EUR/USD has been declining since the opening of today's trading day. At the time of publication of this article, the pair is traded near the 1.0700 mark, against today's high of 1.0779. The pair fell sharply after the publication of inflation indicators from the Eurozone in the morning: the consumer price index (CPI) for the Eurozone rose in May by +8.1% (in annual terms), which was higher than the forecast of growth by +7.7% and the previous value +7.4%.

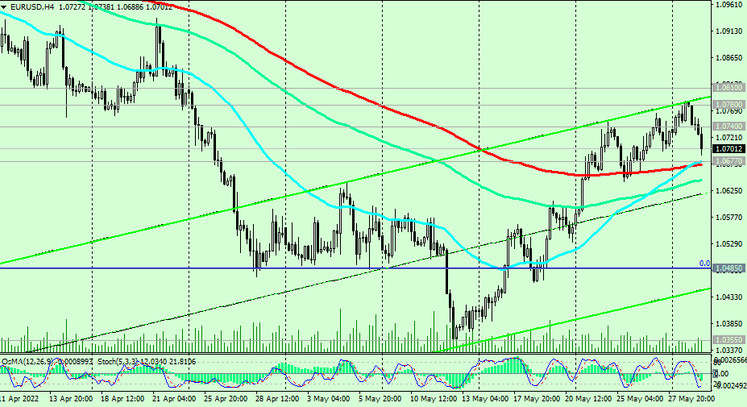

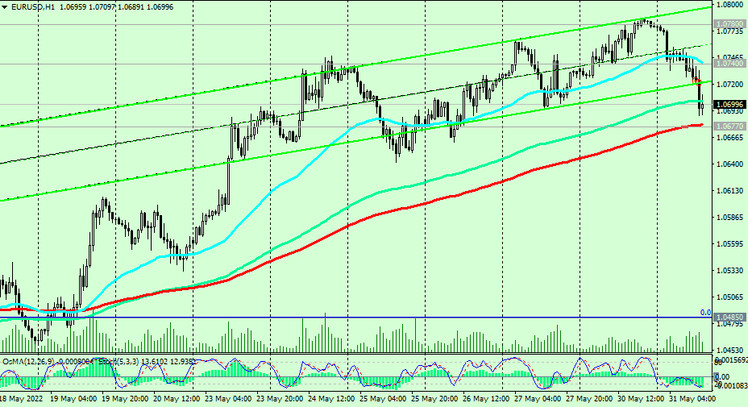

A breakdown of the support level 1.0677 (EMA200 on the 4-hour and 1-hour charts) will accelerate the EUR/USD decline towards the lower border of the descending channels on the daily and weekly charts and the 1.0355 mark.

In an alternative scenario, a breakdown of the resistance level 1.0740 (EMA50 on the daily chart) will become a driver for further growth in EUR/USD. In case of breakdown of resistance levels 1.0780, 1.0810, the growth target will be the key resistance levels 1.1040 (EMA144 on the daily chart), 1.1165 (EMA200 on the daily chart).

In the meantime, short positions remain preferable.

Trading Recommendations

Sell by market. Sell Stop 1.0670. Stop Loss 1.0750. Take-Profit 1.0600, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Buy Stop 1.0750. Stop Loss 1.0670. Take-Profit 1.0780, 1.0800, 1.0810, 1.1000, 1.1040, 1.1100, 1.1165, 1.1285