A stop-loss order is placed either to protect the present portion of profits in the opened trade or to limit the risks. It is usually offered to the trader as a form of option by the trading platform and can be adjusted anytime. Though it might seem like simple trading tool, but it can create a world of difference when used correctly.

How do the Stop-Loss orders work

In the beginning it is important to say that Stop-Loss orders are nothing more than stop pending orders. The Stop-Loss orders in case of buy trades can be placed always below current price, and are filled once the price hit the price level of the Stop-Loss order. In opposite, Stop-Loss order in case of sell trades can be placed always above current price.

Usually, Stop-Loss orders are stored on the trading servers of your broker. Therefore, the orders will be activated and filled even if your trading platform is not running. The only exception are Expert Advisors (forex robots) - these can either place orders on the trading servers of your broker as well, or wait until the price approaches some price level and perform some action then (close the order like the stop-loss would get filled). In the second case, to keep your trading platform online is required.

The first rule of using Stop-Loss orders correctly

The first golden rule that must be followed when you are planning to implement it in your trading style is never place a stop-loss order on random value of pips. Remember, this is not an ideal allocation and definitely not one of the wisest ways to use them.

Rather, the stop loss order should always be based on the current situation of the market. First of all, you should give your opened trade enough space to "breath". Your entry might not be the best timed, but still the trade can end like a winner. The key to that is to set Stop-Loss orders correctly. This means there are two important aspects that you should look after when setting stop-loss:

- Context of the market in which you have placed the trade (current market structure and volatility)

Therefore, both chart and logical reasoning are essential when you want to place a perfect stop-loss, not any random pip size or fixed SL based on risk reward ratio (which is not good as well - because you are not adapting to the current market structure and volatility).

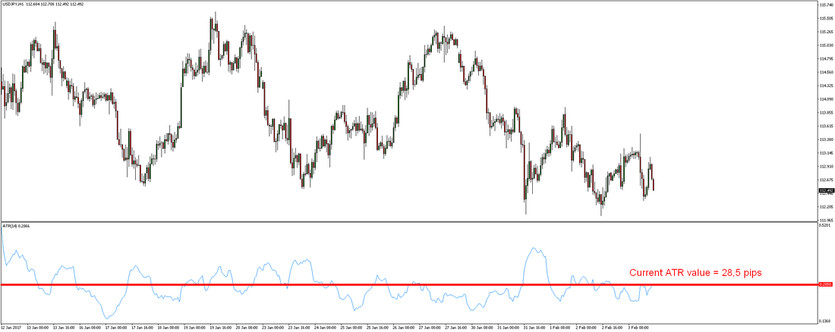

Setting Stop-Loss with a help of forex indicator

When working with the stop-loss orders, you can try using for example the Average True Range forex indicator. You should ensure that the Stop-Loss is at least half or more of average true range (ATR) value otherwise you might get stopped out too soon. ATR is an excellent tool that can be used to analyze the volatility of the market over any number of days (periods). Hence, it is ideal for placement of stop-loss orders, especially if there are no support resistance price levels present nearby.

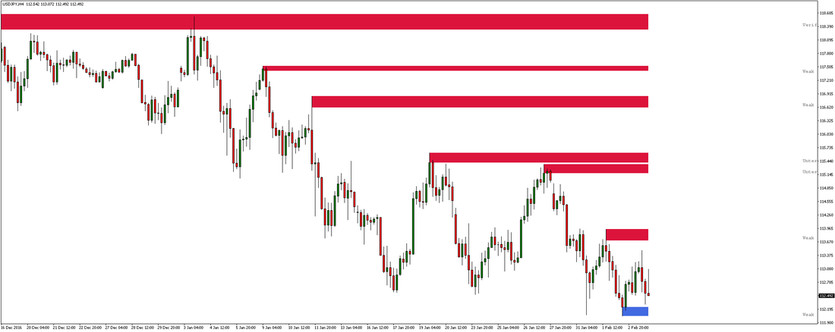

Setting Stop-Loss based on support and resistance zones

This is probably one of the most effective as well as my most favorite technique when setting stop-loss orders. Thanks to analyzing current market structure - support and resistance price zones - you will always adapt your trades to the latest market moves and volatility.

The rule of using support and resistances for setting stop-losses is very simple. If you are going to open a long trade, simply set your stop-loss below the nearest support zone. And if you are going to open a short trade, simply set your stop-loss order above the nearest resistance zone.

If you would like to have the latest support and resistance price zones drawn in your charts automatically, you can use our free support resistance forex indicator .

Setting Stop-Loss based on market highs and lows

This stop-loss strategy is very similar to the one above. In case that you are trading for example candlestick patterns or just wait until the market is starting to reverse, you can simply set the stop-loss orders below the swing / closed candle low or above the swing / closed candle high.

The Advantages of using Stop Loss orders

Though traditionally stop-loss was meant for preventing losses, but soon it became a tool of locking profits as well, and thus it is possible to use it also as a trailing stop-loss. In that case, the stop loss order is placed at a certain level distanced from your entry price level, and moved every time the market moves in your favor. Then if the price starts going against your order, the stop-loss is locked at its last price level. This ensures that your profits are maximized if there is a strong market move in your favor, as well as locked if the market is already exhausted or starting to reverse.

If you are considering to use techniques like trailing stop-loss, forex indicators like Parabolic SAR can be used for that purpose.

So, when you are searching for an effective risk management tool then you should definitely consider using stop-loss orders in your trading strategy. Also remember, that the key to successful trading is to minimize risks and maximize profits. And using Stop-Loss orders will definitely help you with that. However, never forget to place the stop-loss orders like a professional because ultimately this can help you to have a competitive edge and make your strategy much more successful.