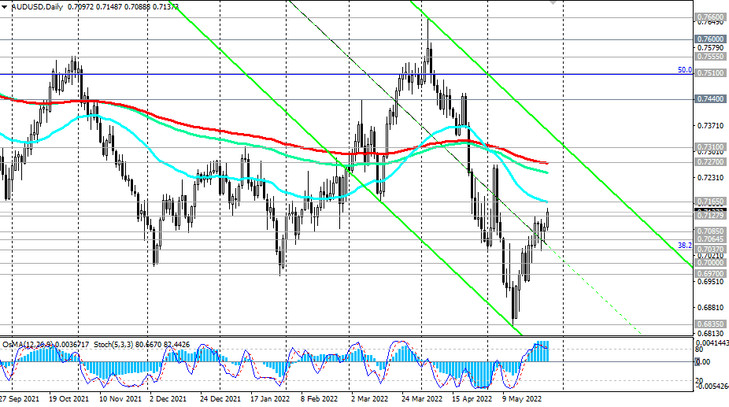

The weakening of the dollar, in particular, is reflected in its fall against major commodity currencies. Thus, the AUD/USD pair is traded at the time of publication of this article near the mark of 0.7138, 41 points above the opening price of today's trading day.

Most likely, the dollar will end this week, the second in a row, in negative territory, while the pair AUD / USD, at the same time, will have the opportunity to rise to the level 0.7165 in the short term.

AUD/USD is receiving support from weaker macro data from the US, which increases the risk that the Fed will pause the interest rate hike cycle after the July meeting.

At the same time, economists note increased inflationary pressures in the Australian economy, which may force the Reserve Bank of Australia to tighten policy more aggressively. According to their forecast, in the 3rd quarter, the annual inflation rate in Australia will exceed 7%, which may force the RBA to raise the key rate to 2.75% by the beginning of next year despite the weakening of economic activity and lower house prices. Thus, the likelihood of a repeated increase in the RBA rate by 50 basis points has increased, and this is a positive factor for the Australian currency.