Powell did not disappoint dollar buyers, promising that "restoring price stability will take some time and will require the decisive use of central bank instruments."

And this means that the Fed's ultra-tight cycle of monetary policy tightening will continue for the time being, perhaps even at about the same pace. Thus, the trend of further strengthening of the dollar remains.

The DXY dollar index opened the new week with a gap up and a new 20-year record at 109.44, having received a bullish momentum last Friday, starting to strengthen immediately after the start of the Fed Chairman Powell's speech. He confirmed that the priority goal for the Fed is to fight high inflation.

A lot of important macro statistics are planned for the US this week, however, the main focus will be on the publication on Friday (at 12:30 GMT) of the monthly report of the US Department of Labor with data on the state of the US labor market for August. This publication is extremely important for market participants: data on the state of the labor market (along with data on GDP and inflation) are key for the Fed in determining the parameters of the current monetary policy.

According to the forecast, 285,000 new jobs were created in the American economy in August, salaries of employees continued to grow, and unemployment remained at 3.5%, the same as in July. These are the lowest levels of unemployment over the past few years, correlated with pre-pandemic levels.

In general, the figures can be called encouraging. The data shows continued improvement in the US labor market, and before the coronavirus, the US labor market remained strong, indicating the stability of the US economy.

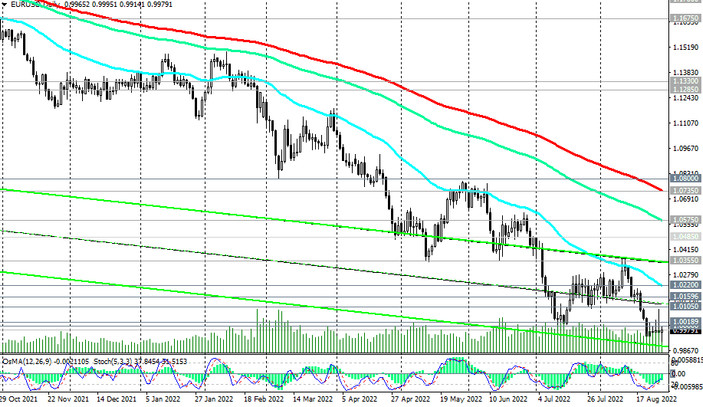

As for the main competitor of the dollar on the euro currency market, today it is strengthening at the beginning of the European session both in cross rates and against the dollar. At the time of publication of this article, the EUR/USD pair is traded near the 0.9980 mark, having risen from today's local low of 0.9915. Will there be another return to the zone above parity 1.0000? Perhaps it will. But whether there will be further growth is unlikely. In general, the downward dynamics of EUR/USD remains.

Of the news for today, it is worth paying attention to the speech at 18:15 (GMT) by Lal Brainard, a member of the US Federal Reserve's Open Market Committee. It will be interesting to hear her opinion on the prospects for the Fed's monetary policy, harshly outlined by Powell last week. The harsh rhetoric of her comments may encourage market participants to new purchases of the dollar.