IC Markets: A Global Forex Powerhouse

Located in Sydney, Australia, IC Markets has gained a reputation as a top-tier forex CFD provider worldwide. Its daily forex trade volume exceeds $15 billion, with over half a million orders executed daily. Regulatory bodies such as the Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, and the Financial Services Authority (St Vincent & the Grenadines) oversee the broker's operations. At present, IC Markets serves over 100,000 active clients across more than 140 countries.

Unrivalled Trading Experience with IC Markets

IC Markets stands out for its narrow variable spreads, starting from 0.0 pips on major FX pairs. It's renowned for its impressive order execution speed, often processing trades in under 40 milliseconds. This makes it a prime choice for high-frequency traders, algorithmic strategies, and institutional investors. While the minimum deposit of $200 may seem higher than that of other FX brokers, it remains accessible for both beginners and seasoned traders. IC Markets accepts deposits through various channels, including credit/debit cards, bank transfers, PayPal, Skrill, Union Pay, and Neteller. They take extra measures to ensure customer funds are safe by keeping them in segregated accounts, fully insured.

The Pros & Cons of Trading with IC Markets

Pros

- Exceptional Order Execution Speeds

- Support for All Trading Strategies & Styles

- User-friendly Trading Platforms with Added Value Tools

- Super Tight Variable Spreads & Minimal Commissions

- Around-the-Clock Customer Support

- Zero Charges for Deposits or Withdrawals

Cons

- Elevated Minimum Deposit

- Does Not Cater to US Clients

Ideal Clientele for IC Markets

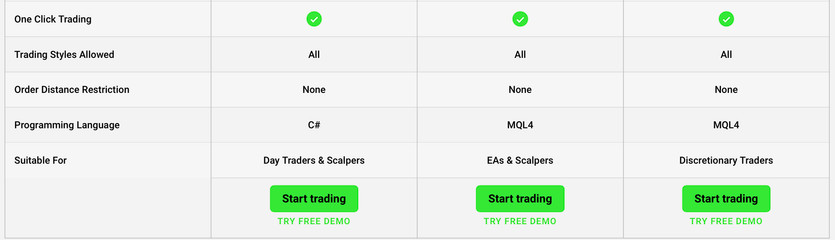

IC Markets is a go-to platform for discretionary traders, day traders, and those utilizing automated strategies. The platform is especially attractive for advanced traders and institutional investors seeking superior trading conditions, like ultra-fast order execution. IC Markets guarantees near-instantaneous order execution, with average latency speeds just below 40ms. It supports a wide range of strategies, including scalping, hedging, and high-frequency algorithms.

New traders will appreciate the educational resources and helpful tools like AutoTrader and ZuluTrade, catering to those favoring a hands-off investment approach. Moreover, IC Markets offers a diverse range of instruments, covering foreign exchange, commodities, indices, shares, bonds, futures, and cryptocurrencies, enabling investors to diversify their portfolios effectively.

Top Features of IC Markets

- Exceptional Trading Conditions: IC Markets shines with superior trading conditions, including ultra-low latency execution, high-speed order matching, deep liquidity, and tight spreads, along with advanced features like multiple order types, detachable charts, and market depth.

- Open to All Strategies: IC Markets welcomes all trading strategies, including scalping, hedging, and automated algorithmic trading, facilitated by ultra-fast Equinix servers in London and New York that deliver rapid colocation execution and virtual private servers (VPS) boasting unparalleled reliability and security.

- Wide Range of Supported Securities: Investors keen on diversifying their portfolios will appreciate the range of over 230 financial instruments, including less commonly available securities like bonds, futures, and cryptocurrencies.

- Round-the-Clock Customer Support: IC Markets provides continuous customer support to address user queries and troubleshoot any third-party tool connectivity issues 24/7. The customer service team is multilingual and can be reached via various channels.

Compliance & Regulation at IC Markets

IC Markets operates under the regulations of three authorities: the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the

St. Vincent & the Grenadines Financial Services Authority (SVGFSA). The broker also adheres to global regulations on Anti-Money Laundering (AML) and Counter Financial Terrorism.

IC Markets prioritizes client fund security by holding funds in segregated accounts and providing full insurance. The broker has also satisfied all requirements related to internal risk management and adequate capital, and their operations undergo regular external audits to ensure full compliance. This level of regulation and transparency reassures clients that their interests are always paramount.

