Tracking the current trend and open trades towards the global trend is an integral part of the trading process of any successful trader.

Of course, in theory, the recommendation sounds quite simple, to open deals with the trend and perhaps to study the theory in the book, it seems that it is quite simple to identify the trend and open in its direction.

However, if examples look beautiful and convincing in books and on various resources, in practice, everything turns out to be not so real.

Whatever trend indicators you use to analyze trends, you will always face the same problem - signal lag.

Of course, you can use oscillators, but the number of false signals will be significant.

An excellent solution to this problem would be to use the Aroon indicator in a trading strategy. Most traders using this indicator note that the signals of this instrument practically do not lag behind and sometimes even have a leading effect, which is typical for almost all oscillators.

The multicurrency and versatility of this indicator allows it to be used in any trading tactics as a signal tool and as a filter.

Aroon & MA H1 is a simple and proven strategy that yields good results when used correctly. It is built using two indicators: Aroon and MA. The Aroon indicator is available for download on our website in the Indicators section.

Aroon with MA H1 Trend following Strategy

Indicator settings

Since Aroon perfectly shows short-term trend changes, but at the same time does not see a global trend, when building this strategy, a Moving Average with a period of 90 is also used.

Moving average settings - Aroon with MA H1 Trend following Strategy

A moving average with such a period will perfectly show you the global trend direction and compensate for the weakness of the signal instrument.

Leave the Aroon indicator period with the default value - 14.

Aroon indicator settings

To trade according to the Aroon&MA strategy, only two trading conditions must be observed, and the position must be closed exclusively by a closed candle.

Buy signal

- Under these conditions, a BUY deal is opened.

It is very important to limit risks, so set your stop loss at the level of the local minimum, or at the minimum of the signal candle.

Exit from a position occurs at the take profit, which must be equal to or a couple of points higher than the stop loss.

Aroon with MA H1 Trend following Strategy. BUY deals

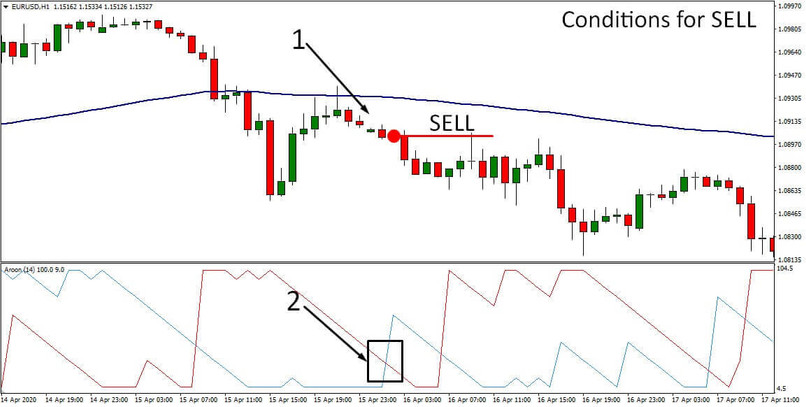

Sell signal

- As with a buy position, you should enter the market using a closed candle.

Stoploss should be set either at the local maximum or at the maximum of the signal candle.

Exit from the deal is done by take-profit, which must be a couple of points more or equal to the stop order.

Aroon with MA H1 Trend following Strategy. SELL deals

Conclusion

The advantage of this trading system is undoubtedly its reliability and ease of understanding and study. Use it only with well-defined risk control and money management system.