Introduction

Ortega Capital, not to be mistaken with Ortega Capital Group, is a brokerage firm primarily specialized in foreign exchange (Forex) and metal trading. Established in Labuan, Malaysia, Ortega Capital has a substantial range of offerings, but some information gaps exist. This firm also operates a legal entity in Saint Vincent and the Grenadines, an offshore area that investors must consider carefully. It is crucial to determine which company you are dealing with before opening an account with this broker. Ortega Capital's digital presence supports languages like German, Chinese, and English.

Account Types

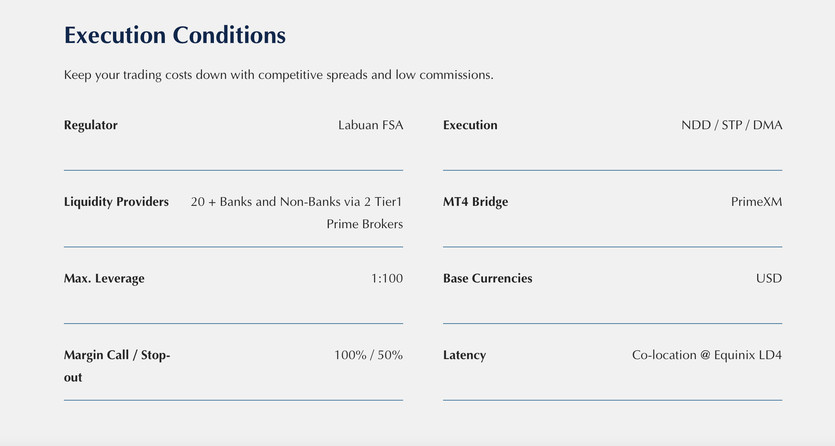

Ortega Capital appears to offer only a single standard account type. The minimum deposit to start trading is $5,000, providing traders with a leverage ratio of 1:100. Spreads commence at 0.2 pips, and there is an additional commission of $8 per lot traded. Notably, Ortega Capital does not profit from its client's losses. The terms STP, ECN, and NDD interchangeably apply in this scenario, suggesting that the broker functions as an ECN, earning from trade lot commissions and spreads.

Platforms

Fortunately, Ortega Capital offers MetaTrader 4 (MT4), a leading forex platform despite its 11-year presence in the market. MT4 comes with an advanced yet intuitive graphic package, and the real strength of the platform lies in its capability to use a vast array of sophisticated technical indicators and expert advisors (EAs). These EAs are available on the MQL market and other online providers.

Leverage

Ortega Capital provides a leverage ratio of 1:100, considered an optimal level for trading. This leverage is a refreshing break from the 1:500 or 1:1000 leverages offered by other brokers that pose a higher risk. Most professional traders prefer the 1:100 leverage.

Trade Sizes

Information about the minimum or maximum trade sizes with Ortega Capital is not readily available. Nor is there any option to test these parameters through a demo platform.

Trading Costs

Ortega Capital charges an $8 commission for each lot traded, equivalent to 0.8 pips in spread for pairs where USD is the second quoted currency. The minimum total expenditure would start from 1 pip for the most traded currency pair (0.8 pips equivalent to the commission plus a 0.2 pip spread). These costs tend to escalate for other currency pairs.

Assets

Ortega Capital primarily focuses on Forex, offering 69 currency pairs and four metals for trading. However, they do not provide CFDs. Though the number of supported currency pairs is quite impressive, the lack of indices, commodities, or other CFDs is a notable drawback.

Minimum Deposit

Ortega Capital has a high barrier to entry, requiring a minimum deposit of $5,000. This high requirement might deter many potential traders from using this broker.

Deposit Methods & Costs

Ortega Capital offers several deposit methods, accepting bank transfers, credit or debit cards (Visa or Mastercard), Skrill, Neteller, and China Union Pay.

Customer Service

For customer service, Ortega Capital offers three primary methods of communication: email, a web contact form, and a live chat feature.

Conclusion

Ortega Capital, with its low spreads and reasonable commission rates, is a competitive broker in the forex and metals markets. However, its high minimum deposit requirement and lack of information about trade sizes might discourage some traders. Hence, as with any financial decision, thorough research and due diligence are essential before deciding to open an account.