Bitcoin is all the rage these days. The hype is nearly as strong as it was back in the heady days of 2017 when everyone at Thanksgiving dinner was discussing the best ways to buy the digital asset and musing over how rich they were all about to become.

In this article, we’re going to discuss what bitcoin is and isn’t. We’ll talk about the economics of bitcoin and whether the hype behind it is justified. And we’ll end with the three modes of analysis for analyzing it along with the best macro strategy for trading and investing in this market.

Okay, first up, what is bitcoin?

Let’s start with some quick semantics… There’s a difference between bitcoin and Bitcoin. Bitcoin, with a capital B, refers to the cryptographic protocol of the network, otherwise known as the blockchain.

Blockchain is the digital ledger that uses the cryptographic protocol proposed by Satoshi to solve the Byzantine Generals Problem — basically, the tech to help with our internet trust issues.

While bitcoin, small b, refers to bitcoin the currency. This is the token that’s connected to Bitcoin’s blockchain network and which bitcoiners transact in. It’s also often used as a blanket term for cryptocurrencies in general.

There are now over 1,000 different cryptocurrencies that are similar, yet different, to bitcoin with a small b. This list is growing every day.

Despite what its many ardent proponents say, bitcoin is not a currency and never will be… at least not in its present form. A proper currency must meet two requirements (1) act as a medium of exchange and (2) provide a good store of value.

Bitcoin fails at both. It’s not a viable medium of exchange because it has a costly and timely transaction process, especially compared to available alternatives. The following excerpt from BofA explains:

The problem with bitcoin as a peer-to-peer payment system is that it’s expensive, relative to conventional alternatives. This comes from the mining process. Mining isn’t a zero-sum game. The economics of mining are pretty simple. There is a fixed reward per block mined. At present, each block generates 12.5BTC. So, each block mined produces in Dollars around 12.5*bitcoin/dollar rate. At present, this is around $60k per block. This is a function of the bitcoin price. There are roughly 2000 transactions in a block, give or take. This implies that around $30 of bitcoin are created per transaction at present. Economically, we would regard this as a cost of the transaction, although this is not how people always view it.

Not only are the costs of transacting and running the network absurd, but the speed at which transactions are processed are extremely slow. BofA lays out the problem:

To illustrate, Visa’s payment system processes 2,000 transactions per second, on average, and can handle up to 56,000 per second, if needed. Assuming similar transaction handling capabilities at other large payment schemes such MasterCard, UnionPay, AliPay etc, total digital payment transaction volume in the retail space can be an order of magnitude higher than the aforementioned 2,000 transactions per second. Assuming 20,000 retail transactions are processed every second, it would take about 100 minutes for one second’s worth of transactions to be recorded on the bitcoin blockchain.

Okay, so bitcoin is not a good medium of exchange. But what about a store of value? Are cryptos a fiat currency similar to the US dollar, as many crypto fans proclaim?

Here’s economist Brad DeLong’s take:

Underpinning the value of gold is that if all else fails you can use it to make pretty things. Underpinning the value of the dollar is a combination of (a) the fact that you can use them to pay your taxes to the U.S. government, and (b) that the Federal Reserve is a potential dollar sink and has promised to buy them back and extinguish them if their real value starts to sink at (much) more than 2% / year (yes, I know).

Placing a ceiling on the value of gold is mining technology, and the prospect that if its price gets out of whack for long on the upside a great deal more of it will be created. Placing a ceiling on the value of the dollar is the Federal Reserve’s role as actual dollar source, and its commitment not to allow deflation to happen.

Placing a ceiling on the value of bitcoins is computer technology and the form of the hash function… until the limit of 21 million bitcoins is reached. Placing a floor on the value of bitcoins is… what, exactly?

Bitcoins lack the essential qualities to make it a viable medium of exchange and store of value. Hence they can’t and shouldn’t be thought of as currencies or valued as such.

So what are they?

Bitcoins and all current cryptocurrencies (as things currently stand) are speculative assets. That means Its “value” is based purely on the beliefs of those who buy it. And this belief is that bitcoin is valuable because other people think it’s valuable. “If I buy it now, I’ll be able to profit at a later date by selling to somebody else”. This is called Greater Fool Theory (GFT), where the premise of valuation is based on the idea that you’ll be able to sell the token to the next fool at a higher price.

Is there anything wrong with this? No, not at all. We’re active traders in bitcoin ourselves and think it’s a great trading asset. It’s just imperative that we call a duck a duck and don’t get caught up in all the hype.

Moving on… So how does one analyze bitcoin?

All financial market analysis is best done through a Trifecta Lens, where fundamentals, technicals, and sentiment are looked at holistically. Doing this allows you to identify high expected value (+EV) trade setups.

Fundamentals drive the big long-term swings in markets, so it’s critical to understand what they are and how they work.

Now, bitcoin doesn’t have any cash flows or intrinsic value as we discussed above. It’s similar to gold in that sense. But, no worries, there are still macro fundamentals that drive the market. Three in fact. These three are:

1. Demand vs. Supply: The entire investable gold market (bars, coins, futures, ETFs, etc…) equals out to roughly $2.6trn. The market cap of bitcoin would have to rise 10x to match that. The fact that bitcoin’s share of global liquid markets is basically a rounding error, means that it will only take a small shift in crypto adoption to move the market dramatically.

