The Equalizer strategy, due to its specificity, is not widely known and popular in Forex. However, the famous trader Larry Williams had a hand in its creation. The approach is easy to use and does not require the use of technical indicators. And the time it takes to trade can be as little as 10 minutes a day.

This system uses the concept of «shock days.» This concept was introduced by the legendary Larry Williams, the author of many indicators, who invented the COT report analysis system, and the first trader to show the ability to trade futures with a five-digit percentage yield.

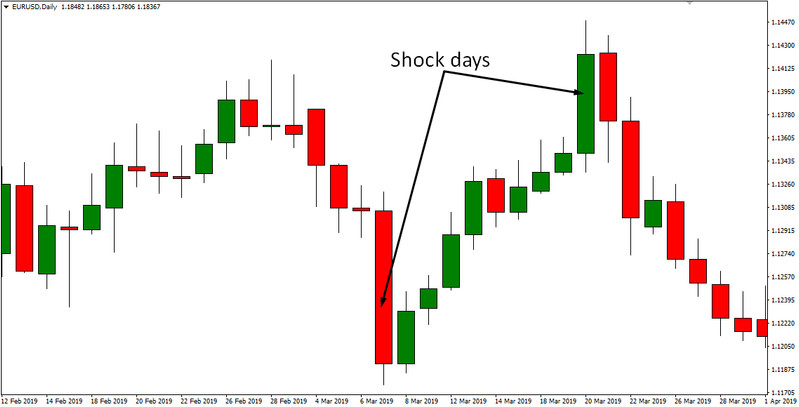

Williams studied many market patterns and determined that after days with a high trading range (in other words, with a maximum fall or rise at the end of the trading day), a reversal of quotes or a continuation of the trend can be expected. It is these moments that have received the name of the «shock day,» however, without clear selection criteria for the range of changes in the cost of instruments.

The trader was asked to independently determine it and then observe the behavior of the asset. The close level of subsequent candles should have indicated in which direction of the trend or countertrend to place pending orders. You can read more and more precisely about this in Williams' book «Long-term secrets of short-term trading.»

The proposed method - the countertrend strategy of shock days - is much simpler. Many traders know that the most liquid EURUSD pair rarely goes beyond the +/- 1% level. In points, the EURUSD shock day can be calculated using the method described below.

For some reason, trading activity is almost constantly interrupted at this level - large players take a break. Perhaps this is due to some kind of trigger for the Regulators, who track significant changes in the exchange rate.

The frequency of the above-described phenomenon became the basis of the countertrend strategy Equalizer for the most liquid pairs in the Forex market.

Strategy setting

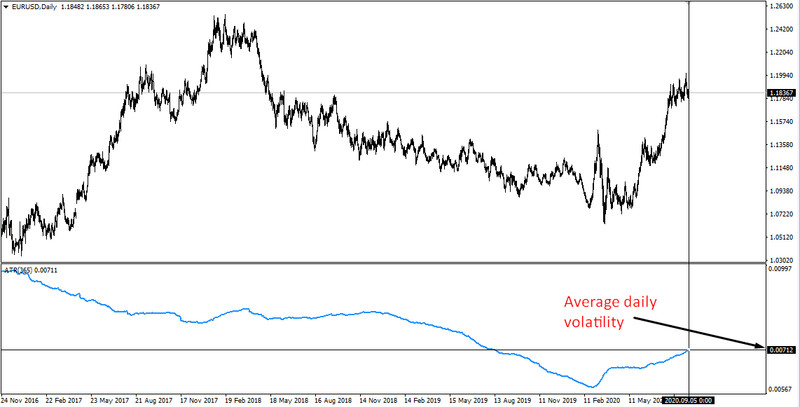

First of all, for the currency pair to which this strategy will be applied, you need to find the average daily volatility. The ATR indicator is well suited for this task.

Having applied this indicator to the chart of a trading asset, set its period to 365. The indicator line will show the current average daily volatility for the last year.

Position opening rules

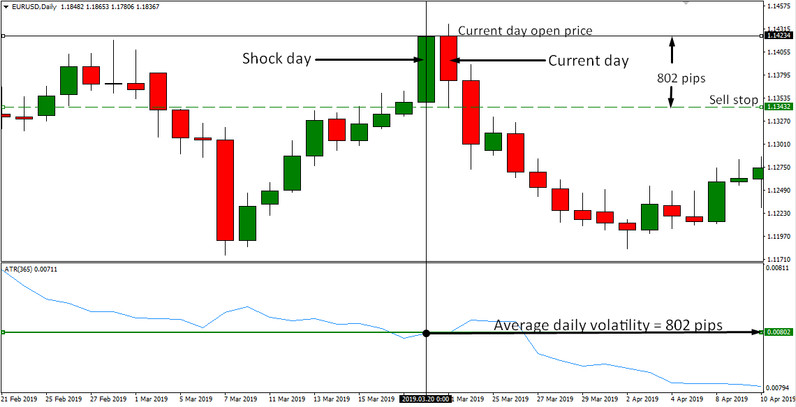

The strategy is based on the idea of catching a correction that occurs when a currency pair exceeds a range of N points, equal to the average daily volatility. The presence of such a massive movement often indicates the emergence of a strong and stable medium-term trend; therefore, the tactic does not imply holding the position for a long time - you should exit at the end of the day.

Thus, the rules for placing pending orders have the following criteria:

1. The previous day's volatility range is higher than the daily average volatility.

2. Pending stop orders are placed at a distance equal to the average daily volatility from the opening price of the current day.

Stoploss and TakeProfit

Stop loss for a pending order is placed at a distance equal to half of the average daily range, i.e., 50%. Take profit should be placed 30% of the average daily range.

Conclusion

Equalizer's countertrend strategy uses pending BUY and SELL orders, which frees the trader from having to predict the direction of the trend.

This system is simple and easy to use: it does not require complex indicators and deep technical or fundamental analysis; it takes about 10 minutes every day. Entry tactics allow setting up alerts or using auxiliary advisors to support and close a position.