Last Thursday, the DXY dollar index broke through another "round" level 109.00, rising to 109.14 mark and adding another 200 points over the week. This is the 3rd consecutive week of growth in the DXY: the dollar index is in a steady bull trend from June 2021. Given the strong bullish momentum, as well as the long-term uptrend in DXY, a breakdown of yesterday's local maximum 109.14 will be a signal to increase long positions in DXY futures with the prospect of growth towards multi-year highs of 121.29 and 129.05, reached, respectively, in June 2001 and November 1985.

The dollar continues to dominate financial markets, while major US stock indices are under pressure, remaining in the area of critical support levels that separate the long-term bullish trend from the bearish one. Market participants continue to evaluate the inflation indicators published earlier this week, which pointed to the continuing rise in inflation in the US.

As follows from the data of the US Bureau of Labor Statistics, published last Wednesday, in June, inflation in the US accelerated from 1.0% to 1.3%, and in annual terms jumped to the highest level in the last 40 years, amounting to 9.1%. (YoY) vs. 8.6% in May and market expectations of 8.8%. Such a sharp increase in inflation, despite the actions of the Fed, strengthened the expectations of market participants regarding the more rapid tightening of the monetary policy of the US central bank, and as a result, the dollar continues to strengthen, well ahead of its main competitors in the foreign exchange market.

At the same time, at the end of such a successful week for the dollar, some downward correction is possible, which may be provoked by weak macro data, the publication of which is scheduled for 12:30 and 14:00 (GMT): retail sales data and a preliminary index of consumer confidence from the University of Michigan.

Consumer spending accounts for most of the overall economic activity of the population, while domestic trade accounts for the largest part of GDP growth. The indicators are expected to rise, but their relative decline may have a short-term negative impact on the dollar, and the growth of the indicator will have a positive impact on the USD.

The consumer confidence index is also a leading indicator of consumer spending and reflects the confidence of American consumers in the economic development of the country. Its next relative decline is expected (previous indicator values: 50.0, 58.4, 65.2, 59.4, 62.8, 67.2 in January 2022), which may also provoke a weakening of the dollar.

Inflation in the US is still growing, and at a rapid pace, and this cannot but alert American consumers.

Thus, today's US macro data may provoke a dollar correction, provided that they turn out to be worse than the forecast. It is unlikely that this correction will be long-term, however, it may provide some respite to market participants betting on the weakening of the dollar and buyers of US stock market assets.

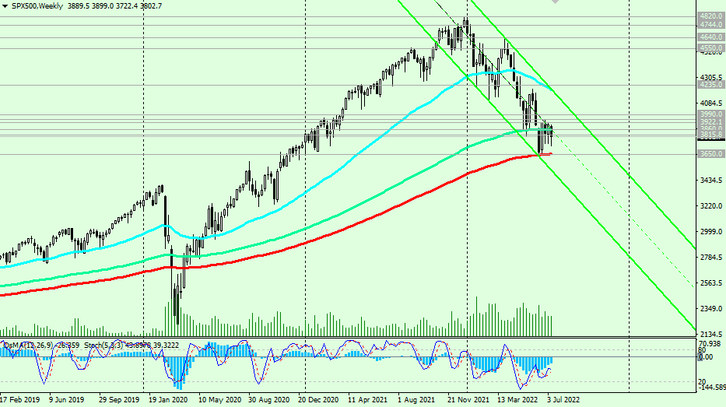

Despite the current upward correction, in general, the negative dynamics of the S&P 500 and the entire American, and not only the American, stock market remains. Investors prefer the safe dollar.

A breakout of today's low 3778.00 and the local support level 3740.00 will be a signal for the resumption of short positions, and a breakout of the key support level 3645.00 (EMA200 on the weekly chart) - for their buildup.