Today's "ladies" are one of the most used technical indicators, on the basis of which many professional traders decide whether they enter new or remain in a trading position.

Crossing moving averages has indeed gained popularity across different trading styles. But in this case is more important how fast the moving averages are than the crossing itself.

Ema&Ema up

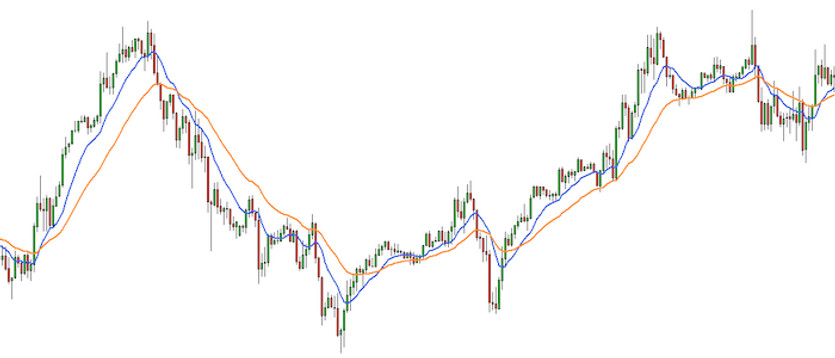

The Ema&Ema strategy is not only very simple and well-known, but also effective. The principle of this strategy is based on the crossing of two moving averages, a faster one (blue line) and a slower one (orange line). If the faster Ema crosses the slower one from bottom to top and if both lines are tilted upwards at the same time, then it is advisable to enter buying positions (see below - the first filal ellipse). Exits occur when the price hits the faster Ema and on the other hand re-entries occur when the price gets above it again.

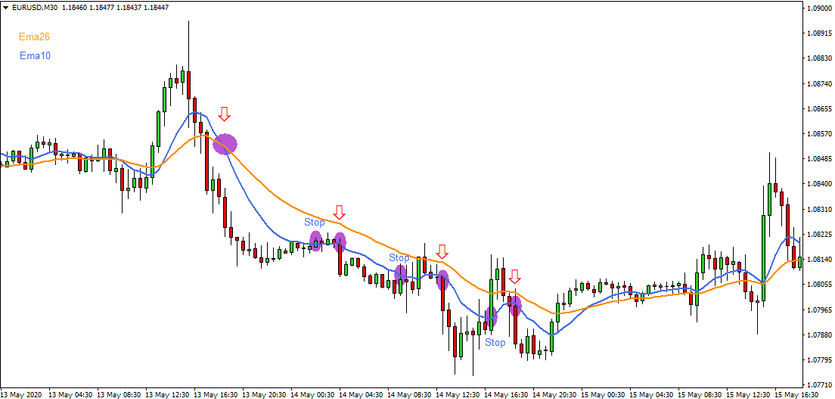

Ema&Ema down

Conversely, if the faster Ema (blue) passes through the slower one from top to bottom and both curves are downward sloping at the same time, then it is usually a very opportune time for short entries (see chart below - first purple ellipse). As we can see, traders should follow the same analogy for exits, that is, exits are normally made when price passes through the fast EMA.

Our strategy today performs best on currency pairs that are predominantly long. Under these conditions, then, the strategy typically achieves success rates in front of 70%, which is more than sufficient in terms of long-term sustainability.