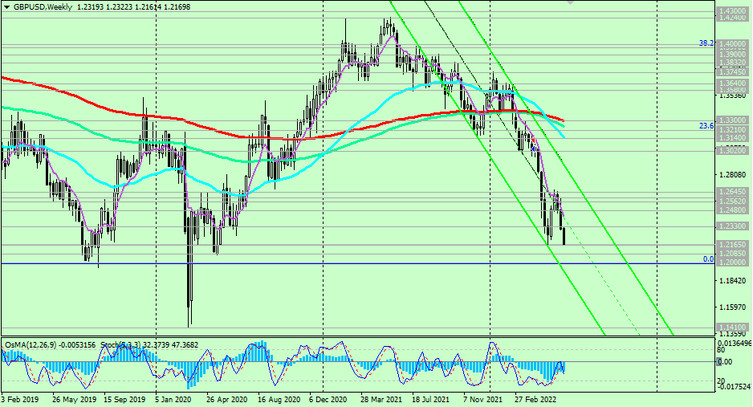

In an alternative scenario, from the current marks and near the support level 1.2165, GBP/USD will again attempt a correction, especially if the dollar gives it a reason.

As expected, on Wednesday, the Fed leaders will again raise interest rates by 0.50% and confirm their inclination to continue the aggressive tightening of monetary policy. If the market evaluates the accompanying statements of the FRS leaders as “soft”, then the dollar may come under pressure against the backdrop of fixing part of long positions on it. In this case, our alternative scenario will be relevant. The first signal to open long positions will be the breakdown of the local resistance level 1.2330, and the confirming one – the breakdown of the resistance level 1.2480 (EMA200 on the 1-hour chart).

In the meantime, short positions on GBP/USD remain preferable, moreover, with entry into shorts directly "by-the-market".

Support levels: 1.2165, 1.2100, 1.2085, 1.2000

Resistance levels: 1.2330, 1.2480, 1.2562, 1.2600, 1.2645, 1.2700, 1.3000, 1.3020, 1.3100, 1.3140, 1.3210, 1.3300

Trading recommendations

Sell Stop 1.2185. Stop Loss 1.2315. Take-Profit 1.2165, 1.2100, 1.2085, 1.2000

Buy Stop 1.2315. Stop Loss 1.2185. Take-Profit 1.2330, 1.2480, 1.2562, 1.2600, 1.2645, 1.2700, 1.3000, 1.3020, 1.3100, 1.3140, 1.3210, 1.3300