The Gator Gold Strategy is a trading system designed for use on XAUUSD with the H1 timeframe. It is implemented using two indicators: Gator and OsMA . The Gator Gold system allows catching both short-term and medium-term trend reversals based on the readings of these two indicators.

You can download these indicators for FREE in the indicators section on our website.

Indicator settings

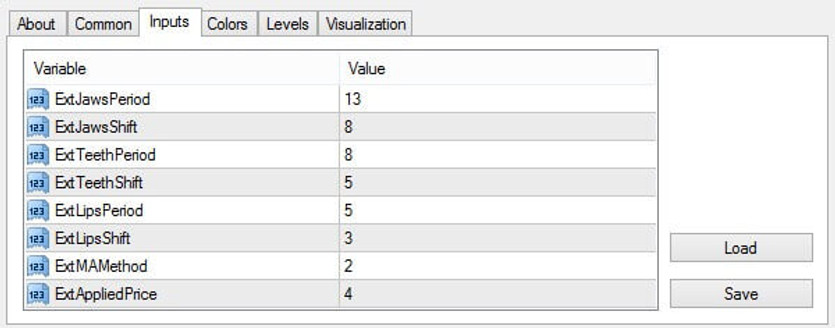

Applying both indicators to the XAUUSD chart with the H1 timeframe, set the following input parameters for the indicators:

- For the OsMA indicator: Fast EMA Period = 14, Slow EMA Period = 33, Signal SMA Period = 10.

The Gator indicator is used with default settings.

Conditions for opening long positions

After fulfilling these conditions and when the hourly candle closes, you can open a BUY deal at the beginning of the next hour.

Conditions for opening short positions

The deal should be opened after closing the candle on which Gator showed the red zone.

Stoploss and Takeprofit

Under the terms of this trading system, reverse signals are used to close a trade. There are no predefined stop-loss and take-profit. For example, if the conditions and the opening of the deal are met, the signal to close the deal will be the opposite signal to sell. But in order to follow these conditions, it is necessary to establish such a position volume that will be safe in the event of a sudden price jump. We recommend using a safety stop-loss according to your risk control rules to avoid unforeseen situations.

Conclusion

In the Gator Gold system, despite the Gator indicator, which is used as a filter for detecting signals, the main signal is OsMA divergence. Therefore, the main component of success in this strategy is finding the right divergence. Try to open deals only with pronounced divergence. By pronounced divergence in this context, we mean the height of the columns of the OsMA histogram. And as in any system in which the opposite signals serve as closing deals, use the position volume that is the safest for your deposit.