The Five Hungry Wolves is a trading formation that is not difficult to understand and at the same time it also harbours immense trading potential.

The whole formation consists of waiting for the moment when five consecutive candles are formed in one direction, after which an entry in the same direction is made. In fact, from long term observations, it has been found that the markets tend to continue after so many candles in one direction, as by definition there is considerable strength in the markets in that direction at the moment, which stimulates the aforementioned continuation.

Strategy entry rules

Entering long positions

-five consecutive rising candles

Entry into short positions

-five consecutive declining candles

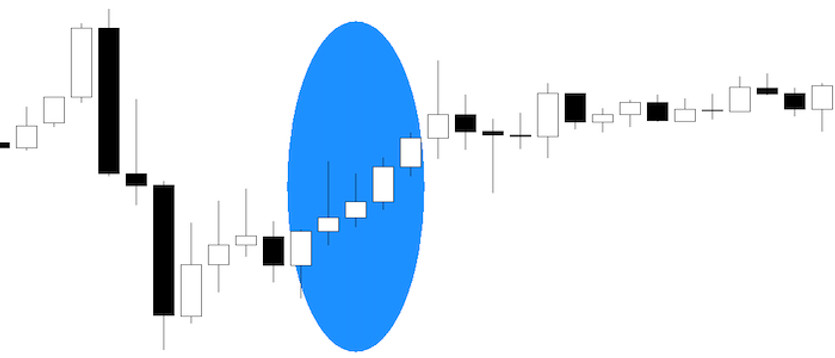

The chart above and below show situations where the entry conditions have been met and therefore, immediately after the completion of the fifth candle, the trading position can be entered in both cases.

The Stop-Loss is usually placed above/below the first candle (oldest) of the entire formation, but the Profit-Target is a bit more complicated here, as the markets can travel hundreds of pips after some of these formations are formed, while others may only take a few units.

With this strategy based on the price action formation of five candles, it is possible to achieve a success rate of around 80% on some currency pairs, thanks to which the trader can then afford to lose several trades in a row. If properly set up money-management, it would not significantly jeopardize the state of the trading account.