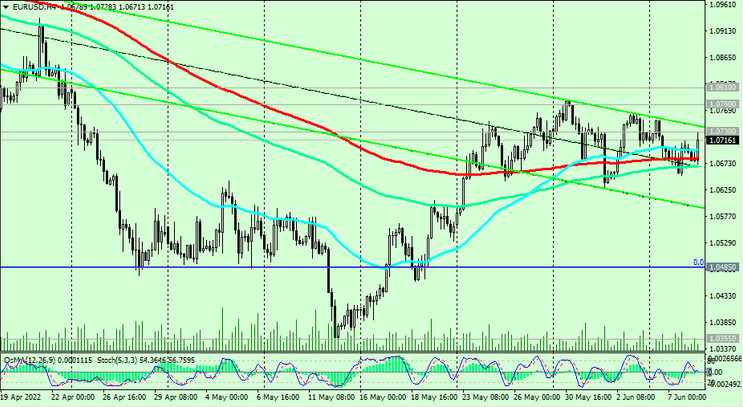

At the time of writing this article, EUR/USD is traded near 1.0717, developing an upward correction from more than 5-year lows hit last month near 1.0350. The price is above the important short-term dynamic support levels 1.0700 (EMA200 on the 1-hour chart), 1.0682 (EMA200 on the 4-hour chart).

If tomorrow the leaders of the ECB make unexpectedly tough statements about the prospects for the bank's monetary policy, then EUR/USD will break through the resistance levels 1.0780, 1.0810 and continue to grow. The first signal for the resumption of long positions will be a breakdown of the resistance level 1.0760, and the confirming one – the resistance levels 1.0780, 1.0810 (local minimum).

The growth target is the resistance levels 1.1020 (EMA144 on the daily chart), 1.1140 (EMA200 on the daily chart), below which EUR/USD remains in the bearish market zone.

Otherwise, EUR/USD runs the risk of resuming the decline, and the signal for the resumption of short positions will be a breakdown of the support levels of 1.0700, 1.0682.

Support levels: 1.0700, 1.0682, 1.0650, 1.0600, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Resistance levels: 1.0730, 1.0780, 1.0800, 1.0810, 1.1000, 1.1020, 1.1100, 1.1140, 1.1285

Trading Recommendations

Sell Stop 1.0670. Stop Loss 1.0770. Take-Profit 1.0650, 1.0600, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Buy Stop 1.0770. Stop Loss 1.0670. Take-Profit 1.0800, 1.0810, 1.1000, 1.1020, 1.1100, 1.1140, 1.1285