As we have already noted in our previous review, today the focus of investors will be the report of the US Department of Labor with monthly data on the labor market, which will be published at 12:30 (GMT).

Also at the same time, Statistics Canada will publish data on the country's labor market for July. Unemployment has risen in Canada in recent months: from the usual 5.6% - 5.7% to 7.8% in March and already to 13.7% in May 2020. If unemployment continues to rise, the Canadian dollar will decline. If the data turns out to be better than the previous value, then the Canadian dollar will strengthen. Decreasing unemployment rate is a positive factor for CAD, rising unemployment is a negative factor.

Unemployment is expected to rise to 5.1% in July (previous value of 4.9%). The deterioration of the situation on the labor market will significantly exacerbate the Bank of Canada's problem of curbing rising inflation while the labor market and the country's economy are slowing down.

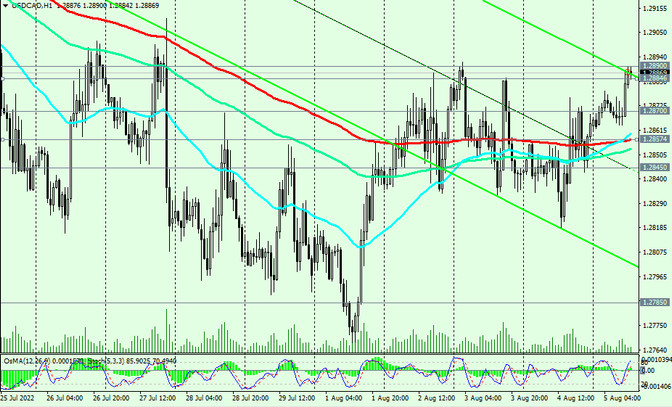

From a technical point of view, USD/CAD is in the bull market zone, above the key support levels 1.2850 (EMA200 on the weekly chart), 1.2785 (EMA144 on the daily chart), 1.2755 (EMA200 on the daily chart).

Today's publication at 12:30 (GMT) may become a driver for further growth, if the data for the US turns out to be positive, and for Canada it is negative.

The breakdown of the local resistance level 1.2890 will be a confirmation signal for new long positions in USD/CAD.

In an alternative scenario, and after the breakdown of support levels 1.2857 (EMA200 on the 1-hour chart), 1.2845 (local support level), USD/CAD will head towards the key support levels 1.2755, 1.2740 (Fibonacci level 38.2% of the downward correction in the USD/ CAD from 0.9700 to 1.4600). Their breakdown will return USD/CAD to the bear market zone.

Support levels: 1.2870, 1.2857, 1.2845, 1.2800, 1.2785, 1.2755, 1.2740, 1.2700, 1.2550, 1.2520

Resistance levels: 1.2890, 1.2960, 1.3000, 1.3070, 1.3100, 1.3223

Trading scenarios

Sell Stop 1.2860. Stop Loss 1.2910. Take-Profit 1.2845, 1.2800, 1.2785, 1.2755, 1.2740, 1.2700, 1.2550, 1.2520

Buy Stop 1.2910. Stop Loss 1.2860. Take-Profit 1.2960, 1.3000, 1.3070, 1.3100, 1.3223