The Russian Ruble, often spelled as "rouble," is not just the official currency of the Russian Federation; it's an emblem of Russia's rich and complex history. Tracing its origins back to the 13th century, the Ruble is the second-oldest currency still in existence today, surpassed only by the British pound. Its intricate story unfolds through significant economic shifts, geopolitics, and modern transformations like the digital ruble.

Sections covered in this article:

- Historical Journey: From its medieval origins to modern times.

- Influence on Economy: Connection with global commodities, especially oil.

- Geopolitical Impact: Effects of international relations on the currency.

- Digital Transformation: Introduction and implications of a digital ruble.

Key Takeaways

- Currency's Stature: The Ruble stands as Russia's official currency, with a history dating back to the 13th century.

- Global Commodity Influence: Tied to oil prices, reflecting Russia's status as a major oil exporter.

- Geopolitical Sensitivity: Economic sanctions and political events have caused substantial shifts in the Ruble's value.

- Digital Era: Testing of a digital ruble prototype began in December 2021.

Understanding the Russian Ruble (RUB)

The Russian Ruble's history spans nearly eight centuries, witnessing multiple transformations, revaluations, and devaluations. The currency underwent significant changes before the fall of the Soviet Union in 1992 and during the redenomination in 1998, when one new ruble became equivalent to 1000 old rubles.

A. Historical Overview

- Early Beginnings: The Ruble's history spans nearly eight centuries, undergoing multiple transformations, revaluations, and devaluations.

- Soviet Era: Major shifts occurred before the fall of the Soviet Union in 1992 and the redenomination in 1998, when one new ruble replaced 1000 old rubles.

- Modern Times: A close relationship with global commodity prices, especially oil.

B. Economic Sensitivity

- Oil Prices: The Ruble experienced a sharp decline in 2014, losing nearly half its value against the U.S. dollar as oil prices fell.

- Sanctions Effect: U.S. and European Union sanctions in response to Russia's actions in Crimea led to further weakening.

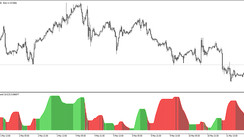

The currency's exchange rate has closely followed global commodity prices in recent years, particularly oil prices. This is due to Russia's heavy reliance on exporting oil, natural gas, and other resources. The Ruble experienced a collapse in 2014, losing roughly half of its value against the U.S. dollar as global oil prices dropped. The situation was further complicated by sanctions imposed by the U.S. and European Union on Russia in July 2014, in response to Russia's actions in Crimea, causing additional weakening of the currency.

The Ruble and Geopolitics

The Ruble's value does not solely hinge on economic considerations; geopolitical events and tensions involving Russia and neighboring countries also play a crucial role. In recent years, the Ruble has seen significant volatility due to crises and conflicts that strained Russia's relations with the West and other nations.

A prominent example is Russia's annexation of Crimea in 2014, an act that prompted international sanctions and condemnation. These sanctions targeted vital sectors of Russia's economy, such as energy, finance, defense, and trade, and led to restrictions on foreign capital and technology access. The impact sent the Ruble to record lows against the dollar and the euro in late 2014 and early 2015. This period marked an increase in the USD/RUB exchange rate from around 30 rubles to 50-60 rubles to the dollar.

Further strains occurred with Russia's large-scale invasion of Ukraine in February 2022. This event led to another round of stricter sanctions, including actions against Russia's central bank and energy giant Gazprom. Many Western corporations halted business within Russia, causing the Ruble's value to plummet to nearly 135 rubles to the dollar.

Recent events, such as the 2023 incident involving the private military contractor Wagner Group, have shown that the Ruble remains volatile and susceptible to internal political tensions, fluctuating between 70 to 80 RUB per USD.

To sum up, geopolitical events have greatly affected the Ruble in recent times:

A. International Tensions

- Crimea Annexation: Russia's move in 2014 resulted in international sanctions and record lows against the dollar and euro.

- Ukraine Invasion: Large-scale military action in 2022 led to even stricter sanctions, causing the Ruble to plummet to nearly 135 rubles to the dollar.

- Wagner Group Incident: The Ruble remains sensitive to internal political tensions.

