Fear rocked the markets yesterday following news that Russia had attacked Ukraine early on Thursday morning. Risky assets and risk-related currencies suffered while safe-havens (gold, USD, JPY) and Russia-linked commodities (oil, gas) surged higher. The EUR currency and Eastern European currencies were also hit hard due to their geographic proximity to the conflict zone and economic linkages with Russia.

In light of this, we are taking the opportunity of this week's newsletter to break down the recent developments in Ukraine and their impact on markets.

Many traders are wondering and have asked us, what is the best way to trade war?

The short answer: DON'T!

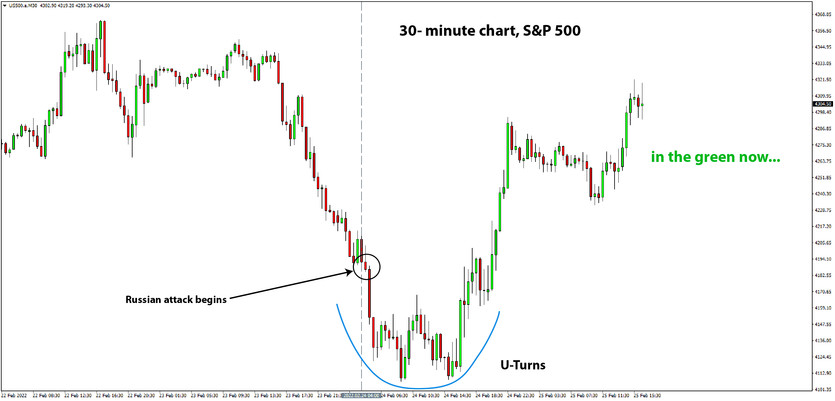

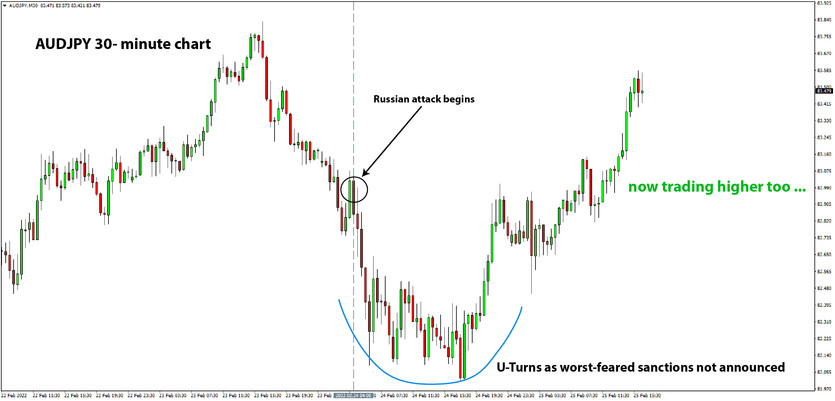

Yesterday's action in the markets best explains why:

Gold, the ultimate safe-haven, rallied to as high as 1973, before tumbling lower to end the day in the red near the 1900 level.

At about the same time, stocks U-turned and reversed all the losses from the deep sell-off induced by the Russian attack. The S&P 500 and the NASDAQ ended the day positive.

In Forex, the JPY exhibited the same behavior. USDJPY closed green, up 50 pips on the day. Other risk-proxy pairs like AUDUSD, AUDJPY, NZDJPY bounced significantly off the lows.

Many traders were left puzzled by the moves. So, let's try to decompose what the heck is going on.

The first part of the moves (the risk aversion) was obviously driven by multiple different fears regarding world peace and the global economy. First, will NATO react and enter a war with Russia? And second, will US and EU sanctions be severe to the point of damaging their own economies and the global economy in general? Investors fled to safety in the face of these uncertainties.

However, later in the day, it became clear that none of the severe scenarios for the world were likely to materialize. We can summarize it like this:

- Sanctions announced by the west are perceived by investors as rather weak.

- A ban on Russia from the SWIFT payment system was not announced, and it seems several EU countries opposed the idea. The SWIFT ban option is considered the most potent of sanctions and would be the biggest blow to Russia.

- US President Joe Biden and NATO's Stoltenberg reaffirmed, "we are not sending our army, our troops won't fight in Ukraine."

Guess what. The markets are reading this to mean that it will be a short war, resulting in a change of the Ukrainian Government. In essence, meaning that Ukraine would become a pro-Russian state. The worst sanctions are likely to be avoided, and therefore, the worst economic effects on the world will be avoided. And more importantly, direct NATO-Russia war is avoided as both Biden and Stoltenberg confirm they have no intention of fighting in Ukraine.

This is how the situation stands at the moment, or at least how the markets are reading it. Hence, investors are ready to take on risks again.

With that said, the situation remains highly uncertain. Things could still go either way and, unfortunately, can escalate further. Let's hope that doesn't happen.

Let's pray for peace in Ukraine.

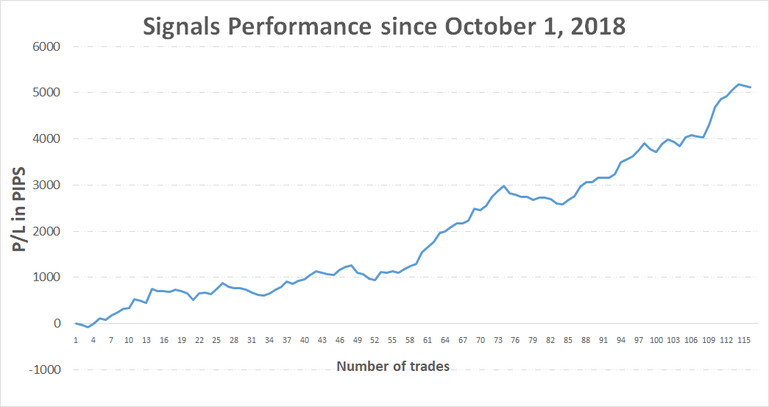

This post is part of our Free Profitable Forex newsletter. The trade ideas and trade signals sent in the newsletter have achieved +5120 pips profit since October 1, 2018