Dynamic trends, or changing trends, are a great example of how it is possible to adapt inputs over time to changing situations without worrying about whether or not the trend line is still valid after several breakthroughs.

Moreover, they are also a great example of how it is possible to make profits and protect them by closing positions regularly, as it is no secret that the profit that comes from a still open trading position is not a profit, but only an opportunity that can still end up in a loss despite various protections.

Strategy entry rules

Entering long positions

-the market hits a rising trend line

Entry into short positions

-the market hits a falling trend line

How to trade dynamic trends - step by step

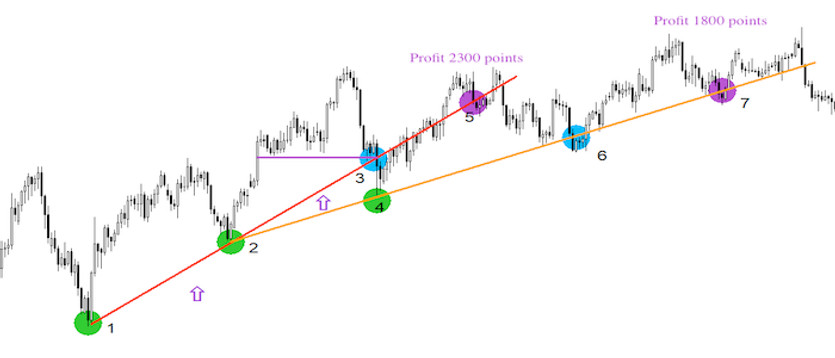

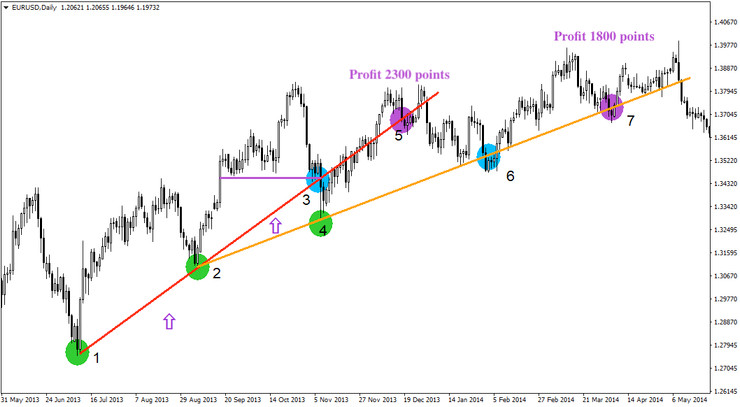

The basis of the whole strategy is of course the trend lines, which, however, due to the chosen timeframe D1, may not be plotted with such precision as is the case with lower timeframes. Therefore, the above chart shows a situation where the first trend line has been formed using two support points (see points 1 and 2 on the chart). As part of the strategy, it was now necessary to wait for the price to come back and hit the trend line again (see point 3), at which point it is at this point that the long trading position is entered. Of course, we must not forget about protection and therefore the Stop-Loss was placed at the support located at point 2.

On the chart below, it is now possible to see a continuation where the price continued to fall after entering the position, but eventually turned around and the market took the expected direction. With the market forming another support point (point 4), it was possible to form another trend line (formed by connecting points 2 and 4 - two consecutive supports should always be connected), which will later serve as an indicator for further entry. Now the market again got above the first trend line and after it bounced off it, so to speak, and later hit it again from above (point 5), the position was closed with a profit of about 2300 points.

Please note: There is never more than one entry on the same trendline within this strategy.

Now again there was a wait for the market to hit the second trendline, at which point the whole process could be repeated again, but this time with a 500 point profit. Of course, it was also possible to form another new trend line located between point 4 and the new support that the market had formed below point 6.

As you can see, with this strategy it is possible to achieve really great results with almost every trading opportunity. Moreover, the immense advantage here is that with the right money-management, traders can open positions of smaller volumes that are not as margin intensive, and there is still a lot of room to achieve above-average appreciation.