Liquidity in relation to the market defines the ability of the market to purchase or sell an asset without bringing an abrupt variation in asset’s price. The liquidity providers are the market players that are making the sale or purchase of assets.

In the forex market, liquidity providers are often banks, financial institutions, and brokers also known as market makers. Liquidity provider increases the liquidity of the market by connecting the brokers and traders for settling the trading transactions. A higher liquid market is desirable in order to reduce the cost of trading because the higher liquidity causes the spread to squeeze.

Role of liquidity providers

The role of the liquidity provider is very important in order to protect the market against the volatility and support the volume of the trading transactions.

The trading volume is based on the number of buying and selling during a trading session.

Liquidity providers make the market very easy for the investors to buy and sell the currency pairs or other trading assets.

Generally in forex trading operations, trader’s place their trading orders with the brokerage and the broker’s passes these orders to the liquidity providers (banks, investment institutions, and other market makers) for execution of the trading transaction and charge the fee or commission in the shape of spread. This is how transparent forex trading should look like.

However, sometimes brokers act as the counterparty in the trade by fulfilling the trade order by means of matching the trading order with other customer’s order or from the inventory thus act as a market maker in the said transaction.

Tier-1 liquidity providers

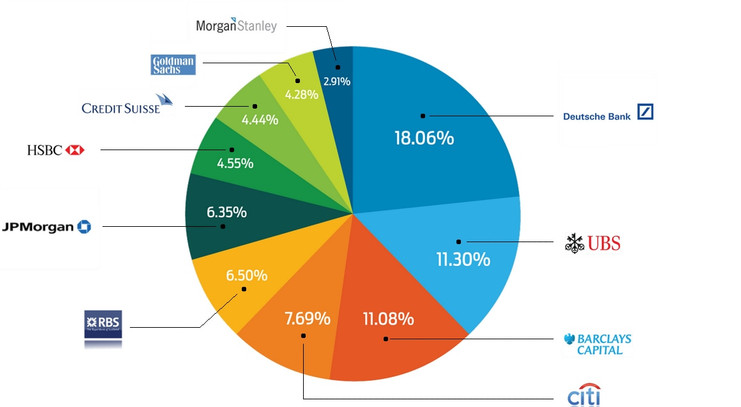

In the foreign exchange market, top liquidity providers consist of the largest investment banks and financial institutions - usually known as Tier 1 liquidity providers. Tier 1 liquidity providers buy and sell quotes for all currency pairs and offer numerous trading services to the traders. Tier 1 liquidity providers make the market by offering the tighten spread for all the foreign currency pairs. In forex trading, Deutsche Bank is the largest liquidity provider also known as the leading or key retail and investment bank. A tier 1 liquidity provider often makes the money by taking the counter position in the trade rather than just relying on the spread.

Execution of orders by liquidity providers and market makers

In many cases the expression liquidity provider is synonym with the word market makers as both parties operating the same line of the business and make their money through spread, commission or slippage and whether to take the risk by taking the position another side of the trade or pass it on to other liquidity providers.

Most forex brokers (Dealing Desk Brokers) and commercial banks perform the role of liquidity providers in respect of several forex currency pairs by eagerly buying forex positions from the clients and selling the forex positions to their other clients at any time during the trading session.

In general market makers quote buy and sell prices in respect of a currency pair and make the compensation through the differential between the bids / ask rate that is usually known as the dealing spread.

The presence of more market makers operating in a number of currency pairs increases the liquidity of the market that reduce the trading costs for traders and intact the prices in the market.

However, it is important to note that it is always better to have as many liquidity providers who compete for your orders as possible. Not like in case of low-quality retail market making brokers or fake ECN / STP brokers who have the only one liquidity provider owned by them. Only in case of more liquidity providers competing for your orders, you will always get the best prices and execution of orders

Especially Straight through Processing (STP) brokers (or ECN brokers as well) are actively involved in the interaction with the liquidity providers for passing the customer orders to improve the liquidity and rates.

Other known retail liquidity providers are: FXCM, LMAX, Swissquote or Sucden Financial.