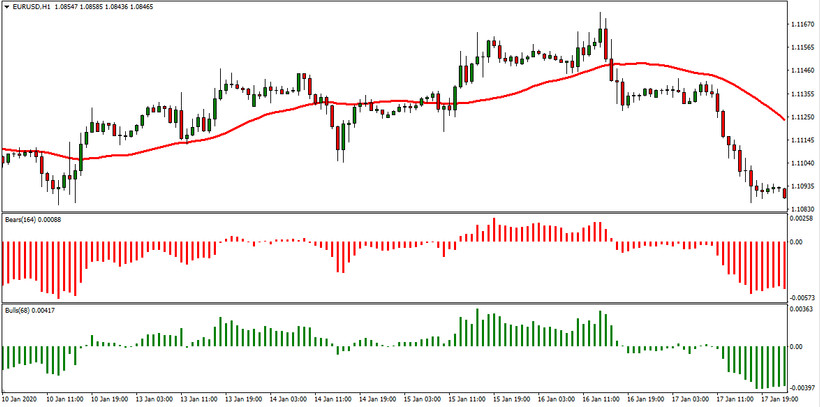

BullsBears & EMA trading strategy is a universal strategy based on the signals of three technical indicators: pair indicators Bulls and Bears, which determine the strength of buyers and sellers, as well as moving average values, which are used to further confirm entry into the market. The strategy can be tested and applied to any of the Forex assets on the H1 timeframe. You can download the indicators used in this system on our website in the Indicators section.

Indicators settings

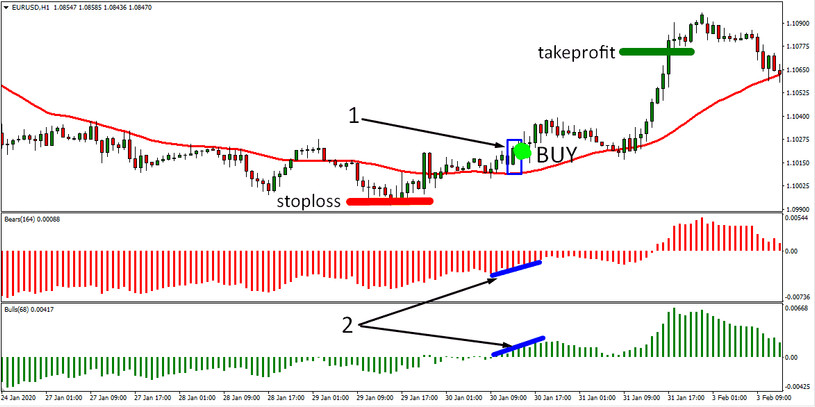

Search for signals to open long positions

- In this case, the entry into the market for the purchase occurs on the next candle.

- The Safety Stop Loss is set below the last local minimum.

- As a goal, you should choose a distance exceeding Stop Loss by half.

- The transaction is terminated if the price crosses the EMA in the opposite direction.

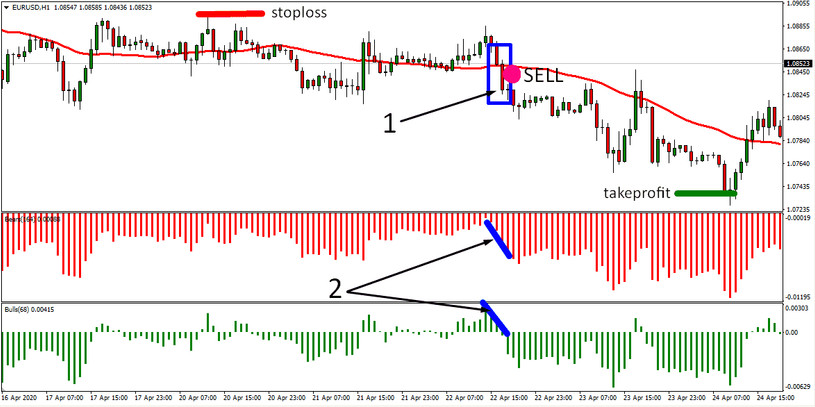

Search for signals to open short positions

- The entry takes place on the next candle.

- Safety Stop Loss should be set just above the last maximum.

- Take Profit is twice the distance to Stop Loss.

- The order closes as soon as the price crosses the moving bottom-up.

Conclusion

As can be seen from the above, along with the Bulls & Bears indicator brothers, the moving average is also used in this trading strategy. Since Bulls & Bears are indicators of the strength of one of the parties, it is the moving average, as a trend-determining tool, that is used here to confirm entries. Experimenting with various Forex trading assets, you can achieve excellent results by trading on the BullsBears & EMA strategy.