The EUR/USD exchange rate has experienced significant volatility in recent months, prompting caution among analysts as they assess the outlook for the currency pair. While some remain bullish on the euro's prospects, others are more pessimistic, citing a range of factors that could weigh on the currency in the coming months.

Analysts' opinions on the EUR/USD

Analysts' opinions on the EUR/USD are mixed, with some forecasting continued strength for the euro and others anticipating a decline. JP Morgan analysts expect the EUR/USD price to stay at approximately the same level by the end of the year. Their research states:

“EUR/USD is predicted to reach 1.10 in March 2023, before declining to 1.08 September 2023 and holding at 1.08 in December 2023.”

The forecast provided by longforecast.com is more positive. According to their EUR/USD predictions, this pair price is going to slightly increase reaching $1.219 in November 2023 and closing the year at the price of $1.188.

According to Deutche bank, EUR/USD will be traded at around $1.05 at the end of 2023. Here is what their experts say:

“Growth in the Eurozone and in China in particular may pick up again following a weaker winter. For this reason, we expect the EUR/USD rate to be around 1.05 at year-end 2023.”

Trading economics is rather bearish about EUR/USD. According to their predications, the pair is going to continuously drop throughout the year, being traded at around $1.06 in the Q2 of 2023, $1.04 in the Q3 of 2023, and $1.03 in Q4 of 2023.

EUR/USD historical performance

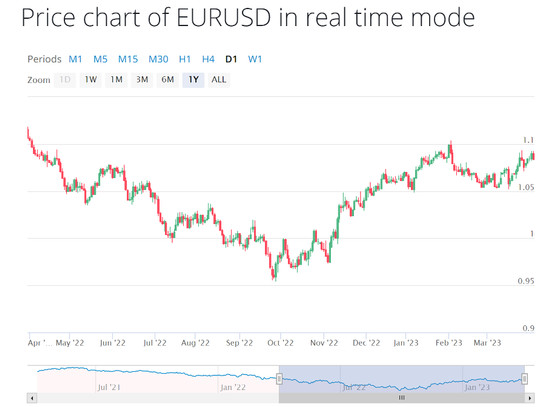

The EUR/USD exchange rate has experienced significant fluctuations over the years. In the past 20 years, the pair has ranged from a low of around $0.82 in 2000 to a high of approximately $1.60 in 2008. Since then, the exchange rate has remained relatively volatile, with a range of factors affecting its performance.

In recent years, the EUR/USD has traded within a range of approximately $1.05 to $1.25, with occasional spikes or dips outside this range. For example, in October 2022, amid the global COVID-19 pandemic, the EUR/USD briefly dropped below $1.00, its lowest level since 2017. As of beginning of April 2023, EUR/USD is traded at around $1.09.

Factors affecting the EUR/USD

There are a range of factors that could affect the EUR/USD exchange rate in the coming months. Here are some of them to keep in mind.

● Divergence in monetary policy between the European Central Bank and the US Federal Reserve, which could put upward pressure on the dollar as the Fed is expected to start tapering its asset purchases later this year.

● COVID-19 developments - any significant changes in the trajectory of the pandemic, such as new variants or vaccine distribution, could affect the exchange rate as they impact the economic outlook for both regions.

● Geopolitical risks, such as tensions between the EU and Russia over Ukraine, which could weigh on the euro if they escalate.

● Ongoing Russian gas crisis, which could potentially impact the EUR/USD exchange rate in 2023. If the crisis leads to higher gas prices in Europe, this could hurt the Eurozone's economy and lead to a weaker Euro. Conversely, if the crisis is resolved and gas prices stabilize, this could boost the Eurozone's economy and lead to a stronger Euro.

The importance of risk management

Given the range of factors that could affect the EUR/USD exchange rate in the coming months, it is important for investors to approach the currency pair with caution and to implement effective risk management strategies. This could include diversifying portfolios to reduce exposure to any one currency or asset class, as well as using options or other hedging strategies to mitigate potential losses.

In addition, it is important for investors to stay informed about developments that could affect the EUR/USD exchange rate and to monitor economic indicators such as inflation, employment, and GDP growth in both the US and Europe.

Conclusion

The EUR/USD exchange rate is likely to experience volatility in the coming months as a range of macroeconomic and geopolitical factors come into play. While some analysts are optimistic about the euro's prospects, others are more cautious, citing a range of risks that could weigh on the currency. Given the uncertainty surrounding the outlook for the EUR/USD, investors are advised to approach the currency pair with caution and to implement effective risk management strategies to mitigate potential losses.