Pricing Structure at IC Markets

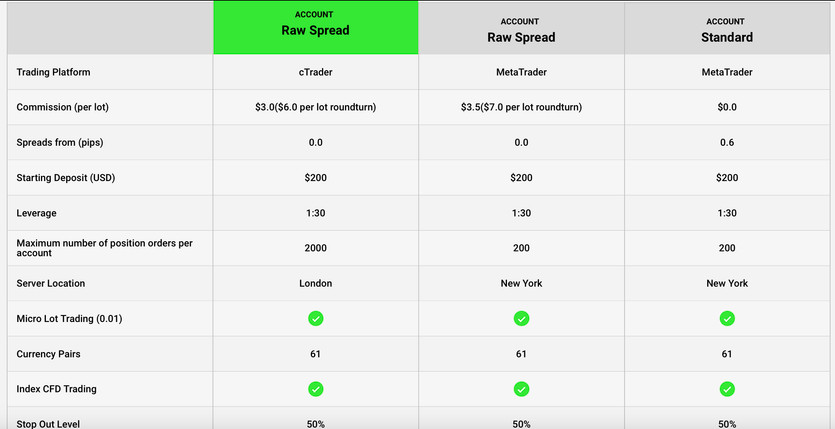

IC Markets boasts some of the most competitive spreads in the industry. Spreads start from 0.0 pips for both the cTrader Account and Raw Spread Account, while the Standard Account offers spreads beginning at 1.0 pip. The broker also charges commissions depending on the account type, with the cTrader Raw Spread Account and the Raw Spread Account incurring commissions of $3 and $3.5 per trade, respectively. No commissions apply for the Standard Account.

Considering the tight spreads and affordable commissions, IC Markets' fee structure is among the industry's best. The broker also supports leverage of up to 500:1, offering clients the opportunity to significantly leverage their capital. Importantly, IC Markets imposes no fees for deposits or withdrawals and no inactivity charges.

The Reliability & Security of IC Markets

IC Markets provides users access to three major trading platforms: cTrader, MetaTrader 4, and MetaTrader 5. These platforms can be accessed on desktops, web-browsers, and internet-connected mobile devices, with dedicated mobile apps for both Android and iOS.

These platforms are known for their ultra-low latency order execution, facilitated by IC Markets' connections to two Equinix data centers in London and New York. These data centers employ dedicated fiber-optic networks to ensure rapid, slippage-free order execution.

The platforms are reliable, intuitive, and feature advanced options such as built-in spread monitoring, automated trade closing with custom order templates, and ladder trading. Additionally, they provide real-time pricing updates.

IC Markets has earned several awards for its superior trading conditions, including:

- ADVFN International Financial Awards Best ECN Broker 2019

- Forex Magnates Awards Best Retail Broker Execution 2013 Winner

- Asia-Pacific Financial Investment Association Financial Institution of the Year 2012

User Experience with IC Markets

Apart from superior trading conditions, IC Markets excels in delivering a remarkable user experience. The platform features valuable tools like alarm managers, correlation metrics, and sentiment maps, enabling traders to make informed decisions. Additionally, a strong emphasis on user education is apparent through advanced trading support, including web TV and video tutorials.

The broker provides round-the-clock support via its customer service team, proficient in many subjects related to trading and third-party integrations. Support is available in various languages and can be reached via phone, email, and webchat. The broker's FAQ section is also comprehensive and searchable, enabling clients to find relevant information quickly.

Overall, IC Markets provides an exceptional user experience, with top-notch trading platforms and supportive trading tools.

Final Impressions of IC Markets

IC Markets truly stands out as a leading forex trading platform, thanks to its superior order execution and high forex trading volumes. Its excellent features, including fast order execution, narrow spreads, deep liquidity, valuable tools, and diverse assets, make it an attractive platform, particularly for professional investors seeking optimal trading conditions.

The broker's commitment to regulatory compliance across three jurisdictions, transparency, and prioritizing client interests further elevates its stature. Coupled with its focus on exceptional customer service, IC Markets presents a unique value proposition, equipping traders with advanced tools, remarkable speed, and comprehensive support.