The Inside Bar model is one of the fundamental Price Action models that have been tested for decades. But, despite the simplicity of the setup, the search for a well-formed model requires careful attention and perseverance from the trader, which, by definition, is exhaustible. It is much easier to assign this task to an indicator that automatically signals the appearance of a new pattern on the chart. The InsideBarSetup indicator was created specifically to simplify these tasks.

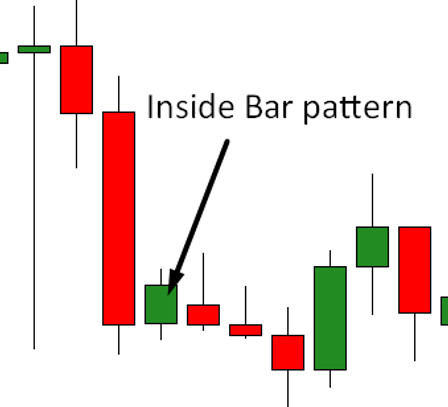

As the name suggests, the Inside Bar is within the boundaries of the previous bar. Its maximum is always lower than the maximum of the previous one, and the minimum is always higher. The traditional model assumes that the inside bar's size is significantly smaller than the previous outside bar. After an active rally, the market always pauses, and the price temporarily consolidates before the next breakthrough.

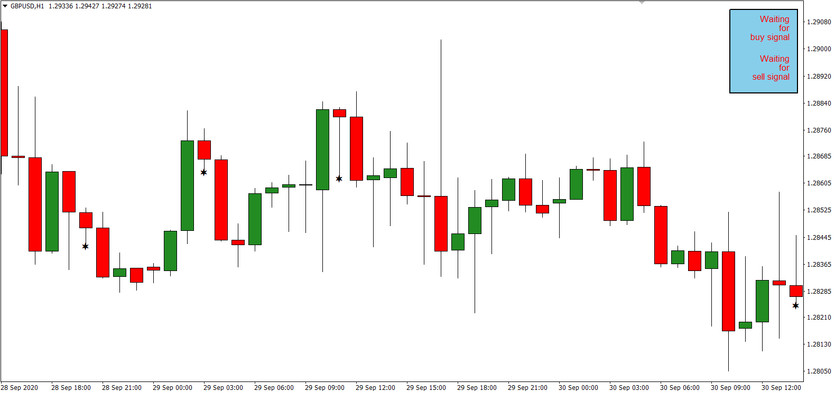

In addition to the models themselves, the indicator displays full-fledged setups on the chart. The essence of the setup is to trade on the breakout of the inside bar boundaries. This is one of the most popular ways to trade this model.

Indicator settings

The indicator has many settings, including visual, audio, and stop loss and take profit indicators.

Inside bar search settings:

Inside Bar Minimum Size in Points - the minimum size of the Inside bar in points;

Limit Second Bar Size to the percent of First Bar - the maximum size of the inside bar in percent in relation to the outside bar;

Use ATR Filter to Limit Second Bar Size - replace the internal bar filter by ATR;

Period for ATR Filter - ATR period;

ATR Percent Limit for First Bar - maximum ATR value of the inside bar in relation to the outside;

Entry Break plus Points - the number of points added to the entry point (false breakout filter).

Stop-loss indicator settings:

Calculation Method - a method for calculating stop-loss;

Plus Points - additional points to stop-loss;

ATR multiplier - ATR ratio for stop calculation;

ATR period - ATR period.

Take profit pointer settings:

Calculation Method - take profit calculation method;

One plus points - the number of additional points to the first take;

Two plus points - the number of additional points to the second take;

ATR Period - ATR period for calculating the take;

1 ATR multiplier - coeff. ATR readings for the first take;

2 ATR multiplier - coeff. ATR readings for the second take;

TP1 Reward - multiplier of the first take relative to the calculated value;

TP2 Reward - multiplier of the second take relative to the calculated value.

The rest of the settings are responsible for changing the indicator's appearance and enabling / disabling alerts.

Indicator signals

The found setup is displayed at the bottom of the bar with some Star of David's semblance. The color of this star can be changed in the settings. For the current setup, the area of the outer bar (red zone) is shown - the place for placing pending orders and stop levels (stop and double-take). Also, in the upper right corner, the numerical values shown in the graph are duplicated.

Use the InsideBarSetup indicator only on large time frames, preferably from H4 and higher. The easiest way to trade the setup is to determine the direction of entry by the inside candle's color. It should be borne in mind that the internal candlestick, in the case of a well-formed setup, may not have a body at all, or it may have a too-small body.

Also, pay attention to layered setups. The Nested Inside Bar is a very strong signal. Such a setup speaks of a longer consolidation, and therefore a stronger price surge can be expected later.

An equally strong signal can be obtained when an Inside bar is formed near important key levels. If a level has been tested many times in the past, the probability of a rebound from it is much more likely than a breakdown. Therefore, in this case, it would be reasonable to trade from the level.

Conclusion

The Inside bar model's versatility will seem to be a minus for some, and, on the contrary, an advantage for others. In any case, the indicator will save a lot of time when searching for Price Action patterns. At the same time, you will have much more time to react and think about the entry, which can directly affect the trade's profitability.