This strategy is based on a set of three indicators. One custom made indicator, (known as Modified Bollinger Bands), attached below, and two simple moving averages with the following settings (plus one chart pattern).

Custom Indicator settings (Modified Bollinger Bands)

- Use default settings - DOWNLOAD THE INDICATOR FOR FREE HERE

The First Moving average settings:

- Period: 1

- MA Method: Exponential Method.

- Apply: High price

- Color: Red

The Second Moving average settings:

- Period: 1

- MA Method: Exponential Method.

- Apply: Low price

- Color: Green

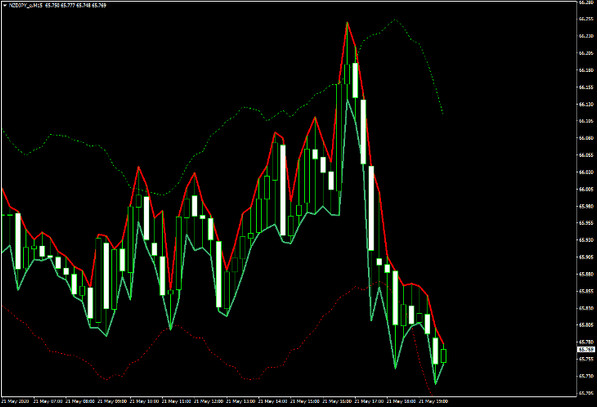

After setting up everything as in the instructions above, you should have something like this on your screen.

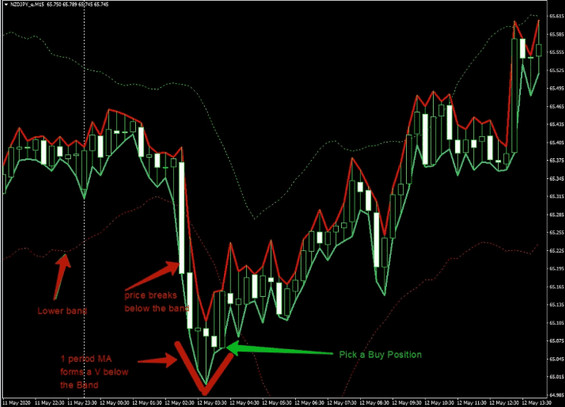

Conditions For Long Positions:

First ensure you are on the 15 minutes chart. Attach the custom made Bollinger bands and the two moving averages with the settings above.

Wait for price to break below the lower band (red dotted band). While the price is below the lower band, wait for the green 1 period EMA to form a “V”, and then open a Long position, after the completion of the V formation.

How to Place SL and TP

For a buy position, your stop loss should be below the V shape formed by the 1 period EMA, and your take profit should be twice the distance from your entry price and Stop loss.

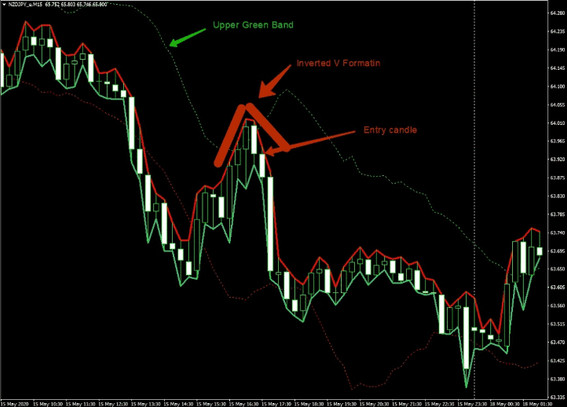

Conditions For Short Positions:

First ensure you are on the 15 minutes chart. Attach the custom made Bollinger bands and the two moving averages with the settings above.

Wait for price to break above the upper band (green dotted band). While the price is above the upper band, wait for the red 1 period EMA to form an inverted “V”, and then open a Short position, after the completion of the inverted V Formation.

How to Place SL and TP

For a sell position, your stop loss should be above the inverted V shape formed by the 1 period EMA, and your Take-Profit should be twice the distance from your entry price and Stop loss.

Conclusion

While this strategy appears to work the best on the 15 minutes time frame, using it on a 5 minutes chart brings very good results too, just ensure that your Stop-Loss loss is above the inverted V formation for a sell and the Stop-Loss below the V formation for a buy. You will achieve around 78% success rate of profitable trades if you follow this strategy as described and with a good money management strategy. Remain with the major pairs only.