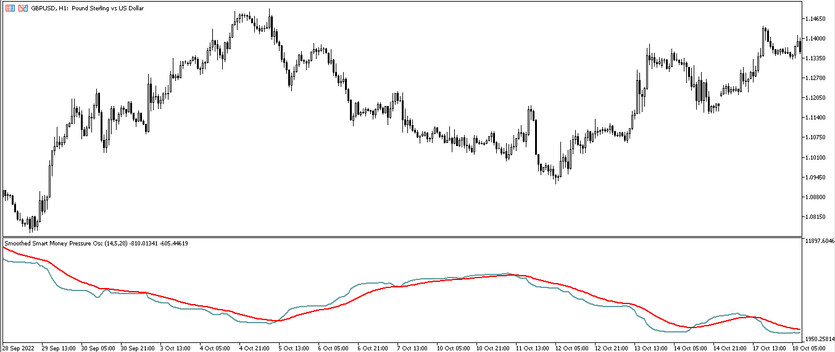

Smoothed Smart Money Pressure Oscillator, which can also be known as SSMP, is used to trade with the trend and determine changes in market movements. In addition to the main one, that is, the Smart Money indicator, two exponential moving averages with different periods are taken as the basis for its calculations, it makes indicator calculations more accurate and efficient. The indicator is displayed in the lower window of the price chart as two lines, the intersection and direction of which will directly affect the definition of the current trend. This information will allow opening trades in the direction with the current trend.

The SSMP indicator is suitable for use on any timeframes, with any currency pairs.

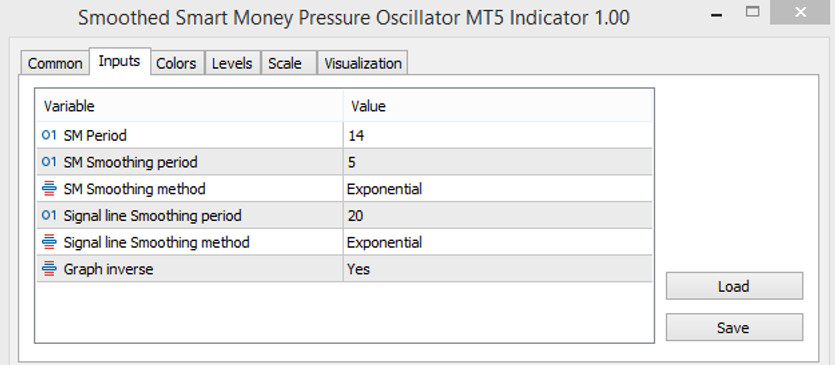

Input parameters

The SSMP indicator settings consist of a fairly extended list of input parameters that directly affect the calculations and the overall functioning of the indicator, so when changing the value of at least one of them, market conditions and trading parameters must be taken into account. The Colors section in its settings affects its color scheme and thickness values, and the Levels section for adding signal levels to its window.

- SM period - Smart Money indicator period. The default value is 14.

- SM Smoothing period - smoothing period for Smart Money indicator values. The default value is 5.

- SM Smoothing method - the type of moving average used to smooth values. The default value is Exponential.

- Signal line Smoothing period - smoothing period for the signal moving average of the indicator. The default value is 20.

- Signal line Smoothing method - Smoothing type of the signal moving average. The default value is Exponential.

- Graph inverse - parameter responsible for displaying the indicator opposite to the chart. The default value is Yes.

Indicator signals

It doesn't take much effort to open a specific trade with the Smoothed Smart Money Pressure Oscillator indicator, as the indicator is really easy to use. To start trading, it is needed to determine the current market trend by taking into account the direction and intersection of the lines. Thus, if the indicator indicates an uptrend, buy trades are opened, and if there is a downtrend, sell trades are opened.

Signal for Buy trades:

- The indicator lines move up and intersect so that the fast line is higher than the slow one.

Upon receipt of such conditions characterizing an uptrend, a long position may be opened. It should be closed after the lines intersect again. At this moment, a change or weakening of the current trend should be expected, which in turn will allow considering the opening of new trades.

Signal for Sell trades:

- The indicator lines intersect so that the slow line is higher than the fast one. At the same time, both lines move downward.

A sell trade can be opened immediately after such conditions are received on the signal candle. It is needed to close such a trade when the lines cross again. At this moment, the current downtrend is expected to change and weaken, which will allow considering the opening of new trades.

Conclusion

Smoothed Smart Money Pressure Oscillator is a very efficient and accurate trading algorithm based on moving averages, the calculations of which carefully filter Smart Money signals. The indicator is very easy to use and even suitable for beginners, while preliminary practice on a demo account will allow using the indicator correctly.

You may also be interested The RSI of Super Trend Trading Indicator for MT5