As follows from a recent report from Statistics Canada, unemployment in June 2022 was at 4.9% (against 5.1% in May, 5.2% in April, 5.3% in March, 5.5% in February, 6.5% in January 2022). The decline in unemployment is positive for the CAD and for the Bank of Canada, which may act more decisively in the face of rising inflation. And it is growing rapidly in Canada, as elsewhere in the world.

The annual consumer price index (CPI) rose in May to +7.7%, the highest level in 39 years. The annual CPI was above the forecast of +7.4% and the previous value of +6.8%. On a monthly basis, CPI rose by +1.4% in May (against the forecast of +1.0% and the previous value of +0.6%). Core CPI, which excludes food and energy, rose to +6.1% (y/y) in May, also beating the +5.9% growth forecast and the previous +5.7%. As Bank of Canada Senior Deputy Governor Carolyn Rogers recently said, commenting on inflation data released in late June, this is "an undesirable figure." "The CPI is too high, it's hurting Canadians, it's keeping us up at night," Rogers said, and "it's still a long way before inflation starts to come down."

Economists believe that the Bank of Canada will accelerate the cycle of monetary tightening it has begun and raise the key interest rate by 75 bp. at today's meeting, and then by 50 b.p. in September and October, thus bringing it to the level of 3.25%. In this sense, the Bank of Canada is a kind of competitor to the Fed, which is also accelerating the pace of tightening its monetary policy.

However, it should be noted that although the increase in the interest rate by the central bank is, in principle, a positive factor for the national currency, one cannot discount the strong US dollar, which is in active demand.

What can be guaranteed in this situation is a sharp increase in volatility in CAD quotes and, accordingly, USD/CAD, during the time period when the decision of the Bank of Canada on the interest rate is published. And it is scheduled for 14:00 (GMT). At 15:00, the Bank of Canada press conference will begin, which may also cause an increase in volatility, especially if unexpected statements are made by the bank's management regarding the outlook for the central bank's monetary policy.

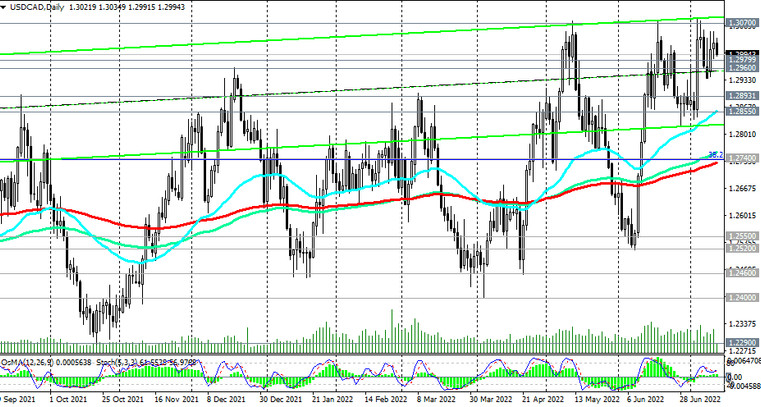

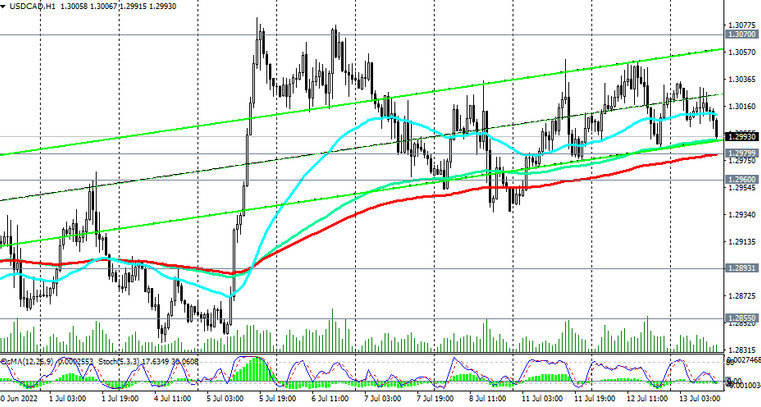

A breakdown of the local resistance level 1.3070 will confirm the bullish market sentiment and send USD/CAD towards the resistance level 1.3450 (Fibonacci level 23.6% of the downward correction in the USD/CAD growth wave from 0.9700 to 1.4600) with the prospect of further growth.

In an alternative scenario, USD/CAD will break the support level 1.2980 (EMA200 on the 1-hour chart) and fall to the support level 1.2855. Its breakdown will be the first signal that USD/CAD will return to the zone of a long-term bear market.

Support levels: 1.2980, 1.2960, 1.2893, 1.2855, 1.2740, 1.2700, 1.2550, 1.2520

Resistance levels: 1.3070, 1.3100

Trading scenarios

Sell Stop 1.2970. Stop Loss 1.3050. Take-Profit 1.2900, 1.2893, 1.2855, 1.2740, 1.2700, 1.2550, 1.2520

Buy Stop 1.3050. Stop Loss 1.2970. Take Profit 1.3100, 1.3200, 1.3300