This trade idea was first sent to subscribers of the Free Profitable Forex Newsletter on August 5 2022.

Note: The FxTR newsletter will take a break from August 15-29; Stay tuned for our special edition to be released next week (August 10), where we will discuss the US dollar and the long-term outlook for the second half of this year.

It’s NFP day in the US, and we are seeing some significant moves across markets following the huge surprise release. The story is a stronger dollar in the Fx market, while most other asset classes are falling and bond yields rising.

The just-released Nonfarm payrolls report was a massive blowout to the upside. All components are much better than expected, and wage growth stronger. NFP printed 528k vs 250K forecast, the unemployment rate came lower at 3.5% (vs 3.6% forecast), while y/y average hourly earnings accelerated to 5.2% (vs 4.9% expected). These are some massive upside surprises and will surely keep the Fed aggressively hawkish.

Gold, silver falling after Nonfarm payrolls massive positive surprise

For the markets, the stellar NFP report means the trend of a strong USD will persist for longer. In the precious metals space, both gold and silver are getting dumped today following the NFP news. This is likely the peak of their recent retracements, and a new bear leg may be starting for both metals from here. Below we look at how you can trade this potential setup in gold (XAU/USD), where a revisit of the lows in the 1700 area and below now looks probable.

The hawkish Fed, doing rate hikes and QT, will keep downside pressure in the coming months on inflation-protection assets like gold. Today’s blowout NFP report only means that the Fed will need to be even more hawkish than we thought before, hence the large market reaction today. An even more hawkish Fed is bad news for gold. A move toward the 1500 area (last seen two years ago) has just become much more likely.

1800 area is big resistance

Gold was testing the 1800 area just before the NFP release (managed to climb to 1795) when it got hammered down and fell to 1965 in the space of an hour. It is now bouncing slightly there at a key support trendline, which would clear the road for a deeper decline if broken.

The daily chart (see below) shows the 1800 area is a big resistance due to the falling trendline and previous lows in this area. It is also a historically important zone for gold, especially recently in the past two years. These factors point to a high probability that the rally could end here or has already ended.

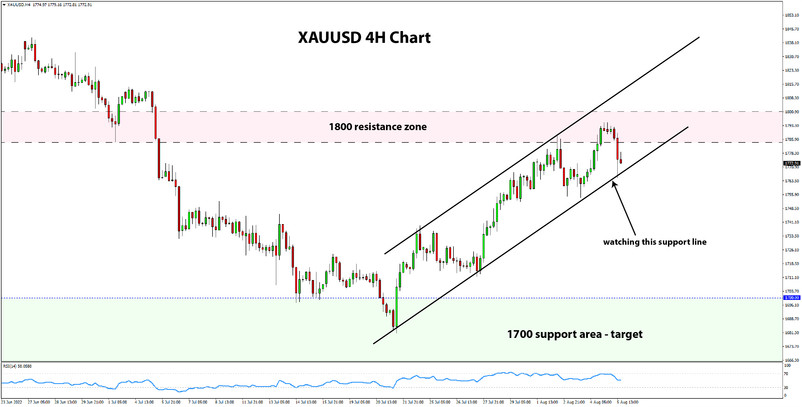

The 4-hour chart below gives us a better perspective of the near-term developments. Namely, we should monitor the retracement support trendline and the reactions around it. Gold now bounced off the trendline post the NFP decline, but it doesn’t look very convincing so far. A renewed bearish attempt on the trendline could mean that we’ll see a downside breakout, which would be a confirming sign that the top of the retracement is likely in.

Another scenario is if gold makes a new attempt to the upside. Technically, this is still possible, though the fundamentals suggest it’s unlikely. In this case, a move above 1800 is possible, where the market thoroughly tests the resistance area here. Both the higher (daily, weekly) and lower timeframes indicate that gold could go as high as 1830 without breaking the resistance of the wider 1830 area.

Trade Plan:

Entry:

- Wait for a bearish break of the support line (4h chart). This should confirm the retracement has ended.

- Currently, the trendline stands at the 1760-1770 zone but could move higher if we don’t see a breakout soon. In this case, short entries at higher levels could be appropriate.

Stop:

- Above the most recent swing high (4h chart) following the entry signal

- Also, gold shouldn’t repeatedly test the 1800 area once it has decisively turned bearish (currently, we are still waiting for this).

Targets:

- 1700 area (prior lows)

- Longer-term target can be toward the 1500 area

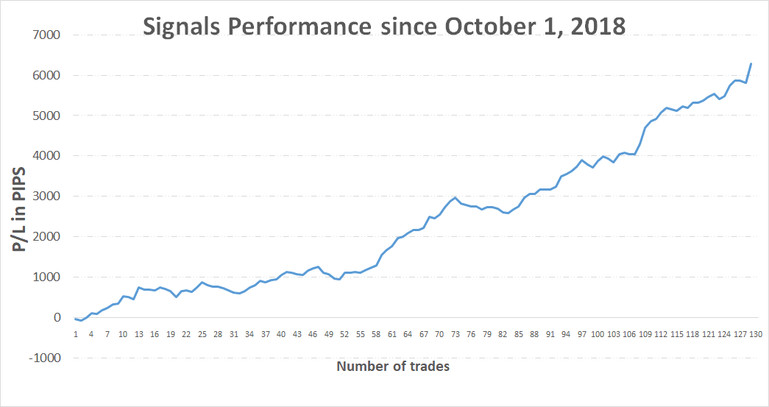

Trade signals from the past weeks

- July 25, 2022 - Short EURJPY from 139.70, target reached at 135.00 = +470 pips (trade idea sent July 22)

TOTAL P/L in the past week: +470 pips profit

TOTAL: +6275 pips profit since October 1, 2018

![Gold Downtrend to Resume After NFP Report [Newsletter Aug 5]](https://cdn.investworld.net/insecure/w:835/h:407/rt:fit/g:ce:0:0/el:1/f:jpg/c:0:0/q:90/czM6Ly9zZXJ2aWNlcy0tODM1OS0taW1hZ2VzLzZmMWQyOWJlYjMwYTMyZWQ1NjM2NGY0ODVlMDliN2YwODY4OTk2ZTAucG5n.jpg)