If the term Bollinger Bands is quite new to you, then you’re lucky because you just hit the key to discovering all about it.

The term Bollinger Bands came from the name of its own developer and creator John Bollinger in 1980s. John Bollinger, the brain behind this technique is one of the known long-time technicians of the market. Bollinger Bands are the kind of technique that use moving average with the help of trading bands below and above it.

Compared with the regular percentage calculation of the normal moving average, Bollinger Bands basically subtract and add standard deviation calculation.

Bollinger Bands and Standard Deviation calculation

How does the standard deviation calculation work? Standard deviation shows how a price can differ from its real value because they calculate volatility. Through calculating the volatility of price, Bollinger Bands automatically adjust to the condition of the market. Thus, Bollinger Bands come in real handy for many traders.

Besides from that, these bands allow traders to see almost all data of the prices that are necessary between the 2 bands. Bollinger bands consist of 2 price channels or bands and a center line below and above it. The exponential moving average serves as the center line while the standard deviations serve as the price channels or bands. As the price action becomes more unstable or more bound to a tight pattern in trading, the bands tend to contract and expand.

Bollinger Bands and Moving Average

Why does a trader use a moving average to filter price action? Using a moving average is the way to see how the trend goes because a currency can be traded for a long period within the trend. On the other hand, traders still prepare themselves for encountering volatility occasionally. But still, traders treat this as a good opportunity to get essential information about the market’s movements.

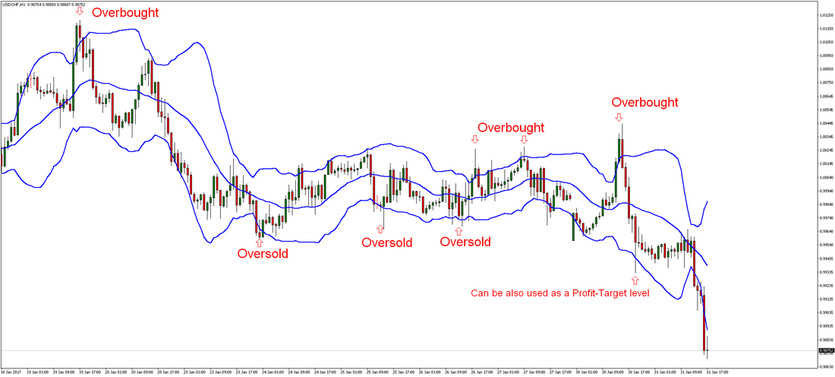

As the Bollinger Bands indicator is based on the moving average, traders can also very effectively use the Bollinger Bands indicator. If the currency price frequently taps the Bollinger Band above, it’s price is considered as overbought. But if the currency price frequently taps the Bollinger Band below, it is considered as oversold that triggers the buy signal for traders. Traders can also see the lower and upper bands as their price goals (levels for setting profit-targets).

If the bounce from Bollinger Bands occurs, the currency price will be most probably seen returning to the middle line of the Bollinger Bands. The middle line can also be used as a moving support / resistance price level. But if the bands tend to squeeze in together, it is called Bollinger Squeeze that signals a low volatility, and if a breakout will occur, new trend will be established. Once the bands started to hike up, the price will continue to hike up too, and once it started to drop below, the price will continue to drop too.

In other words, Bollinger Bands serve as a little handy tool that tells traders if the market shows a loud or quiet sound. If the market shows a quiet sound, the Bollinger Bands contract. But if the market shows a loud sound, the Bollinger Bands widen. If the market is seen out of the Bollinger Bands, it can be considered to be a trading signal - in case of trade entries as well as exits.