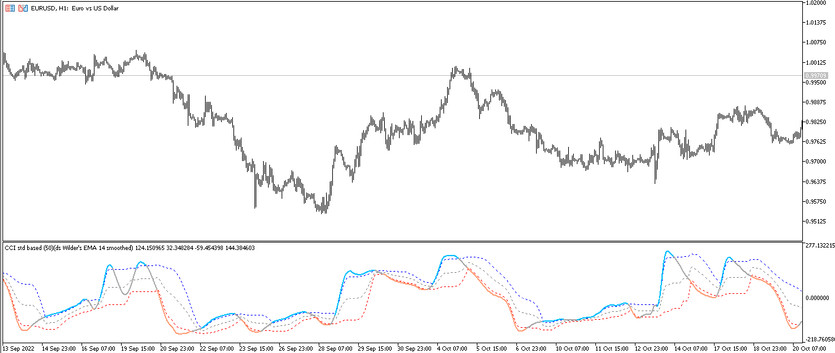

The CCI Double Smoothed Wilders EMA indicator is a whole trading algorithm based on a smoothed CCI and an exponential moving average. The developed algorithm allows determining the presence or absence of a market trend, determine its strength and find the best moment to open a trade in its direction. In addition, the indicator is suitable for determining whether the market is in the overbought or oversold zone. The indicator is presented in the lower window of the price chart in the form of four lines: the main line, which, depending on current market conditions, changes its color and direction relative to its signal level 0 and other lines, and three signal ones that do not intersect with each other. Thus, depending on the values of the indicator lines, the current trend can be determined and a position opened in its direction.

The CCI Double Smoothed Wilders EMA indicator is suitable for use on any timeframes, with any currency pairs, as it does not lose its effectiveness at any values.

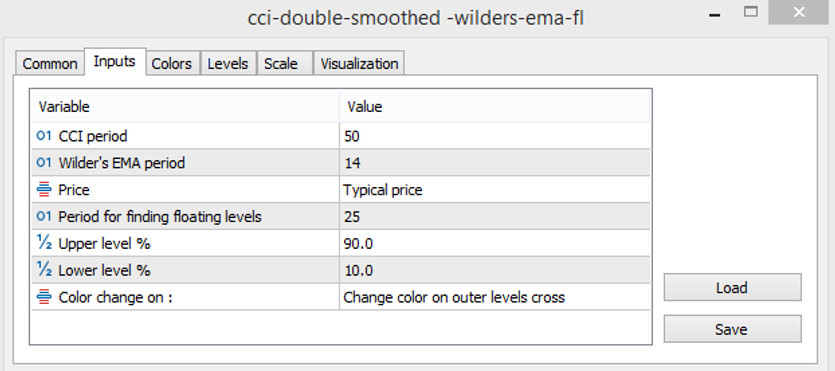

Input parameters

The settings of the CCI Double Smoothed Wilders EMA indicator consist of seven input parameters that are responsible for its general functioning. The remaining sections are responsible for the color scheme of the indicator and adding signal levels to its window.

- CCI period - period of the CCI indicator. The default value is 50.

- Wilders EMA period - value of the period of the Wilders EMA indicator. The default value is 14.

- Price - price type that will be used to interact with the indicator. Default value is Typical price.

- Period for finding floating levels - the period for finding floating levels in the current market. The default value is 25.

- Upper level % - percentage of the value of the upper signal level of the indicator. The default value is 90.

- Lower level% - value of the lower signal level of the indicator. The default value is 10.

- Color change on : - parameter that is responsible for the reason for changing the color of the indicator. The default value is Change color on outer levels cross.

Indicator signals

The concept of the CCI Double Smoothed Wilders EMA indicator is very simple. To open a certain trade using the indicator, it must be first determined the current trend. To do this, the color and location of the main indicator line should be determined relative to its levels and signal lines. If the indicator line moves up, it is above level 0 and at the same time, if it has a color with a growth value, then the trend is ascending, and if, on the contrary, the line is colored in color with a falling value and moves below the level of 0, then the trend is down. And thus, a trade is opened in the direction with the current trend. If the main the indicator line acquires a neutral hue, sideways movement is determined in the market, and in order to avoid a loss, all current trades should be closed, and new ones should not be temporarily opened.

Signal for Buy trades:

- The main line of the indicator, coloring in color with the growth value, moves up, above level 0 and crosses the signal lines so that it turns out to be above them.

After receiving such conditions, a long position may be opened on a certain candle, due to the presence of an upward market movement. The trade should be closed after the indicator line changes its color, after which the other conditions change. This will indicate a change in the current trend, and when new, it can be prepared to open new positions.

Signal for Sell trades:

- The main line of the indicator intersects with the signal lines and is located below them. It has a color with a fall value, and moves down, falling below its level 0.

A sell trade can be opened on a signal candle after receiving these conditions from the indicator. It should be closed when a reverse signal is received, which begins with a change in the color of the line. At this moment, a change in the current trend is possible, which allows considering the possibility of opening new trades.

Conclusion

CCI Double Smoothed Wilders EMA is formed on the functioning of several indicators, so its signals are very accurate, and the algorithm itself is very effective. The indicator is very easy to use, but despite this, in order to gain great trading skills and use the indicator, preliminary practice on a demo account is recommended.

You may also be interested The AMA Smoothed RSI Trading Indicator for MT5