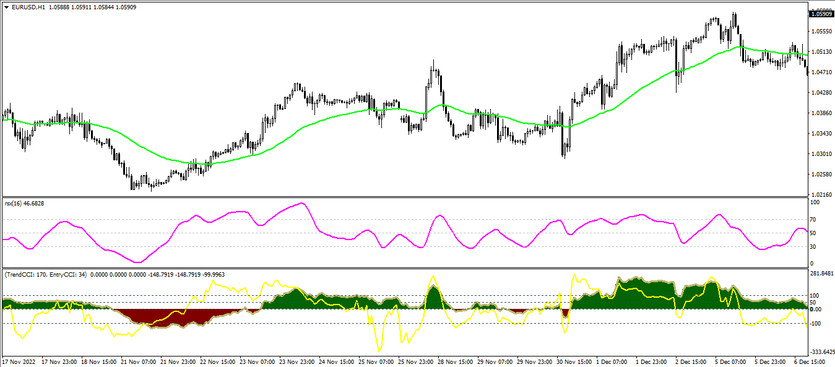

The Double CCI RSX MA strategy is an algorithm based on the interaction of effective indicators, which are modifications and improved versions of standard Forex indicators. Trading according to the strategy is based on the interaction of these indicators, and when opening a certain trade, the signals of all indicators included in it are taken into account. All indicators are considered trend indicators, and therefore the strategy is based on trading during a certain market movement. The current trend opens at the moment when all three indicators of the strategy determine one direction of the trend.

The strategy is suitable for use with any currency pairs and timeframes, while it should be borne in mind that a pair should be selected taking into account the values of the strategy indicators.

Strategy indicators

- EMA - exponential moving average with a period of 50.

- Double CCI with SMAvme - modification version of the standard effective Forex technical market analysis indicator. With parameters 170,34,30 and with added levels 100,50 and -100.

- RSX - trading trend indicator. The period is 16.

Trading with the Double CCI RSX MA strategy

Using the Double CCI RSX MA strategy is not difficult, since it is based on very simple and visually understandable indicators. To open trades using the strategy, it is needed to wait for the full combination of conditions from the indicators on the signal candle. At the same time, if at least one indicator is late with a signal, the opening of a trade should be temporarily postponed. If all the indicators have identified an uptrend, long positions are opened, if the trend is down, short positions are opened.

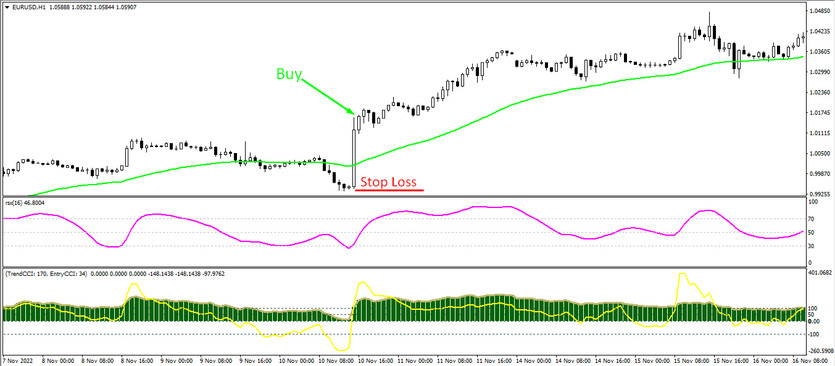

Conditions for Buy trades:

- Current candles form above the EMA.

- Double CCI with SMAvme histogram is colored with growth value and rises above level 50 together with the signal line.

- RSX line moves up and rises above level 50.

Upon receipt of the full combination of conditions on the candle, which is formed after the signal one, a long position can be opened, due to the presence of an uptrend in the market. Stop loss should be set at the point of a recent local minimum. The trade should be closed upon receiving a return signal from one of the indicators. At this moment, the current trend may change, which in turn will allow considering the opening of new trades.

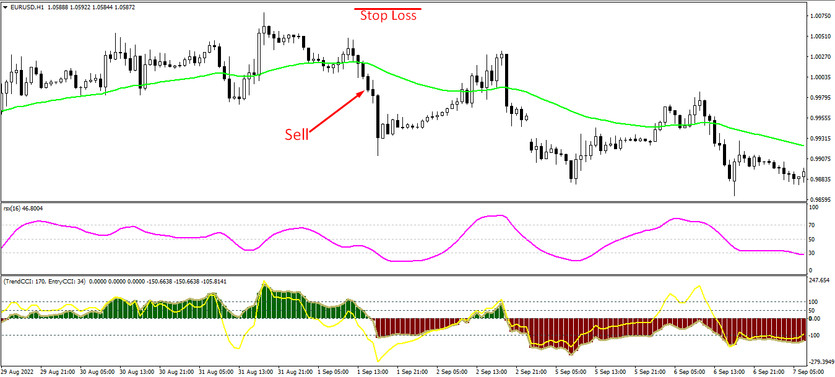

Conditions for Sell trades:

- Candlesticks form below the exponential moving average.

- The Double CCI with SMAvme indicator turns into the color from the fall and its histogram, together with the signal line, goes down, below the level of 50.

- The RSX indicator is moving down, dropping below the level of 50.

A sell trade can be opened on a candle that is formed after the signal one. At this moment, a downtrend is formed on the market. A stop loss order is placed at the point of a recent local extremum. Such a trade should be closed after at least one of the indicators gives a reverse signal will allow considering the opening of new trades after the change of the current trend.

Conclusion

The Double CCI RSX MA strategy is a very effective and accurate trading strategy, which includes effective indicators that allow trading during a certain market movement. In addition to preliminary practice on a demo account, it is also recommended to separately study the algorithm for using the indicators included in its composition.

You may also be interested The AntiAlligator Trend Waves Trading strategy for the EURUSD currency pair