Head & Shoulders Pattern

The head and shoulders pattern is a highly reliable reversal pattern that very often, once completed and confirmed will mark a major turning point in the market. The appearance of the pattern faintly resembles a head and shoulders outline hence the name.

The head and shoulders pattern in the standard form is a bearish reversal pattern. The bullish sibling is called an inverted head and shoulders pattern.

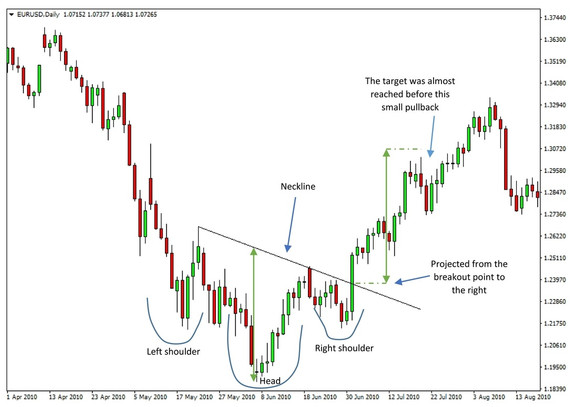

For trading the pattern in the Forex market the implications, rules, and strategies work exactly the same for both the bullish and the bearish versions of the pattern, so everything can be used interchangeably only, of course in the opposite direction.

The head and shoulders pattern is formed by three consecutive highs with the middle one being the highest of the 3, hence the resemblance of a head. The highs on each side of the head resemble two shoulders.

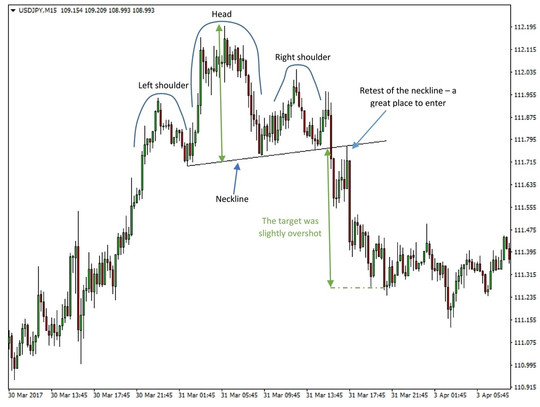

Entry rules: Do not enter on a breakout without at least waiting for a close below the neckline. A high number of potential head and shoulders patterns often will be broken only for it to be a fake breakout in the end. When price closes the trading session past the neckline it’s an additional confirmation that it’s a true breakout.

Initial Stop-Loss placement:

- Behind the right shoulder (this is the ultimate stop out level)

- Or behind the most recent swing high (for a tighter stop)

A head and shoulders on a USDJPY 15 minute chart

Trade management:

Price should not return and close back above the neckline of the head and shoulders pattern. If that happens the trade should be closed because the pattern is invalid under those conditions.

Note, however, that price can come back to the neckline, retest it and even trade above it during the session, but it should not close above the neckline.

Here’s an example of an inverted head and shoulders pattern. All the rules, entry points, stop levels and targets can just be mirrored from the classic head and shoulders.

An inverted head and shoulders pattern on EURUSD daily chart

Profit target:

- Measure the height from the highest point of the head - down vertically to the neckline and project the measurement from the breakout point to right side of the chart (examples are shown in the charts above).

- Always keep in sight of any key support or resistance levels ahead of the target that could stop price from reaching it.

Double Top and Double Bottom Pattern

The double bottom in the bullish case and the double top in the bearish case are classical reversal patterns that can often signal a significant shift in market sentiment, especially when the pattern occurs on a spike in volume and volatility. The pattern is formed by two consecutive equal highs for the double top and two consecutive equal lows for the double bottom pattern.

This pattern also uses a neckline which in a double top is the horizontal line projected from the low (lowest point) between the two tops to the right on the chart.

In a double bottom pattern, the neckline is taken from the high (highest point) between the two bottoms and projected to the right of the chart.

The rules, entry, stop out and target calculating principles work the same for both the bullish double bottom and the bearish double top patterns.

As with most chart patterns, the double top and bottom can be traded with a riskier – higher return approach and a more conservative – lower reward approach.

Entry rules: Initial Stop-Loss placement:

Double bottom on AUDUSD 4h chart

Profit targets:

- Measure the height from the neckline to the lowest point of the two bottoms and project the measurement from the breakout point to right side of the chart (examples are shown in the charts).

- Note that key support or resistance levels ahead of the Profit-Target as always can stop price from reaching the target. That’s why it's necessary to position accordingly if such a situation is encountered.

Here’s an example of the bearish double top pattern. As can be seen, everything works the same as with the bullish double bottom pattern, only in the other direction.

Double top on AUDNZD 1 hour chart