B. International Relations and Currency Stability

- Sanctions and Economy: Targeting vital sectors like energy and finance, leading to restrictions on foreign capital.

- Exchange Rate Impact: Fluctuations from 30 rubles to 50-60 rubles to the dollar in late 2014 and early 2015.

Fast Fact:

In 2017, Russia declared the Russian ruble as the sole legal tender in Crimea, while the National Bank of Ukraine banned the circulation of Russian banknotes depicting images of Crimea.

Russia's Economy

Russia's enormous geographical size and abundant natural resources contrast sharply with its economic ranking. In 2021, despite being more than twice as large as the contiguous 48 U.S. states, Russia's annual GDP ranked only 11th worldwide, at just 7.72% the size of the U.S. economy.

This disparity stems from Russia's heavy reliance on natural resource exports, rather than focusing on higher-value-added industries. Even smaller countries, such as Italy and France, have outpaced Russia in terms of GDP. Political tensions and ongoing sanctions from the international community further compounded economic challenges, particularly after Russia's invasion of Ukraine in February 2022.

In summary, Russia's economy comes down to:

A. Economic Landscape

- Geographical vs Economic Size: Russia's geographical vastness contrasts with its 11th worldwide GDP ranking.

- Natural Resource Dependence: Heavy reliance on resource exports, rather than high-value-added industries.

B. International Stance

- Sanctions and Economic Challenges: Ongoing international sanctions, especially post-Ukraine invasion, have compounded economic struggles.

The Digital Ruble

In an ambitious technological leap, President Vladimir Putin announced in 2017 that the Bank of Russia would issue a Central Bank Digital Currency (CBDC). While many countries are now exploring CBDCs, Russia was among the pioneers. By December 2021, the digital ruble's prototype was completed, and initial transfers were successful. Twelve Russian banks have signaled readiness to adopt the digital ruble.

Some commentators have speculated that a digital ruble might help Russia evade international sanctions. Although a CBDC differs from private cryptocurrencies, it could potentially reduce Russia's dependence on foreign currencies like the U.S. dollar.

A. Innovation and Modernization

- Digital Transformation: Announcement by President Vladimir Putin in 2017 about the Central Bank Digital Currency (CBDC).

- Pioneer in CBDCs: Among the first countries to explore this area, with successful initial transfers in December 2021.

- Strategic Implications: Potential to help Russia evade international sanctions and reduce dependence on foreign currencies.

Fast Fact:

The value of the digital ruble is intended to mirror the value of the physical ruble, ensuring parity.

History and Denominations of the Russian Ruble

The Russian Ruble's rich history dates back to medieval Russia in the 13th century. Its name, derived from the verb "rubit," or "to chop," references how people would create smaller coins from larger currency. In 1704, it became the first European currency to be decimalized, dividing into 100 kopecks. Its journey from silver coins to paper notes signifies various economic reforms, political changes, and inflation.

The current Russian ruble exists in denominations ranging from 5 to 5,000 rubles, adorned with images of monuments, bridges, and historical figures. Coins range in value from 1 kopcek to 10 rubles.

A. A Rich Historical Tapestry

- Origins: From medieval Russia in the 13th century.

- Decimalization: First in Europe, in 1704.

- Transition: From silver coins to paper notes through various economic reforms.

B. Current Denominations

- Range: From 5 to 5,000 rubles, with images of monuments, bridges, and historical figures.

- Coins: Valued from 1 kopeck to 10 rubles.

How the Bank of Russia Influences the Ruble

A. Monetary Policy Tools

The Central Bank of Russia wields several monetary policy tools to control the Ruble's value, including interest rates, reserve requirements, and open market operations. These strategies help in combating inflation or stimulating growth and stabilizing or altering the Ruble's value.

- Interest Rates: Influence the Ruble's value.

- Reserve Requirements and Open Market Operations: Strategies for combating inflation or stimulating growth.

The Bottom Line

The Russian Ruble, one of the oldest currencies still in use, is a multifaceted financial instrument deeply connected to global oil prices and Russia's role as a major exporter. Its transformation since the 13th century is marked by various political and economic shifts, including Russia's relations with Ukraine and international sanctions. Pioneering digital currency initiatives and active central bank interventions reflect the Ruble's dynamic nature and its significant impact on Russia's economy.