2. Real Interest Rates: Negative real rates drive capital flows into riskier speculative assets. Bitcoin is one of the most speculative assets there is. Hence, falling real rates drives bitcoin adoption and vice-versa over the long-term.

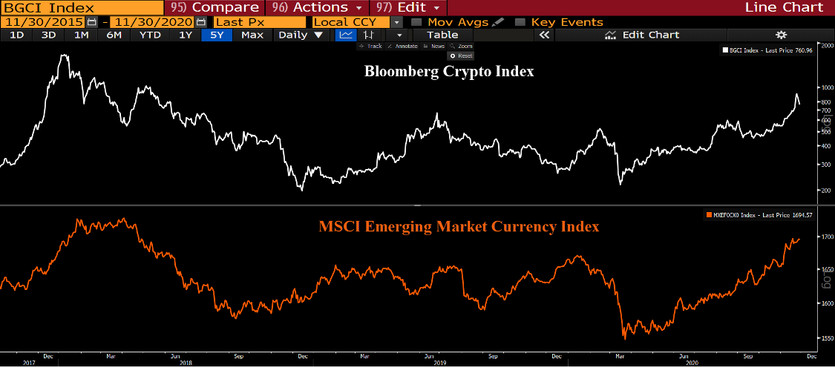

3. Risk Cycle: There’s a tight correlation between crypto and emerging markets forex and that’s due to good reason. Both cryptos and EMFX move off the ebbs and flows of the Risk Cycle, which is just a fancy term for the measurement of money contracting/expanding x investors cutting/adding risk. You can measure this through credit spreads, liquidity gauges such as the ANFCI, and flows.

Bitcoin is one of the best technical markets to trade. This is because there are a lot of emotional new traders in the space. It’s like the wild west of financial markets where the majority of the cowboys have never held a six-shooter, making it easy pickings for those who know how to trade and read the tape.

This manifests in actionable and repeatable chart setups. Now there’s a number of ways to analyze the technicals of bitcoin. But one of the simplest and most effective means is to look for compression regimes.

ll markets oscillate between low volatility (compression) to high volatility (expansionary trends). This is especially true in crypto markets. You can use classical charting to identify congestion zones and breakout setups or you can use measures of volatility such as Bollinger Band Width or Average True Range (ATR). Look at the chart below and see the examples of how these regimes play out.

And finally, we have sentiment… Like the great Oracle of Omaha says, you want to sell when others are greedy and buy when others are fearful. This is true of every market and especially bitcoin.

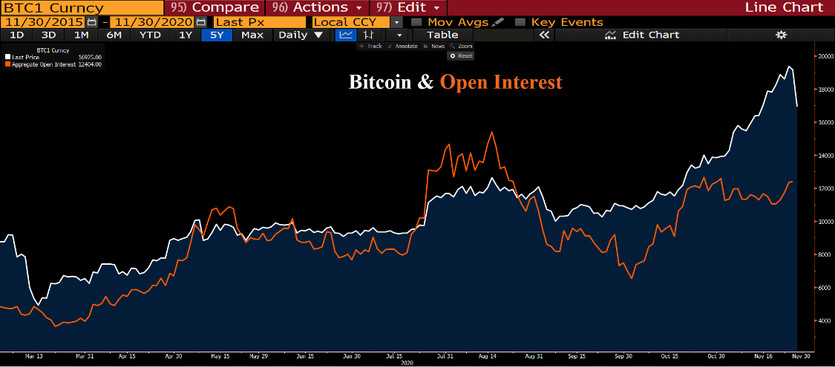

When analyzing sentiment, we want to look at broader market sentiment such as Put/Call ratios, Fund Flows, and the CNN Fear & Greed Index. And we also want to look at bitcoin-specific indicators such as open interest, which measures the total number of outstanding futures contacts that have not yet been settled. It’s a measure of the money flows info futures and options market and whether they’re decreasing or increasing.

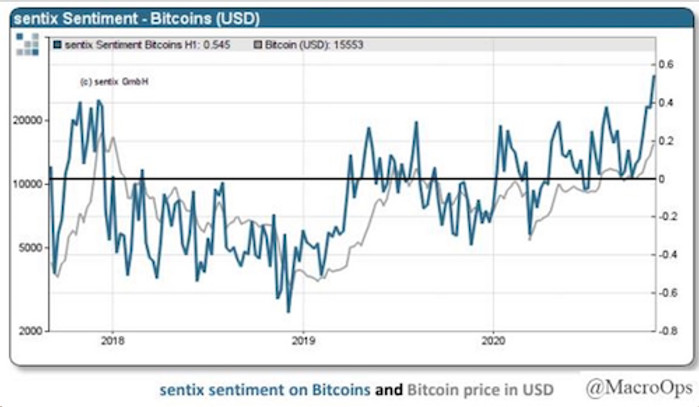

There’s also the freely available Sentix Crypto Sentiment Index. Sentix provides a free email newsletter that measures crypto sentiment through a broad-based institutional survey.

There’s also the Greyscale Bitcoin Trust (GBTC) where we can measure its premium to NAV. When the premium is low it denotes bearish sentiment and vice-versa when the premium is elevated.

There you have it… In this piece, we’ve covered what bitcoin really is, as well as what it isn’t. And we’ve gone over the macro strategies of fundamentals, technicals, and sentiment that help you properly analyze it.

Going forward you’ll now be more prepared to trade and hopefully profit in the bitcoin market.