Today, after the publication of inflation indicators for the UK this morning, market volatility may increase again at the beginning of the US trading session, when consumer price indices in Canada will be published at 12:30 (GMT), reflecting the dynamics of retail prices of the corresponding basket of goods and services (for more details).

As you know, the Bank of Canada aggressively raised its key rate by 100 basis points to 2.5% in July, admitting in an accompanying statement that it underestimated inflation. "Inflation is higher and more resilient than expected in April forecasts and is likely to remain at 8% in the coming months", the bank said, and "interest rates will need to be raised further", "to reach the 2% inflation target".

Market participants watching the Canadian dollar and the USD/CAD pair will also pay attention to the publication at 14:30 (GMT) of the weekly report of the US Department of Energy with data on commercial stocks of oil and petroleum products.

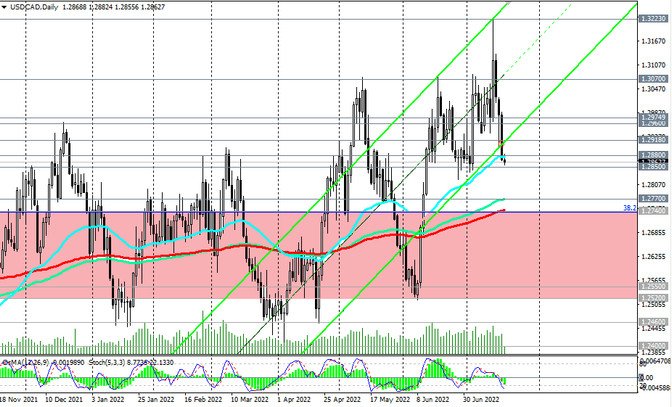

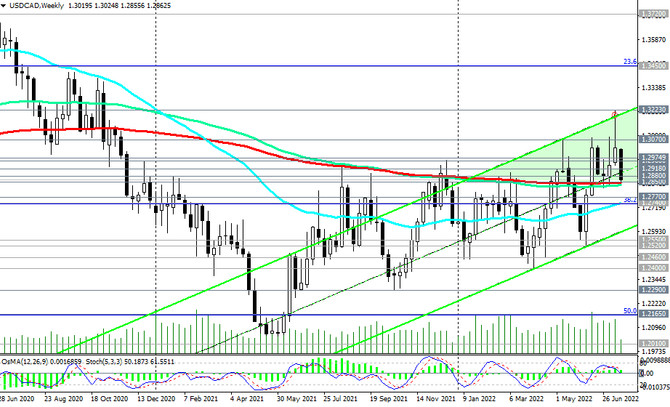

At the time of publication of this article, USD/CAD is traded near 1.2863 mark, remaining in the bull market zone - above the key support levels 1.2850, 1.2770, 1.2740. However, important short-term support levels 1.2975, 1.2918, 1.2880 are broken, which signals the development of a downward correction, which may last up to support levels 1.2770, 1.2740 (if the combination of factors is successful).

The breakout of resistance levels 1.2880 (EMA50 on the daily chart), 1.2918 (EMA200 on the 4-hour chart) will be the first signal for the resumption of long positions, and the breakout of the resistance level 1.2975 (EMA200 on the 1-hour chart) will be a confirming one.

Support levels: 1.2850, 1.2800, 1.2770, 1.2740, 1.2700, 1.2550, 1.2520

Resistance levels: 1.2880, 1.2918, 1.2960, 1.2975, 1.3070, 1.3100, 1.3223

Trading scenarios

Sell Stop 1.2840. Stop Loss 1.2925. Take-Profit 1.2800, 1.2770, 1.2740, 1.2700, 1.2550, 1.2520

Buy Stop 1.2925. Stop Loss 1.2840. Take-Profit 1.2960, 1.2975, 1.3070, 1.3100, 1.3223