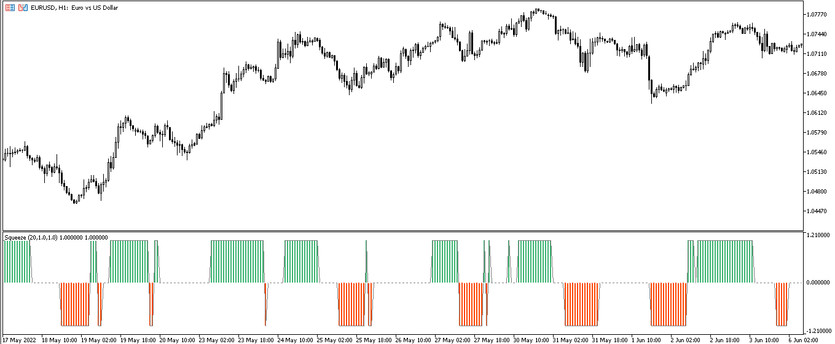

The Squeeze indicator is designed to quickly determine the current trend and then get the opportunity to trade. The indicator itself consists of two parts, the first of which is the indicator histogram, which, depending on the current market situation, is painted in a certain color, while being above or below the zero level, and the second part is the signal line of the indicator, which basically moves in the same direction as the histogram. In addition to the trend, the Squeeze indicator is also able to determine its absence, that is, the lateral movement, which appears at the moment when the indicator temporarily stops forming histogram columns. The indicator is suitable for use on any currency chart using a convenient timeframe.

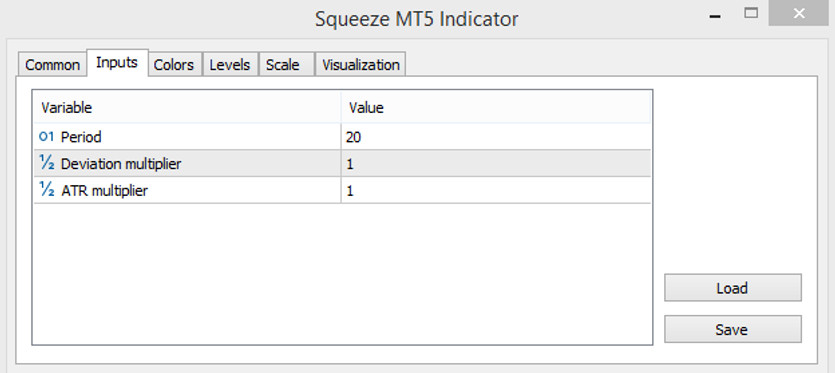

Input parameters

In its settings, the Squeeze indicator has three input parameters, depending on the change of which trading will depend. In addition, in the Colors sections, the color scheme of the indicator values can change, and in the Levels section, additional levels can be added. The indicator window already has a zero level.

- Period - parameter corresponding to the period of the indicator. The default value is 20.

- Deviation multiplier - parameter responsible for the deviation of the indicator values. The default value is 1.

- ATR multiplier - market volatility multiplier parameter. The default value is 1.

Indicator signals

Signals of the Squeeze indicator are generated at the moment when the presence of a trend is detected in the indicator window. At this moment, the indicator forms a histogram, which, depending on a certain trend, is painted in one of two colors, while being above or below the zero level. Then, taking into account all the conditions, a position can be opened in a certain direction. It is recommended not to execute trades if there is no trend movement in the market, since during the period of its absence, trades will not be so profitable.

Signal for Buy trades:

- An upward movement is determined in the market, due to the appearance of a histogram colored in color with a growth value that is above the zero level.

- At the same time, its signal line is on the border above the histogram, without crossing it.

After receiving such conditions, namely, when at least three columns are formed above the zero level, a long position can be opened. It should be closed after the uptrend ends, that is, if the columns run out above the zero level. At such a moment may be considered opening new trades or simply closing old ones, for example, when sideways movement is detected.

Signal for Sell trades:

- The histogram of the indicator should fall below the zero level and acquire a color with a fall value. This means that a downtrend is determined in the market.

- The signal line of the indicator descended after the histogram and is located on the border with the columns.

When such columns are formed, taking into account other conditions, a short position can be opened, which should be closed after the indicator stops forming columns below the zero level, since in this case the end of the trend or the definition of sideways movement can be determined.

Conclusion

The Squeeze indicator is very easy to use, however, it is not always possible to get the maximum profit from all trades. Therefore, it is better to use the indicator in combination with others that would confirm the Squeeze signals. Also, to fully understand the indicator’s working scheme, it is recommended to use a demo account, which will allow not only study the indicator in depth, but acquire the necessary skills in trading.