The Canadian annual consumer price index (CPI) rose to +7.7% in May, the highest level in 39 years, and in June inflation exceeded this level, reaching 8.1%. At the same time, the unemployment rate in July remained at the same rather high level 4.9%. The deteriorating situation on the labor market significantly exacerbates the Bank of Canada's problem of curbing rising inflation while the labor market and the country's economy are slowing down.

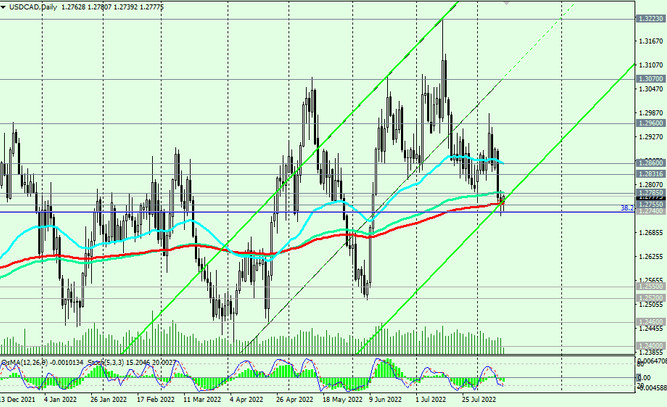

From a technical point of view, USD/CAD is still in the bull market zone, above the key support level 1.2755 (EMA200 on the daily chart).

Today's publication at 14:00 (GMT) may be a driver for further growth if the US data (University of Michigan Consumer Confidence) turns out to be positive.

The breakdown of the resistance level 1.2785 (EMA144 on the daily chart) will be a signal for new long positions in USD/CAD.

In an alternative scenario, and after the breakdown of support levels 1.2755, 1.2740 (Fibonacci 38.2% of the downward correction in the USD/CAD growth wave from 0.9700 to 1.4600), USD/CAD will return to the bear market zone.

Support levels: 1.2755, 1.2740, 1.2700, 1.2550, 1.2520

Resistance levels: 1.2785, 1.2831, 1.2860, 1.2960, 1.3000, 1.3070, 1.3100, 1.3200

Trading scenarios

Sell Stop 1.2725. Stop Loss 1.2810. Take Profit 1.2740, 1.2700, 1.2550, 1.2520

Buy Stop 1.2810. Stop Loss 1.2725. Take-Profit 1.2831, 1.2860, 1.2960, 1.3000, 1.3070, 1.3100, 1.3200