This trading strategy is known to a small number of traders. Its advantage is the definition of clear criteria for entering trades and the same clear criteria for placing takeprofit and stoploss.

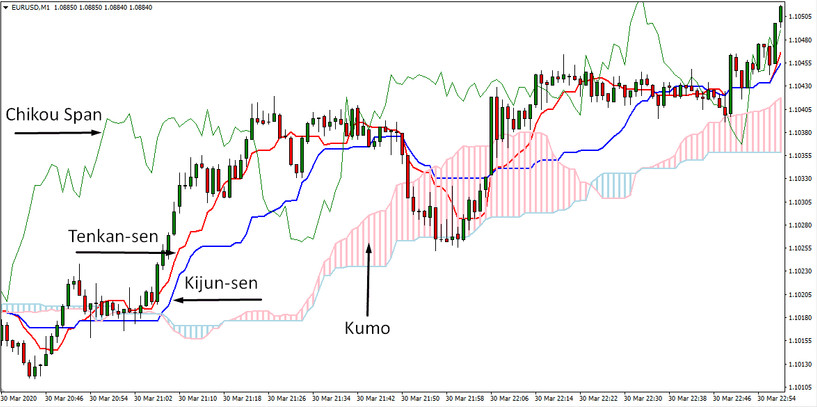

This strategy is based on the readings of the Ichimoku indicator. This indicator is included in the standard Metatrader 4 terminal library. You can also download and install the indicator on our website in the Indicators section for free.

The royal strategy shows good results on the currency pairs that make up the basket of the US dollar index. These include EURUSD, GBPUSD, USDJPY, USDCAD, USDCHF, USDSEK. The preferred timeframe is H1. The settings for the Ichimoku indicator remain the default - 9 for Tenkan-Sen, 26 for Kijun-Sen, 52 for Senkou Span B, respectively.

Having applied the Ichimoku indicator to one of the charts of the indicated currency pairs, carefully examine the position of the Ichimoku lines.

Terms for opening a BUY deal:

- Takeprofit for the first deal is set at 30 points from the opening price, for the second deal 50 points and 100 points for the third, respectively.

- Stoploss is set at 50 points from the level of the open price for all three deals.

Terms of opening a SELL deal:

- Takeprofit for the first deal is set at 30 points from the opening price, for the second deal 50 points and 100 points for the third, respectively.

- Stoploss is set at 50 points from the level of the open price for all three deals.

Conclusion

This trading strategy cannot be called a dynamic trading strategy. As can be seen from the description, such a system requires attention and perseverance. The number of signals and trades for this strategy is small - an average of about 6 per month for each currency pair. Nevertheless, the strict fulfillment of the conditions for entering the deal gives a good reward for the time spent.

Before applying this strategy, practice on demo accounts to learn how to identify the signals of this strategy as efficiently as possible.