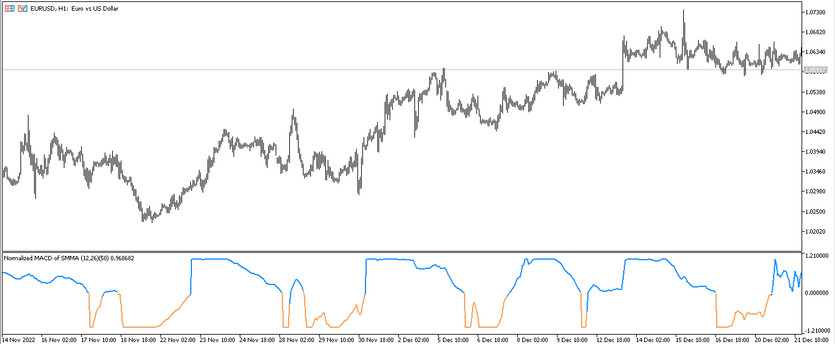

The Normalized MACD of Averages indicator is a modified version of the MACD indicator, which is included in the standard forex set. Its calculations are also based on moving averages, which in turn increase the accuracy of the signals. The indicator is designed to trade with the trend, so its calculations are based on identifying the current trend and trading during this period. The indicator is displayed in the lower window of the price chart as a solid line, which is painted in a certain color depending on the direction of the current market movement. These line values are considered as indicator signals.

The Normalized MACD of Averages indicator can be used with any currency pairs, on any convenient timeframe.

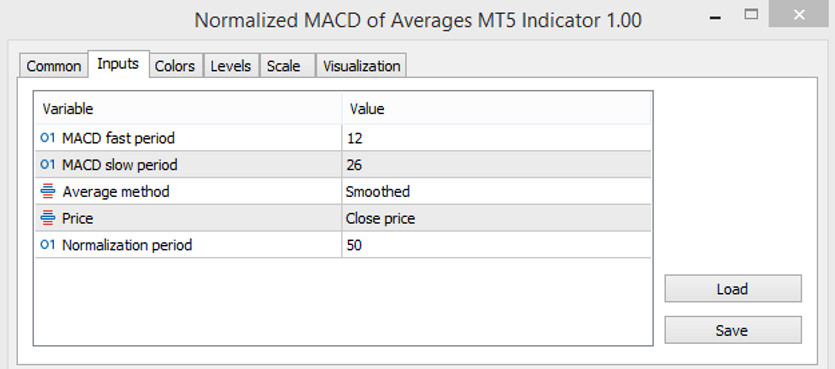

Input parameters

The Normalized MACD of Averages indicator settings consist of five input parameters, each of which affects the overall technical functioning of the indicator. The Colors section in its settings is used to change the color scheme and line thickness, and the Levels section is used to add signal levels to its window.

- MACD fast period - the period of fast value of the MACD indicator. The default value is 12.

- MACD slow period - MACD value with a slow period. The default value is 26.

- Average method - type of moving average smoothing used in indicator calculations. Default value is Smoothed.

- Price - type of the price to which the general calculations of the indicator are applied. The default value is Close price.

- Normalization period - period of normalization of the current values of the indicator. The default value is 50.

Indicator signals

The algorithm for applying the Normalized MACD of Averages indicator is very simple. The indicator is a trend indicator and therefore trading with it is made directly during the period of determining the direction of the current market movement. For this, the color and direction of the indicator line should be taken into account. Thus, if the indicator determines an uptrend, long positions, if the trend is down, short positions. In both cases, trades are closed at the moment of a change in the direction of the current market movement.

Signal for Buy trades:

- The indicator line moves from bottom to top and is colored with the growth value.

Upon receipt of such a condition, a buy trade can be opened on a signal bullish candle, due to the presence of an uptrend in the current market. It should be closed at the moment when the indicator line changes direction and turns into a different color. This will determine the change in the current trend, which in turn will allow considering the opening of new trades.

Signal for Sell trades:

- The indicator line has a color with a falling value and moves down.

A sell trade can be opened on a signal bearish candle upon receipt of such conditions. The current conditions will characterize the presence of a downtrend in the market. It should be closed at the moment the current trend changes, namely, when the color and direction of the indicator line changes. At this time new trades can be opened.

Conclusion

The Normalized MACD of Averages indicator is an efficient and very accurate trading algorithm, since it is based on time-tested indicators. Moreover, the indicator is very easy to use and suitable even for beginners who can improve their trading skills through preliminary practice on a demo account.

You may also be interested The RSI Summed trend trading indicator for MT5