The next two patterns in the harmonic trading article series are the so-called “extreme” Bat and Crab harmonic patterns.

In a way, they can be thought of as the extended versions of their older relatives we discussed in our previous article, namely the Gartley and the Butterfly patterns.

Likewise, the Bat and the Crab are also constructed of 4 legs, starting with the XA leg followed by an ABCD pattern. While the Gartley and the Butterfly patterns have been around for quite some time, the Bat and the Crab were discovered at the beginning of the previous decade by harmonic trader Scott M. Carney.

Although the Bat and the Crab look and are traded very similarly to the other harmonic patterns, they still possess their own distinctive characteristics and subsequent typical price reaction.

Importantly, market reversals from the harmonic reversal zone of the extended patterns, statistically tend to be sharper than those of the standard Gartley and Butterfly patterns. The extremely stretched swings of the patterns as defined by their Fibonacci relationships are one possible explanation for why this is the case.

Other than that, the Bat and the Crab predict reversals in the market just as accurately as the more popular Gartley and Butterfly. The trading approach, rules, and tactics we described in the first article of this series for the ABCD pattern are pretty much the same across all the harmonic patterns, hence there is no need to repeat them here.

We’ll just go into the specific Fibonacci relationships that define the two patterns and some of their unique attributes.

The Bat Pattern

The Bat, like the Gartley, is regarded as a retracement pattern within the group of harmonic patterns. So, while it does tend to form in pullbacks during a predominating trend, a Bat pattern validity is not defined by the context in which it appears, but rather by the distinct Fibonacci relationships between the elements within the pattern.

Still, completely ignoring the context in which the pattern appears is certainly not advised, and in fact, it can be a huge mistake.

Conversely, being aware of the broader context and the bigger picture in the market is always a key trait of successful traders and in this sense, combining harmonic patterns like the Bat with key trading concepts such as classical support and resistance can be a recipe for long-term success and lots of profit reaping.

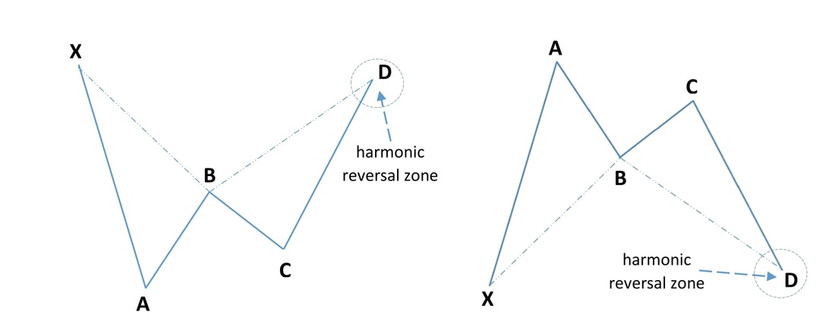

Bearish Bat and Bullish Bat Patterns

The specific Fibonacci alignments between each swing within the Bat pattern that give the highest probability of a reversal to occur are as follows:

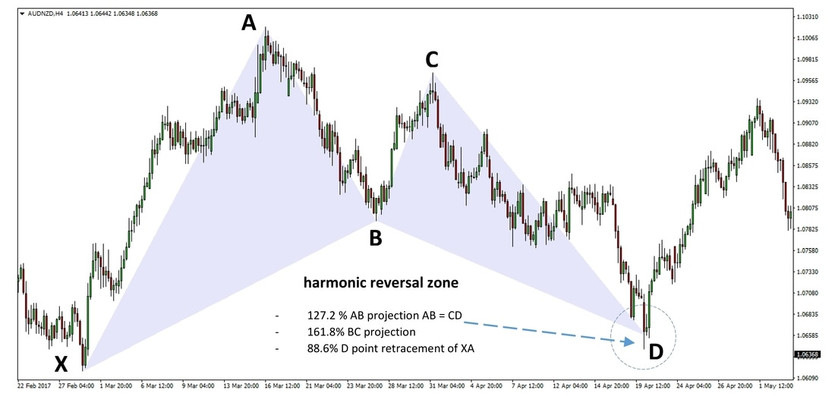

On this AUDNZD 4-hour chart the market reversed quite sharply after testing the harmonic reversal zone. Remember all the 3 levels of the harmonic reversal zone don’t need to be tested and traded but rather reversing from the area between the 3 Fib levels is what matters.

The subsequent reverse move to the upside reached the 78.2% retracement of the AD distance, surpassing both the 38.2% and 61.8% Fib targets on the way.

An example of a bullish Bat pattern on AUDNZD 4h chart

The Crab Pattern

The Crab is very much structurally alike to the Butterfly in that its competition point D must exceed the starting point X, therefore qualifying as an extension pattern just like the Butterfly. The extreme price levels reached with the Crab pattern however often give rise to much more violent and sharp reversals.

Remember, the quicker the reversal from the harmonic zone is the higher the probabilities that the pattern will reach its profit targets and possibly even exceed them.

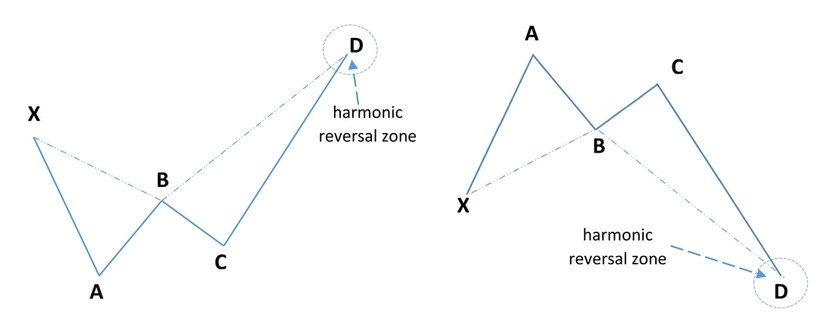

Bearish and Bullish Crab Patterns

Here are the strict Fibonacci ratios between the legs in the Crab pattern that tend to give the best trading setups and yield the best results.

In this 5 minute chart of USDCAD, the price reversed quickly and nicely from the harmonic reversal zone, yet the pattern failed to continue higher than the 38.2 Fibonacci target.

This example just reminds us why it’s important to take partial profits at each target level of the harmonic pattern. Remember that not every harmonic pattern leads to a major full-blown reversal, but instead, the pattern can only reach its 61.8% or 38.2% retracement target and still be valid and profitable, just like it was in this case here.

An example of a bullish Crab pattern on NZDUSD 4h chart