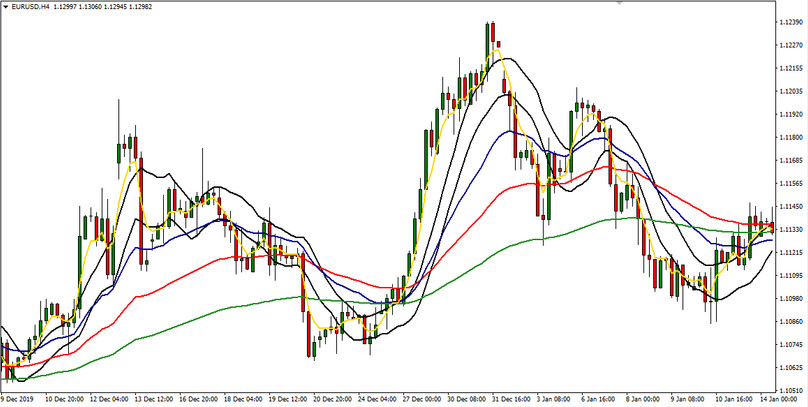

A simple but effective 4 EMA & Channel strategy is designed for medium and long-term Forex trading. The system is suitable for any currency pairs, metals, and other financial instruments. Four-hour charts are used to analyze and determine entry points.

The basis of the system is two moving average lines with a period forming a price channel. One of these lines is drawn at the highs of the bars (high), the other at the lows. Both of these lines form a channel, the behavior of the price relative to which gives reference points for entering the trade.

Also, four exponential moving averages adjusted for certain parameters are used to refine the input and output signals. Thus, the MA indicator is applied here six times with various input parameters.

Indicator Settings

To build a channel, add two moving averages to the chart. In order not to get confused visually assign them a black color, and then set the following parameter values for them:

Period = 10, MA Method = Simple. For one, set the Apply_To parameter to High, and for the other Low.

Then add four more MAs to the chart by setting the following values for them:

All four of these lines must be exponential. To do this, change the MA Method parameter for all four lines from Simple to Exponential and the Apply_To parameter to Close. For the first of these four, set Period to 50, for the second 23, for the third 112 and for the fourth 6.

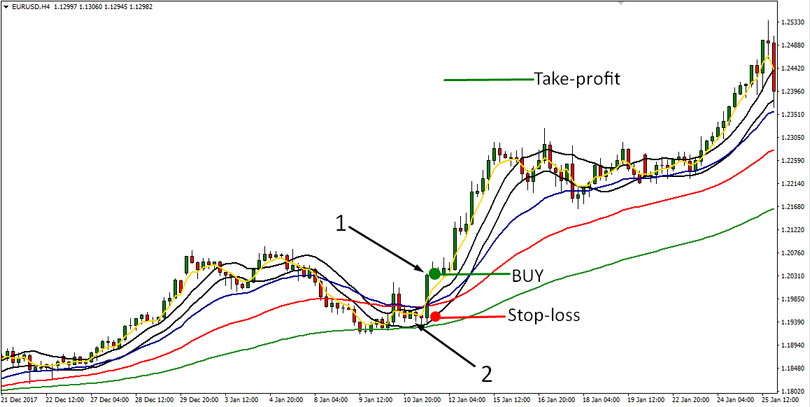

Conditions for opening long positions

1. The price of an asset has gone beyond the channel (from black lines) and is above it.

2. The price rose above the EMA 50, and the EMA 6 and EMA 12 crossed up the EMA 23.

When these conditions are met, a purchase transaction is opened.

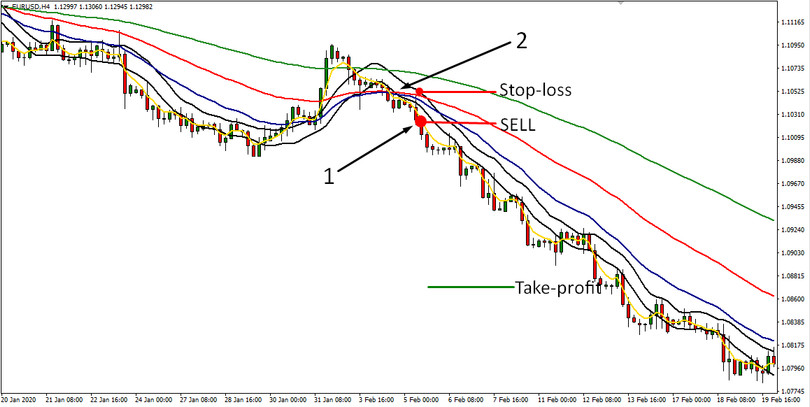

Conditions for opening short positions

1. The price broke through the channel of two MA 10 (black lines) from top to bottom and is below it.

2. Also, the price fell below the EMA 50 and EMA 6, and EMA 12 crossed from top to bottom EMA 23.

Stop Loss and Take Profit.

After the transaction is opened, according to this strategy, the stop loss is placed on the lower border of the channel (for a buy transaction) and on the upper border of the channel (for a sell transaction). Take Profit is four times longer than Stop Loss.

Conclusion

Strategy 4 EMA & Channel is a vivid example of the clever use of the simplest MA indicator. Despite its simplicity, the moving average indicator remains one of the most effective technical analysis tools. Also, systems like this, which are built on the basis of moving average data and configured correctly, often show effective trading results in the long term.