“We will look at changing conditions. And if we come to the conclusion that it is appropriate to act faster and cancel easing measures, then we will do so," Fed Chairman Jerome Powell said at a press conference after the March meeting. As you know, following the meeting ended on March 16, 2022, US central bank' leaders raised interest rates by 0.25% and announced their intention to raise interest rates 6 more times in 2022, also allowing for the possibility of a tougher decision. In May, the Fed also began to reduce the size of its balance sheet.

Now, and as follows from the minutes of the June meeting of the Open Market Committee (FOMC) published last Wednesday, the Fed will raise rates by 50 or 75 basis points in July. They also say that high inflation justifies "restrictive" interest rates, with the possibility of a "more restrictive stance" if inflation continues at high levels.

And now, when the Fed's monetary policy is tightening more and more, recession risks have increased significantly in the global economy, and the US dollar continues to rise in price, commodity prices, naturally, are declining.

Fears are growing in the market that the rapid tightening of monetary policy by the world's largest central banks, which so far cannot stop accelerating inflation, will lead to recession and stagflation (this is when economic growth slows down or stops altogether, while inflation continues to grow) in the global economy. These fears, in turn, lead to increased demand for a safe dollar, which, in turn, puts pressure on stock markets and commodity currencies.

And so far, the strengthening US dollar, and today the DXY dollar index has confidently broken through 108.00, is the determining factor in the dynamics of commodity prices, which are also quoted mainly in dollars.

This week, 2 of the world's largest central banks (RBNZ and the Bank of Canada) will hold their regular meetings on monetary policy issues at once, and both are expected to raise their interest rates: the RBNZ by 0.50%, and the Bank of Canada at once 0.75%.

Both economies (New Zealand and Canada) still have signs of raw materials in many respects.

Moreover, the main share of New Zealand exports falls on dairy products and food products of animal origin, and Canadian exports - on oil and oil products.

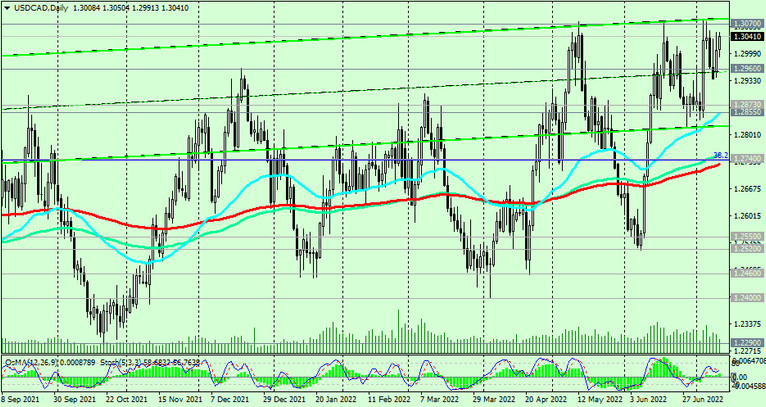

But despite the expectations of an increase in interest rates by the Bank of Canada and the RB of New Zealand, the quotes of the national currencies of Canada and New Zealand are falling against the US dollar.

As we noted above, the risks of a recession have increased significantly in the global economy, and investors are looking for an exit in investing in a safe dollar, while the Fed's monetary policy is currently perhaps the tightest among the monetary policies of other major global central banks.

Recall that the RBNZ interest rate decision will be published on Wednesday at 02:00 (GMT), and the Bank of Canada - at 14:00, and market participants need to be prepared for a sharp increase in volatility during this period of time, especially in NZD and CAD, as well as the NZD/USD and USD/CAD pairs.