The standard deviation may seem simple for non-traders, but in reality, it’s a very useful and important indicator in trading. While it’s fair to say that it can be a complicated concept to deal with for newbies the benefits of using standard deviation are non-negligible.

It’s highly recommended that all Forex traders understand the basics of how they can use standard deviation in their trading.

If you don’t know how it works or how you can factor it within your trading techniques, then, you might setting yourself up for difficulties on the way to long-term profits in trading.

Although the mathematical formula looks scary, if you take a look at how standard deviation works within a trading system, you will see that it’s actually very logical and easy to implement. Once you get to know the key things you need to pay attention to, you will be able to determine better Profit Targets, time your entries more precisely, and you will be able to pick trend reversals more accurately.

A standard deviation indicator is a simple tool in trading yet powerful enough to make or break your chance to win in a certain trade. It will even protect you from huge losses quite often. Thus, you can see why it’s important to learn how to take advantage of this tool and establish a trading approach based on it.

High standard deviation simply means that a big change in the price just occurred in the market – also known as a volatility spike. However, at the same time, this is a sign that a less volatile period will follow as traders and investors take their time to “digest” the previous large move.

Many traders don’t like to enter trades immediately after huge moves without knowing and evaluating the reasons for the move. Hence, while they are doing it, in most cases the price will consolidate in a tight range resulting in a fall in the value of the standard deviation indicator.

On the other hand, a low standard deviation means that the currency pair is in consolidation mode, or that volatility in the market is now low. To make it easier for you to absorb the standard deviation, here are some helpful tips on how to use it:

- Identify any unstable prices in the charts that hiked up too quickly, too far from the mean. This will be accompanied by a sharp rise in the value of the standard deviation indicator regardless of whether the trend is up or down.

- You can target the best entries within the trend by using standard deviation. If the price leaped too high or plummeted too low from its mean, statistically it’s very likely that it will move back to its average line. Targeting this move and taking a trade with a calculated risk is a well-played strategy to earn some pips in the forex market.

- Trade a breakout of a consolidative range. This can be executed when prices are trading in a very narrow range (with a low standard deviation) and suddenly they break out of the range leading to a jump in standard deviation and a sharp move in prices.

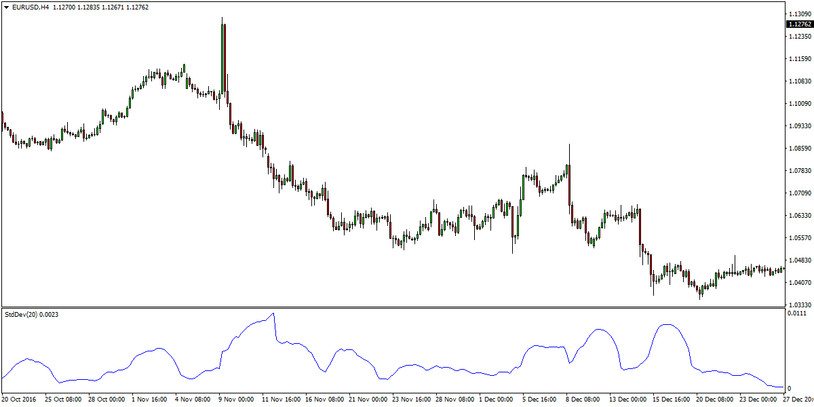

The standard deviation indicator on the MetaTrader 4 platform

The standard setting for the indicator is 20 which is the number of the most recent periods the indicator’s formula uses to calculate the average price. The average price is the mean based on which the standard deviation is calculated.

Of course, traders can simply adjust this number higher or lower according to their needs but should keep in mind that a setting higher than 20 is less susceptible to recent price changes and a setting lower than 20 makes the indicator more susceptible to price fluctuations.

This indicator calculates the size of the current movement of a given asset’s price. Then, it gives a calculated prediction on how unstable the price can be in the near future.

In other words, standard deviation comes in handy for determining if price fluctuations in a given asset will be increasing or decreasing. In the chart example above, this is the blue line that shows the degree of average price fluctuations.