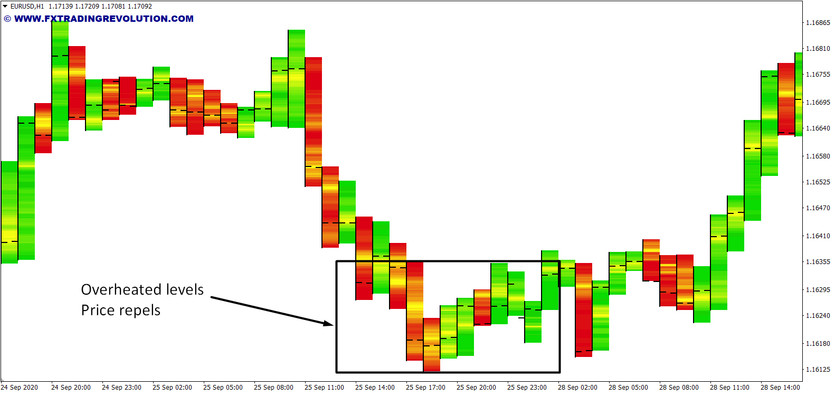

As you know, the market is subject to the same physical laws as the rest of the world around us. In a "cooled" market, the price stops forming natural barriers, as a result of which the rate does not feel strong resistance when moving in either direction. "Heating up," the price forms a firm focus, which is much more difficult to overcome.

It is no secret that horizontal levels play an important role in market analysis. One way or another, almost any trading system takes into account the levels, even if the main signal is given by some kind of technical indicator or with the help of a fundamental component.

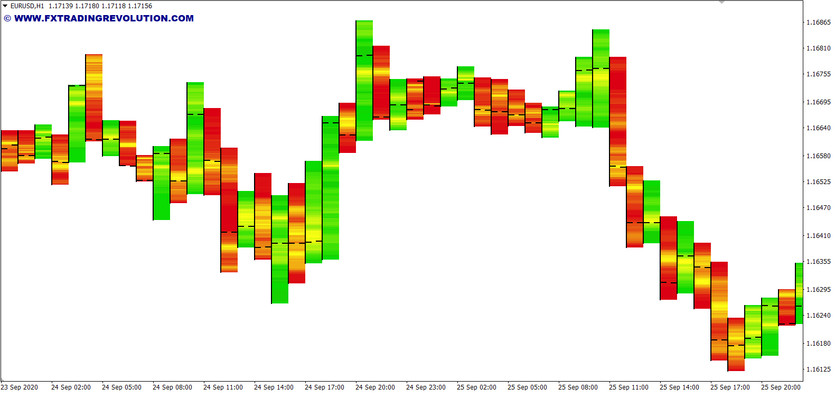

The Candle Temperature indicator shows on the chart at which levels the highest tick volume was observed. In the preset spectra, yellow indicates the highest temperature. That is, the closer to the yellow color, the greater the value of the tick volume at a particular price level.

The indicator is ideal for scalping strategies where traditional levels are not as appropriate. A short-term key level can be formed within one candlestick. In this case, the re-confirmation of the level only amplifies the signal.

By default, the tick volume is taken from the one-minute timeframe, but you can specify any other timeframe in the settings. Also, the indicator has several display settings for a more convenient perception of information.

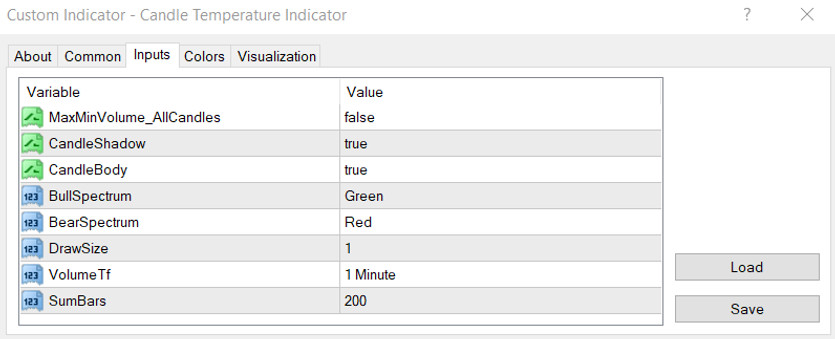

Indicator settings

In general, the indicator does not need to be configured as such, since the calculation algorithm is fundamentally very simple. However, there are several parameters that can affect the visual display of temperature:

MaxMinVolume_AllCandles - This parameter affects how the maximum volume is calculated. "true" - the maximum volume values are calculated based on all the candles involved in drawing (SumBars). Please note that this parameter is only suitable for analyzing volumes on history, since when a new bar appears, the old values will be recalculated. "false" - the maximum volume value is calculated based on a single bar. Past indicator values are not redrawn;

CandleShadow - displays the temperature only on the candle shadows. Useful for analyzing rebounds from levels;

CandleBody - displays temperature only on candle bodies. Useful for analyzing level breakouts;

BullSpectrum - selection of a bullish candlestick spectrum;

BearSpectrum - selection of a spectrum of bearish candles (you can select one spectrum for any type of candlestick);

DrawSize - candle cell size (in pips);

VolumeTf - initial timeframe for calculations. For obtaining a more accurate result, it is advisable to leave the smallest possible TF (minute);

SumBars - the number of candles to display on the chart.

Indicator signals

In fact, everyone can determine for themselves how to interpret the signals given by the indicator. The main thing is to understand what is the peculiarity of tick volumes analysis. With the help of this indicator, you can determine at which levels the trading was most active.

First of all, pay attention to the accumulation of volumes at specific price levels. The more repetitions are, the stronger the level in question. In this case, you should not focus only on the yellow tint of the candle. At times, the price moves evenly, as a result of which there is no accumulation of volumes at a specific level.

The lack of contrasting shades on the candle can also serve as a good signal. This is a sign that the level in question is not being protected and is free for further price movement.

Learn the basics of VSA theory to learn how to use this tool correctly. This will help you to better understand and identify the relationship between price and tick volume.

The main advantage of the Candle Temperature indicator is its versatility and clear short-term signals. In fact, signals can be used both to identify new levels and to confirm the breakout of old ones.

Conclusion

The Candle Temperature indicator can be a great helper in day-to-day trading, specifically to facilitate the identification of key levels and, in particular, for scalping. It should be borne in mind that the entry into a trade must be supported by other signals.