Fibo Levels and Time Zones is a trading system based on the classical theory of trading according to Fibonacci values. The strategy is universal and can be applied to any asset on the H4 timeframe.

For searching the signals in this strategy, classic Fibonacci levels are used, as well as time zones. A feature of this strategy is the use of the AFR indicator to automatically build Fibonacci levels. This makes it easier for the trader to find objective extrema for building levels since the indicator itself applies these levels and saves the trader from this task.

You can download the AFR indicator on our website in the Indicators section.

Build Fibonacci levels and Time Zones

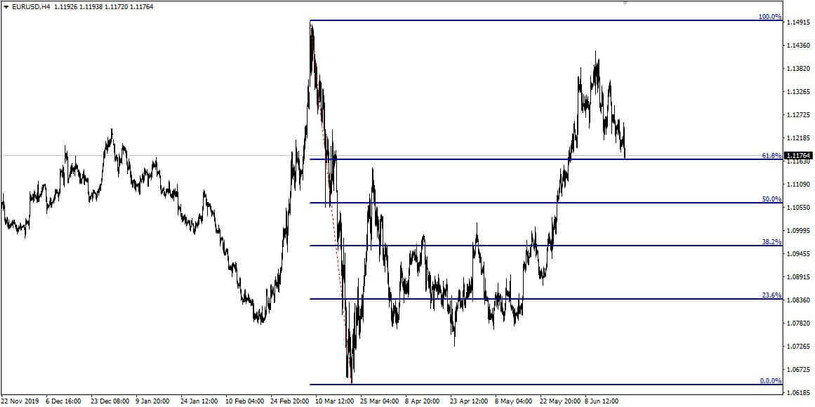

To determine the Fibonacci levels, apply the AFR indicator to the chart of a trading asset on the H4 timeframe. AFR will identify and display Fibonacci levels on the price chart.

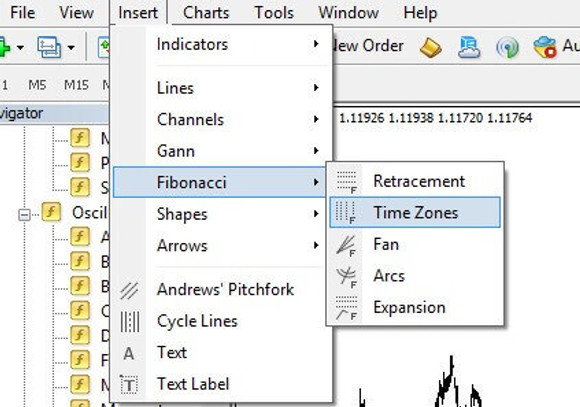

Then, on the Insert tab of the MT4 trading terminal, select Fibonacci-> Time Zones from the list.

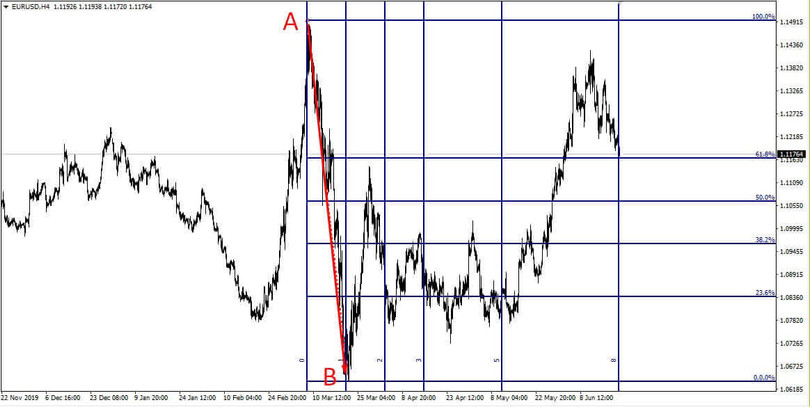

Superimpose Time Zones on extremums just as the AFR indicator did from point A to point B.

Fibonacci levels and time zones should form a grid on the price chart.

Conditions for opening positions

The intersections of the horizontal lines of the Fibonacci levels and the vertical lines of the Fibonacci time zones are considered quite strong obstacles to the price. As a rule, here with a high degree of probability a price rebound is possible. Therefore, according to this strategy, deals are opened when the price is close to the intersection of these lines.

In the above example, a grid consisting of levels and time zones is superimposed on the EURUSD chart on the H4 timeframe. The price of EURUSD approached the intersection of the level of 61.8% with the eighth line of the time zone. This event can be considered as the end of the correction and the continuation of the uptrend. At this point, you can open a BUY deal.

Similar conditions will be for SELL deals. Look for a condition on the chart when the price of the asset approaches the intersection of the Fibonacci levels and time zones.

Stoploss and TakeProfit

Stoploss in this strategy is recommended to be placed at the nearest Fibo level. In the above example, a buy transaction is open at 61.8%. The next closest level from it is the 50% level. Stoploss can be set at this level, because if the price nevertheless breaks the level of 61.8%, which intersects with the time zone line, the probability of the price moving further against the deal increases. It is more logical to play it safe and set a stop loss at a 50% level. Do the same with all trades, placing a stop loss at the nearest Fibonacci level.

Take-profit at least twice as much as Stop Loss. In another option, which is considered more productive, set a trailing stop in increments equal to the size of the stop loss to take profit on the trade.

Conclusion

Levels and Timezones Fibo H4 is considered a professional trading system. It gives good trading results for a long time period. Its disadvantages include a small number of deals on one asset and the fact that this strategy requires knowledge of the fundamentals of the Fibonacci theory.