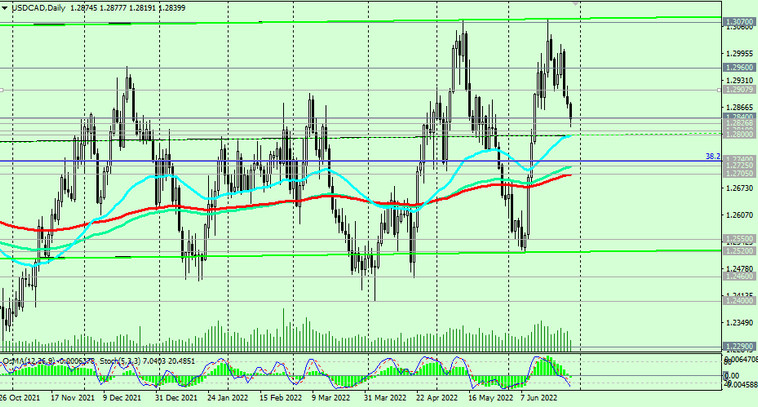

Against the backdrop of the US dollar weakening today, the USD/CAD pair has reached an important support level 1.2827 (EMA200 on the 4-hour chart). However, no further decline has been observed so far, and the USD/CAD pair has moved to a correction, trying to return into the zone above the key support level 1.2840 (EMA200 on the weekly chart).

In general, the positive dynamics of the US dollar remains, which is why we expect further growth of USD/CAD after its breakthrough to the zone above the level 1.2840.

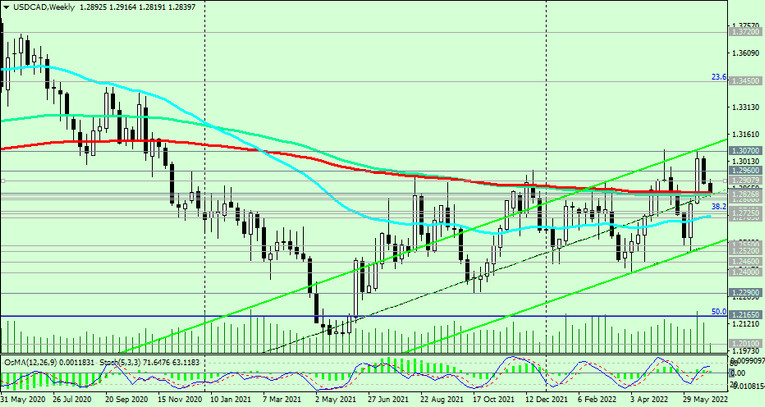

If our forecast is confirmed, then the breakdown of the important short-term resistance level 1.2908 (EMA200 on the 1-hour chart) will be a signal to increase long positions with long-term targets at resistance levels 1.3450 (Fibonacci level 23.6% of the downward correction in the USD/CAD growth wave from 0.9700 to the level of 1.4600), 1.3720 (local resistance level).

In an alternative scenario, USD/CAD will break through the support level 1.2827 and fall to support levels 1.2740 (Fibonacci 38.2% of the downward correction in the USD/CAD growth wave from 0.9700 to 1.4600), 1.2725 (EMA144 on the daily chart). Breakdown of the key support level 1.2705 (EMA200 on the daily chart) will bring USD/CAD into the bear market zone.

Support levels: 1.2840, 1.2827, 1.2810, 1.2800, 1.2740, 1.2705

Resistance levels: 1.2908, 1.2960, 1.3000, 1.3070, 1.3100, 1.3450, 1.3720

Trading scenarios

Sell Stop 1.2790. Stop Loss 1.2880. Take-Profit 1.2740, 1.2700, 1.2600, 1.2550, 1.2520, 1.2460, 1.2400, 1.2290, 1.2165, 1.2010, 1.2000

Buy Stop 1.2880. Stop Loss 1.2790. Take-Profit 1.2908, 1.2960, 1.3000, 1.3070, 1.3100, 1.3450, 1.3720