As we noted above, USD/CAD resumed growth today after falling in the previous 2 days and returned to the closes of last Monday's closing price. As you know, CAD quotes are very sensitive to the dynamics of oil prices, since Canada is a major supplier of oil to the world market, primarily to the United States.

One of the determining factors in the dynamics of the USD is also becoming a tighter monetary policy of the Fed. Although the Bank of Canada has also begun a cycle of tightening its policy, it may still not be able to keep up with the Fed, which will raise rates more aggressively. Market participants are waiting for the speech (today and tomorrow) of Fed Chairman Jerome Powell in Congress. Powell's performance starts at 13:30 today and tomorrow at 14:00 (GMT).

Meanwhile, if Powell's rhetoric is considered soft by investors and if oil prices resume growth, USD/CAD should be expected to resume its decline.

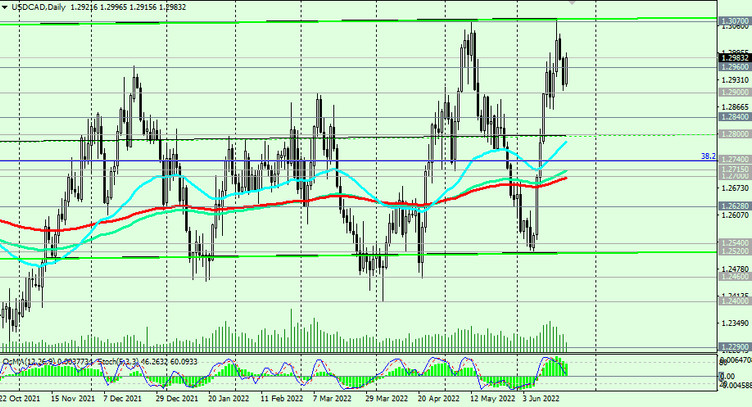

Breakdown of the support level 1.2900 (EMA200 on the 1-hour chart) will be a signal to open short positions with the targets of further decline at the support levels 1.2840 (EMA200 on the 4-hour and weekly charts). A breakdown of the support level 1.2700 (EMA200 on the daily chart) will increase the risks of a further decline in USD/CAD and a resumption of the global downtrend.

Support levels: 1.2960, 1.2900, 1.2840, 1.2800, 1.2740, 1.2700

Resistance levels: 1.3000, 1.3070, 1.3100

Trading scenarios

Sell Stop 1.2890. Stop Loss 1.3010. Take-Profit 1.2840 1.2800 1.2740 1.2700 1.2675 1.2628 1.2600 1.2540 1.2520 1.2460 1.2400 1.2290 1.2165 1.2010 1.2000

Buy Stop 1.3010. Stop Loss 1.2890. Take Profit 1.3070, 1.3100, 1.3200