An Outside Bar (OB) is a form of reversal signal that occurs when the high and low prices of current period / candle exceed its previous session. This pattern can be observed in candlestick charts (or bar charts as well), and is equal to the engulfing candlestick pattern . Forex traders often implement this trading pattern in their trading strategy in order to determine the potential bullish and bearish reversal that may occur in the forex market.

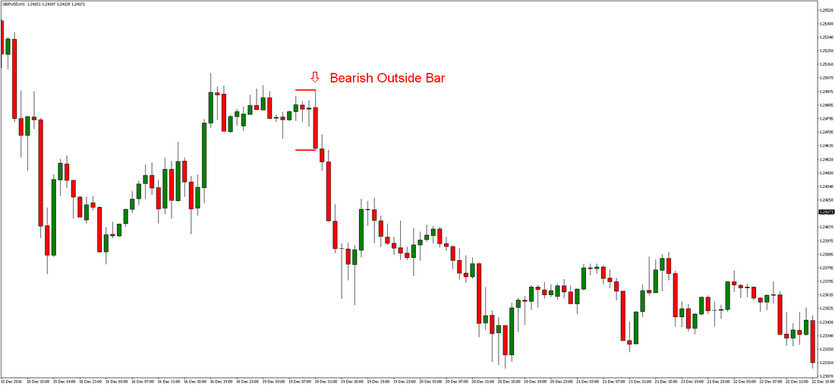

As already mentioned, recognizing the Outside Bars is very simple. Outside Bar's both high and low prices exceed the range of previous candle. In the chart below you can see a very nice bearish Outside Bar. As you can see, this Outside Bar is even exceeding the high as well as low prices of several previous candles.

Bullish Outside Bar looks exactly opposite - like you can see in the chart below. It is usually the best if the bearish Outside Bar closes near its low price level and bullish Outside Bar closes near its high price level. This always adds some extra points to its importance as it confirms the dominance of the bearish or bullish move.

What Are The Advantages of Trading with Outside Bars?

Many advantages can be witnessed when you make outside bar a part of your forex trading strategy. Some of these are:

- The Outside Bars are based on a simple price action and thus are relatively easy to understand. This means both novice and expert traders can make the most of it.

- High-quality Outside Bars will notice you of strong dominance of bulls or bears, and therefore it is usually the best to be on the same side of the market.

- You will realize that the market follows the trend established by high-quality Outside Bars for a long time and that can serve you to be a path acquiring nice profits by using trailing stops or combination of other trade exit techniques.

How To Trade Outside Bars?

When you are planning to trade forex using outside bar then there are five easy rules to look after and this will ensure that you implement the strategy to perfection.

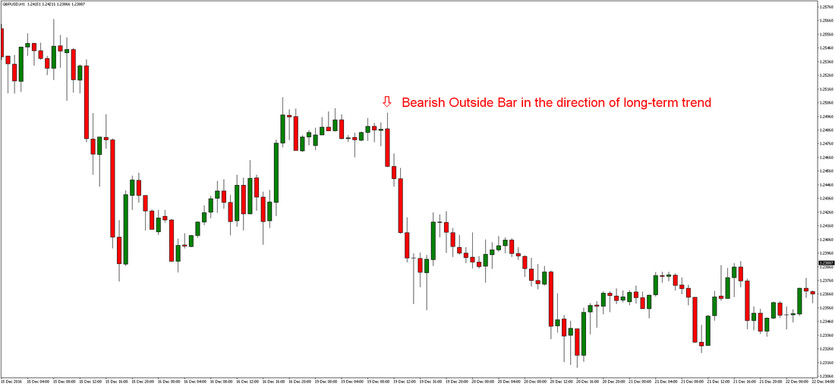

1. Bullish Outside Bar candlestick is created within a down swing move, and bearish Outside Bar can be found within an up swing move. Outside Bars are always reversal patterns. If you will trade the Outside Bars in the direction of a long-term trend, you will have a better scope for success.

For example take a look at the chart below. There was a huge long-term bearish move on GBPUSD, and the bearish Outside Bar below is in that direction. This is increasing our chances significantly, and you can see the following massive bearish move for yourself below.

2. When the bullish Outside Bar closes in top-quarter of its range, then it is likely to be stronger, and the same is seen when the bearish closes in the bottom of its price range.

3. The stronger is a particular trend, the higher are its chances of reversal. This happens because sell orders dry up and everybody starts placing their buy orders in case of a bearish trend reversal. Vice versa applies for bullish trend reversal. So, it can be a good idea to incorporate some oscillators like RSI or CCI at this point to know whether the trend should remain strong or not.

4. The strongest bullish Outside Bars are bouncing from some major support, and the highest quality bearish Outside Bars are retracing from resistances. Using supports and resistances in a conjunction with Outside Bars improves success probability significantly.

5. To trade based on Outside Bars, simply place buy stop order above the high price level of a bullish Outside Bar, and sell stop order should be placed below the low price level of a bearish Outside Bar. Stop-Losses should be simply set at the opposite side of the Outside Bar candle.

Also remember, that if your entry pending order will not get activated soon, it is usually better to delete such a pending order completely and wait for a better opportunity.