As follows from a recent report by Eurostat, annual inflation in the Eurozone in June amounted to 8.6%. The ECB responded to the acceleration of inflation in the region in July by raising interest rates, for the first time in 11 years. The bank raised interest rates by 50 bp last week versus 25 bp expected. Now, ECB leaders expect an increase in short-term and long-term inflationary expectations in the Eurozone, and with it - further tightening of monetary conditions. Inflation in 2022 is expected at 7.3% against an estimate of 6.0% 3 months ago, while GDP growth in 2022 is expected at 2.8% against 2.9% forecast 3 months ago, in 2023 - by level of 1.5% versus 2.3%. Increasing pressure from energy prices, tightening monetary policy, weakening household purchasing power are holding back the growth of the European economy. Amid renewed worries about a looming recession in the bloc, the euro failed to strengthen significantly after the ECB's July meeting.

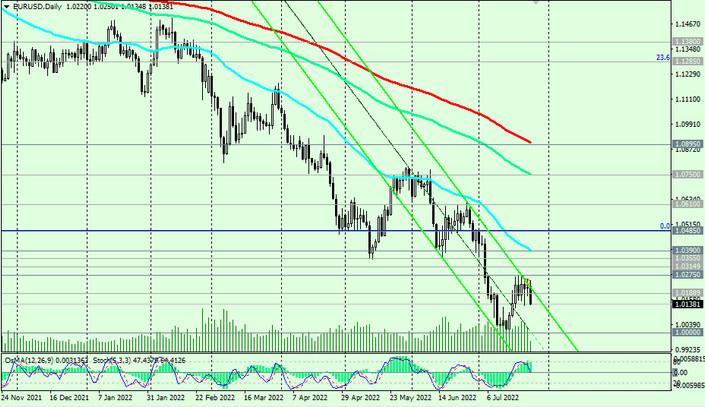

Having risen from the parity level, the EUR/USD pair failed to develop a stable upward trend and overcome the local resistance level 1.0275.

A report released on Monday by the CESifo research group pointed to another deterioration in the business climate and business sentiment in Germany. This report by the German research institute IFO, based on a survey of 9,000 firms in the manufacturing, services, trade and construction sectors, reflecting the current level of business sentiment in Germany, attracts close attention, as it is a leading indicator of current conditions and expectations in the business sector this country, whose economy is the locomotive of the entire European economy.

The frankly weak IFO report suggests that Germany, and to a large extent the entire Eurozone economy, is on the verge of a recession, under pressure from high energy prices and geopolitical uncertainty associated with the situation in Ukraine. According to IFO economists, German companies expect a significant deterioration in business activity in the coming months.

Today EUR/USD is falling, testing the important short-term support level 1.0189 (EMA200 on the 1-hour chart) for a breakdown.

EUR/USD also continues to fall deeper into the downward channel on the weekly chart, the lower limit of which is currently near 0.9800 mark.

Possible corrective growth will most likely be limited either by the local resistance level 1.0275, or (if the circumstances are successful for the euro) by the resistance level 1.0390 (EMA50 on the daily chart). In the main scenario, we expect further decline.

Support levels: 1.0100, 1.0000, 0.9800

Resistance levels: 1.0189, 1.0275, 1.0315, 1.0355, 1.0390, 1.0610, 1.0750, 1.0800, 1.0895, 1.1000

Trading Recommendations

EUR/USD: Sell by market. Stop Loss 1.0210. Take Profit 1.0100, 1.0000, 0.9800

Buy Stop 1.0210. Stop Loss 1.0130. Take-Profit 1.0275, 1.0315, 1.0355, 1.0390, 1.0610, 1.0750, 1.0800, 1.0895, 1.1000